Region:Asia

Author(s):Dev

Product Code:KRAC0553

Pages:88

Published On:August 2025

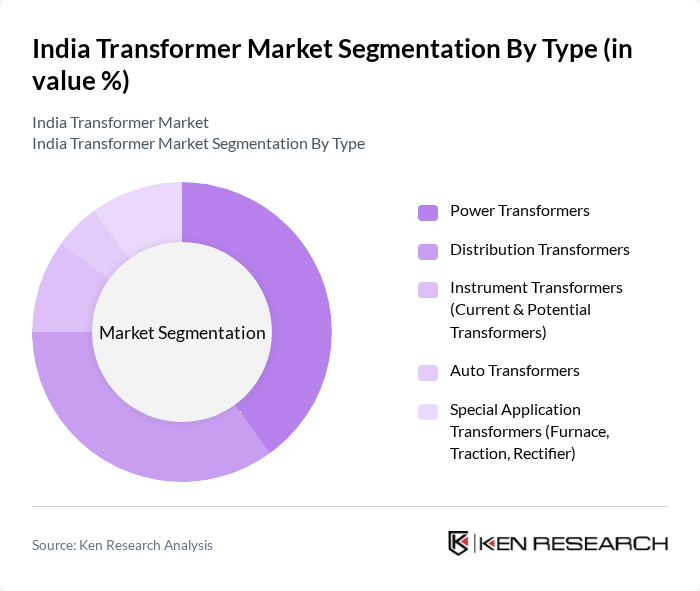

By Type:The transformer market can be segmented into various types, including Power Transformers, Distribution Transformers, Instrument Transformers, Auto Transformers, and Special Application Transformers. Each type serves distinct functions and applications across different sectors.

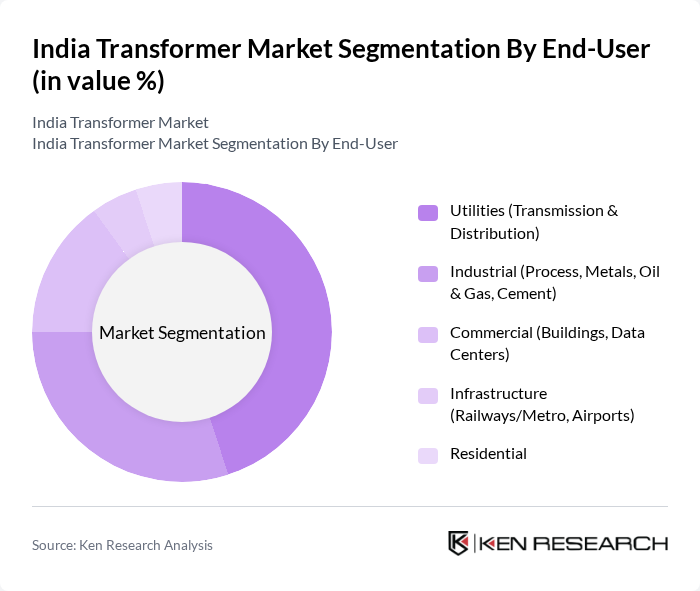

By End-User:The end-user segmentation includes Utilities, Industrial, Commercial, Infrastructure, and Residential sectors. Each segment has unique requirements and contributes differently to the overall transformer market, with utilities remaining the largest due to transmission and distribution upgrades and renewable integration.

The India Transformer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Limited (India), ABB India Limited, Schneider Electric Infrastructure Limited, Bharat Heavy Electricals Limited (BHEL), CG Power and Industrial Solutions Limited, GE T&D India Limited, Larsen & Toubro Limited (L&T Electrical & Automation), Toshiba Transmission & Distribution Systems (India) Pvt. Ltd., Kirloskar Electric Company Limited, Hitachi Energy India Limited, Adani Energy Solutions Limited, KEC International Limited, Transformers & Rectifiers (India) Limited, Bharat Bijlee Limited, Voltamp Transformers Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India transformer market appears promising, driven by the increasing integration of renewable energy and advancements in smart grid technologies. As urbanization accelerates, the demand for efficient power distribution systems will rise, necessitating innovative transformer solutions. Additionally, the government's commitment to sustainability and energy efficiency will likely foster further investments in transformer technology, ensuring that the market adapts to evolving energy needs and regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Type | Power Transformers Distribution Transformers Instrument Transformers (Current & Potential Transformers) Auto Transformers Special Application Transformers (Furnace, Traction, Rectifier) |

| By End-User | Utilities (Transmission & Distribution) Industrial (Process, Metals, Oil & Gas, Cement) Commercial (Buildings, Data Centers) Infrastructure (Railways/Metro, Airports) Residential |

| By Region | West India (Gujarat, Maharashtra, Goa) South India (Tamil Nadu, Karnataka, Telangana, Andhra Pradesh, Kerala) North India (Delhi NCR, Uttar Pradesh, Haryana, Punjab, Rajasthan) East & Northeast India (West Bengal, Odisha, Bihar, Assam, Others) |

| By Technology | Oil-Immersed (Mineral Oil, Ester Oil) Dry-Type (Cast Resin, VPI) Smart/Digital Transformers (On-line Monitoring, IoT-Enabled) Amorphous Core/Energy-Efficient Transformers (Star-Rated) |

| By Application | Transmission Substations (Step-up/Step-down) Distribution Networks (11kV/33kV) Renewable Integration (Solar/Wind Evacuation) Railways & Metro Electrification Industrial Captive Power |

| By Investment Source | Domestic Private FDI PPP Government Schemes (RDSS, Green Energy Corridor, Saubhagya) |

| By Policy Support | Energy Efficiency & Star Labeling BIS/IEC Standards Compliance Renewable Purchase Obligations (RPOs) & RECs Domestic Content Preference (Make in India, PLI where applicable) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Power Generation Sector | 120 | Plant Managers, Electrical Engineers |

| Utility Companies | 90 | Procurement Officers, Operations Managers |

| Manufacturing Sector | 80 | Production Managers, Quality Control Engineers |

| Renewable Energy Projects | 70 | Project Managers, Sustainability Officers |

| Research & Development | 50 | R&D Managers, Innovation Leads |

The India Transformer Market is valued at approximately USD 2.5 billion, with recent estimates indicating a market size between USD 2.24 billion and USD 2.44 billion. This growth is driven by increasing electricity demand and infrastructure investments.