Region:Central and South America

Author(s):Rebecca

Product Code:KRAA0371

Pages:81

Published On:August 2025

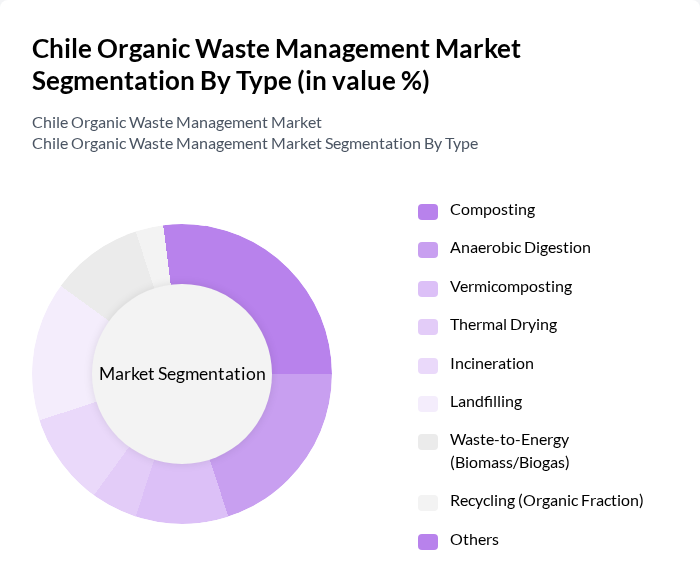

By Type:The organic waste management market can be segmented into various types, including composting, anaerobic digestion, vermicomposting, thermal drying, incineration, landfilling, waste-to-energy (biomass/biogas), recycling (organic fraction), and others. Each of these methods plays a crucial role in managing organic waste effectively, with varying degrees of efficiency and environmental impact. Composting, anaerobic digestion, and vermicomposting are the most widely adopted technologies in Chile, while thermal drying remains limited in application .

The composting segment is currently dominating the market due to its cost-effectiveness and environmental benefits. Composting not only reduces the volume of organic waste but also produces valuable compost that can be used to enrich soil. The increasing awareness among households and businesses about sustainable practices has led to a rise in composting initiatives. Additionally, government support and community programs promoting composting have further solidified its position as the leading method for organic waste management .

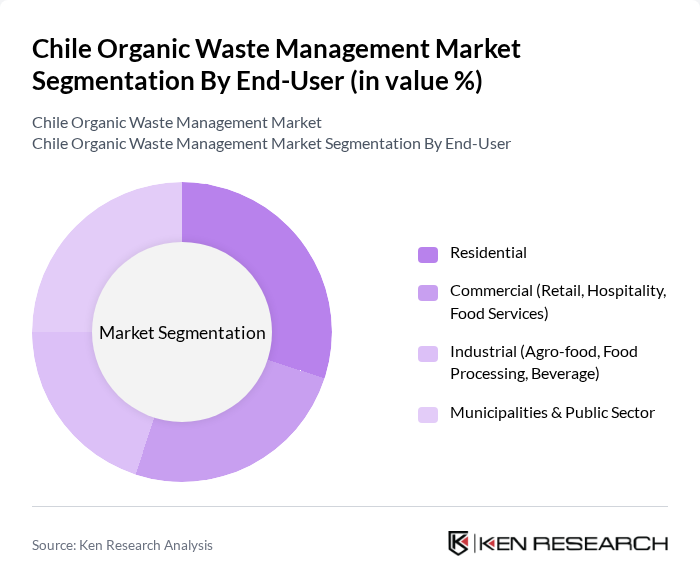

By End-User:The market can also be segmented based on end-users, which include residential, commercial (retail, hospitality, food services), industrial (agro-food, food processing, beverage), and municipalities & public sector. Each end-user category has distinct needs and approaches to organic waste management. The residential and municipal sectors are particularly significant, with municipalities increasingly implementing selective collection and processing programs for organic waste .

The residential segment is the largest end-user category, driven by increasing awareness of sustainable waste management practices among households. Many residents are adopting composting and recycling initiatives, supported by local government programs. The commercial sector, particularly food services, also plays a significant role in organic waste generation, leading to a growing demand for tailored waste management solutions. Municipalities are actively involved in implementing waste management policies, further enhancing their market presence .

The Chile Organic Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Chile, SUEZ Chile, KDM Energía, Biofílica, Ecoclean, Aguas Andinas, Inversiones y Servicios Ambientales (ISA), Reciclaje Orgánico Chile, Grupo Ecológico, Biogás Chile, Fundación Basura, Compost Chile, Green Waste Solutions, EcoLógica, The Waste Transformers (Chile) contribute to innovation, geographic expansion, and service delivery in this space.

The future of organic waste management in Chile appears promising, driven by increasing environmental awareness and supportive government policies. As the country moves towards achieving its waste reduction targets, innovations in waste processing technologies will play a crucial role. The integration of smart technologies and community engagement in composting initiatives is expected to enhance efficiency and participation. Overall, the sector is poised for growth, with a focus on sustainability and circular economy principles shaping its trajectory.

| Segment | Sub-Segments |

|---|---|

| By Type | Composting Anaerobic Digestion Vermicomposting Thermal Drying Incineration Landfilling Waste-to-Energy (Biomass/Biogas) Recycling (Organic Fraction) Others |

| By End-User | Residential Commercial (Retail, Hospitality, Food Services) Industrial (Agro-food, Food Processing, Beverage) Municipalities & Public Sector |

| By Region | Santiago Metropolitan Region Valparaíso Biobío Antofagasta Araucanía |

| By Technology | Mechanical Biological Treatment (MBT) Anaerobic Digestion Technology Composting Technology Thermal Treatment (Incineration, Thermal Drying) Chemical Treatment |

| By Application | Urban Organic Waste Management Agricultural Organic Waste Management Food Waste Management Forestry Waste Management Others |

| By Investment Source | Private Investments Public Funding International Aid Government Schemes |

| By Policy Support | Subsidies for Waste Management Tax Incentives Grants for Recycling Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Waste Management | 100 | City Waste Managers, Environmental Policy Makers |

| Organic Waste Processing Facilities | 70 | Facility Operators, Plant Managers |

| Community Composting Initiatives | 50 | Community Leaders, Sustainability Coordinators |

| Agricultural Waste Management | 60 | Farmers, Agricultural Extension Officers |

| Environmental NGOs and Advocacy Groups | 40 | Program Directors, Policy Analysts |

The Chile Organic Waste Management Market is valued at approximately USD 600 million, reflecting a significant growth driven by urbanization, government initiatives, and increased public awareness regarding sustainable waste management practices.