Region:North America

Author(s):Rebecca

Product Code:KRAD0224

Pages:82

Published On:August 2025

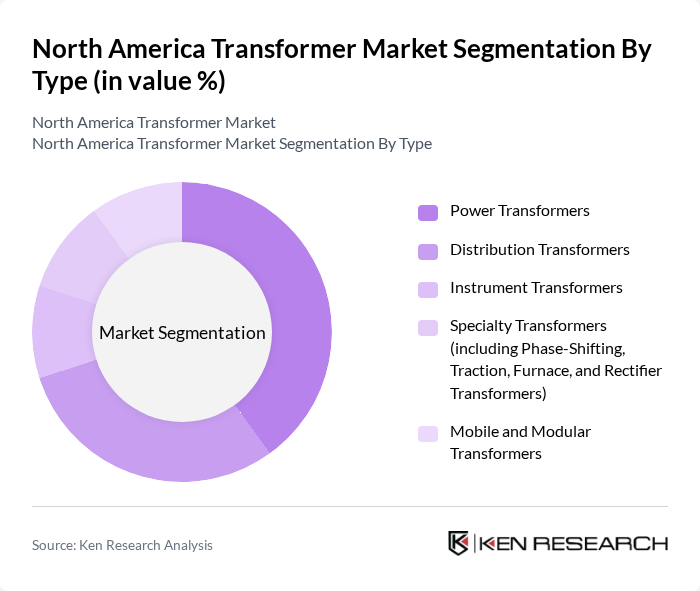

By Type:The transformer market is segmented into Power Transformers, Distribution Transformers, Instrument Transformers, Specialty Transformers (including Phase-Shifting, Traction, Furnace, and Rectifier Transformers), and Mobile and Modular Transformers. Power Transformers are primarily used for high-voltage transmission, Distribution Transformers for local voltage regulation and distribution, Instrument Transformers for measurement and protection, Specialty Transformers for specific industrial applications, and Mobile/Modular Transformers for temporary or emergency power needs .

The Power Transformers segment leads the market due to its critical role in high-voltage transmission systems and the increasing demand for electricity across North America. These transformers are essential for stepping up voltage levels for long-distance transmission, making them indispensable in the energy sector. The growing focus on renewable energy sources, such as wind and solar, further drives the need for robust power transformers to integrate these sources into the grid effectively .

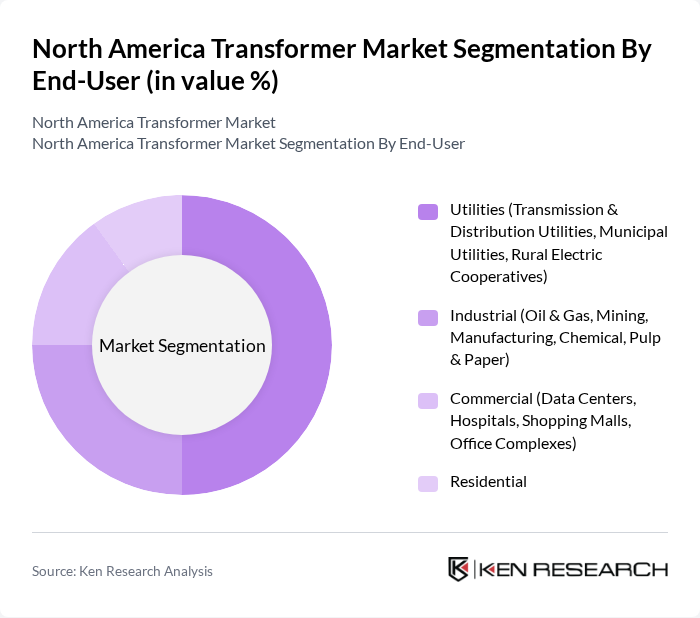

By End-User:The market is segmented by end-users into Utilities (Transmission & Distribution Utilities, Municipal Utilities, Rural Electric Cooperatives), Industrial (Oil & Gas, Mining, Manufacturing, Chemical, Pulp & Paper), Commercial (Data Centers, Hospitals, Shopping Malls, Office Complexes), and Residential. Utilities require a broad range of transformers for grid management and renewable integration, industrial users rely on transformers for process reliability and energy efficiency, commercial users need stable power for critical operations, and residential users benefit from reliable local distribution .

