Region:Africa

Author(s):Shubham

Product Code:KRAA1088

Pages:87

Published On:August 2025

By Type:The organic waste management market can be segmented into various types, including composting, anaerobic digestion, landfilling, incineration, waste-to-energy, organic fertilizers, mechanical-biological treatment (MBT), vermicomposting, and others. Among these, composting and waste-to-energy are the most prominent methods due to their effectiveness in reducing waste volume and generating renewable energy .

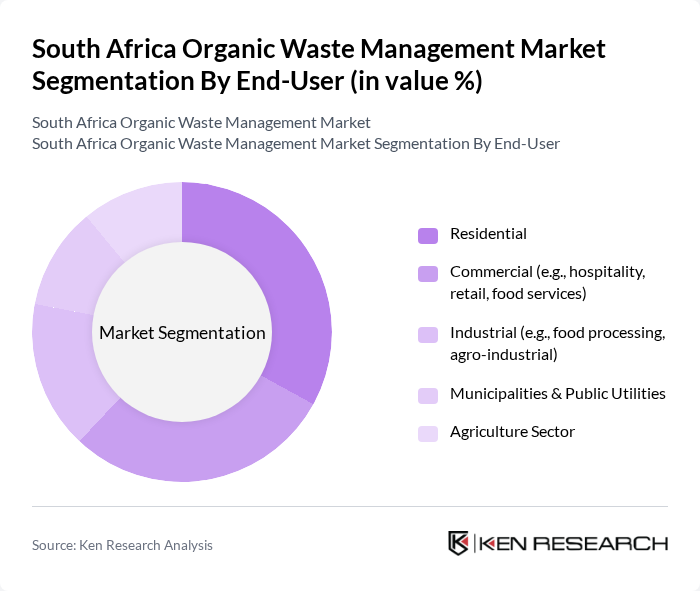

By End-User:The end-user segmentation includes residential, commercial (e.g., hospitality, retail, food services), industrial (e.g., food processing, agro-industrial), municipalities & public utilities, and the agriculture sector. The residential and commercial sectors are the largest contributors to organic waste generation, driven by increasing consumer awareness and the need for sustainable waste management solutions .

The South Africa Organic Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as WastePlan, Interwaste, EnviroServ, Biogas Energy (Pty) Ltd, GreenCape, EcoWaste, Remade Recycling, Waste Management SA, SUEZ Recycling and Recovery South Africa, Veolia Services Southern Africa, EnviroServ Waste Management, Barloworld Logistics, Mpact Recycling, WasteTech (Pty) Ltd, The Waste Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the South African organic waste management market appears promising, driven by increasing environmental awareness and supportive government policies. As urbanization continues, the demand for efficient waste management solutions will rise, prompting investments in innovative technologies. Additionally, the integration of smart waste management systems is expected to enhance operational efficiency. The focus on sustainability will likely lead to greater public participation in recycling initiatives, fostering a culture of environmental responsibility and paving the way for a circular economy.

| Segment | Sub-Segments |

|---|---|

| By Type | Composting Anaerobic Digestion Landfilling Incineration Waste-to-Energy Organic Fertilizers Mechanical-Biological Treatment (MBT) Vermicomposting Others |

| By End-User | Residential Commercial (e.g., hospitality, retail, food services) Industrial (e.g., food processing, agro-industrial) Municipalities & Public Utilities Agriculture Sector |

| By Application | Agriculture (soil amendment, fertilizer) Landscaping & Horticulture Renewable Energy Production (biogas, electricity) Soil Remediation Animal Feed |

| By Investment Source | Domestic Private Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants & Subsidies |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support Training and Capacity Building |

| By Distribution Mode | Direct Sales Online Sales Retail Partnerships Community Collection Programs |

| By Price Range | Low Price Mid Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Waste Management Authorities | 60 | Waste Management Officers, Environmental Policy Makers |

| Organic Waste Processing Facilities | 50 | Facility Managers, Operations Directors |

| Commercial Sector Waste Generators | 40 | Facility Managers, Sustainability Coordinators |

| Community-Based Organizations | 40 | Community Leaders, Environmental Activists |

| Agricultural Waste Management Practices | 50 | Farm Managers, Agricultural Extension Officers |

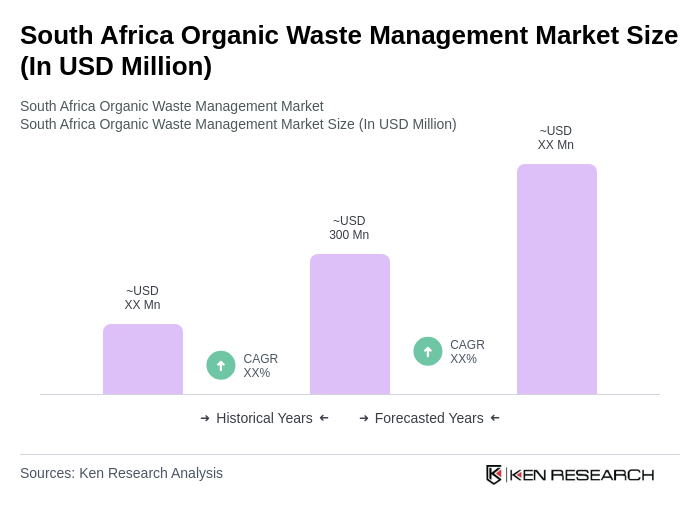

The South Africa Organic Waste Management Market is valued at approximately USD 300 million, reflecting a significant growth driven by urbanization, environmental awareness, and government initiatives aimed at reducing landfill waste.