The Utilities segment is the largest end-user of transformers, driven by the need for reliable electricity distribution and ongoing upgrades to aging infrastructure. Utilities require a wide range of transformers to manage transmission and distribution efficiently. The increasing focus on renewable energy integration and smart grid technologies further enhances demand, as utilities modernize their systems to accommodate new energy sources and improve grid resilience .

The North America Transformer Market is characterized by a dynamic mix of regional and international players. Leading participants such as General Electric Company, Siemens Energy, Inc., Schneider Electric SE, ABB Inc., Eaton Corporation plc, Mitsubishi Electric Power Products, Inc., Toshiba International Corporation, Hitachi Energy Ltd., S&C Electric Company, Howard Industries, Inc., SPX Transformer Solutions, Inc., Virginia Transformer Corp., Prolec GE (a GE & Xignux company), Hammond Power Solutions Inc., ERMCO (Electric Research and Manufacturing Cooperative, Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The North America transformer market is poised for significant evolution, driven by technological advancements and a shift towards sustainable energy solutions. As utilities increasingly adopt smart grid technologies, the integration of IoT for real-time monitoring will enhance operational efficiency. Additionally, the rise of electric vehicle infrastructure will necessitate innovative transformer designs to support charging stations. These trends indicate a robust future for the transformer market, with a focus on resilience and adaptability in energy distribution systems.

| Segment | Sub-Segments |

|---|---|

| By Type | Power Transformers Distribution Transformers Instrument Transformers Specialty Transformers (including Phase-Shifting, Traction, Furnace, and Rectifier Transformers) Mobile and Modular Transformers |

| By End-User | Utilities (Transmission & Distribution Utilities, Municipal Utilities, Rural Electric Cooperatives) Industrial (Oil & Gas, Mining, Manufacturing, Chemical, Pulp & Paper) Commercial (Data Centers, Hospitals, Shopping Malls, Office Complexes) Residential |

| By Application | Renewable Energy Integration (Wind, Solar, Hydro) Grid Infrastructure (Transmission, Substation, Distribution) Electric Vehicle Charging Stations Data Centers & Critical Infrastructure |

| By Component | Core Windings Tap Changer Insulation Cooling System |

| By Sales Channel | Direct Sales Distributors/Channel Partners Online Sales |

| By Distribution Mode | Bulk Distribution Retail Distribution |

| By Price Range | Low-End Transformers Mid-Range Transformers High-End Transformers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Power Transformer Manufacturers | 100 | Production Managers, R&D Directors |

| Utility Companies' Procurement Departments | 80 | Procurement Officers, Supply Chain Managers |

| Renewable Energy Project Developers | 60 | Project Managers, Technical Leads |

| Electrical Engineering Consultants | 50 | Consultants, Senior Engineers |

| Government Regulatory Bodies | 40 | Policy Analysts, Regulatory Affairs Managers |

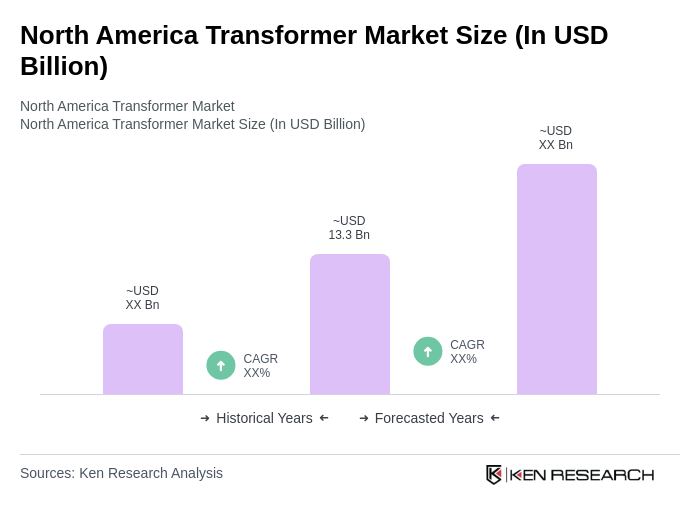

The North America Transformer Market is valued at approximately USD 13.3 billion, driven by increasing electricity demand, renewable energy expansion, and grid modernization efforts. This valuation is based on a comprehensive five-year historical analysis of market trends and growth factors.