Region:Europe

Author(s):Geetanshi

Product Code:KRAA1987

Pages:92

Published On:August 2025

By Type:The organic waste management market can be segmented into various types, including composting, anaerobic digestion, incineration, landfilling, waste-to-energy, organic fertilizers, and others. Each of these sub-segments plays a crucial role in the overall waste management ecosystem, catering to different waste processing needs and environmental goals. Composting and anaerobic digestion are increasingly favored due to their environmental benefits and alignment with circular economy objectives, while waste-to-energy and incineration remain essential for managing non-recyclable organic fractions .

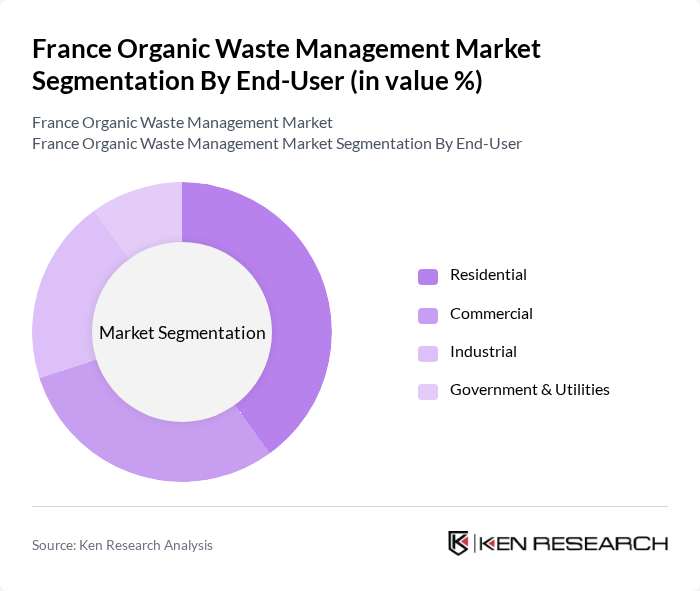

By End-User:The end-user segmentation includes residential, commercial, industrial, and government & utilities. Each segment has unique waste management needs and contributes differently to the overall organic waste management landscape. The residential segment is the largest contributor, driven by municipal collection programs and household participation in organic waste sorting. Commercial and industrial segments are increasingly adopting advanced waste processing solutions to meet regulatory requirements and sustainability targets .

The France Organic Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Environnement S.A., SUEZ Recycling and Recovery France, Paprec Group, Derichebourg Environnement, Citeo (formerly Eco-Emballages), Biogaz Vallée, Fermentalg, TREDI, Ecore, Groupe Pizzorno Environnement, Séché Environnement, GreenWatt, Environnement S.A., SITA France, Coved Environnement contribute to innovation, geographic expansion, and service delivery in this space .

The future of the organic waste management market in France appears promising, driven by increasing regulatory support and technological innovations. As the government intensifies its focus on achieving a circular economy, investments in waste processing infrastructure are expected to rise. Additionally, the integration of smart technologies will enhance operational efficiency, making waste management more sustainable. The growing emphasis on community engagement and education will further foster consumer participation, paving the way for a more robust organic waste management ecosystem in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Composting Anaerobic Digestion Incineration Landfilling Waste-to-Energy Organic Fertilizers Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Agricultural Use Energy Generation Soil Amendment Waste Reduction Programs |

| By Collection Method | Curbside Collection Drop-off Centers Community Collection Points |

| By Processing Technology | Mechanical Biological Treatment Thermal Treatment Biological Treatment |

| By Investment Source | Public Funding Private Investment International Aid |

| By Policy Support | Subsidies Tax Exemptions Grants Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Waste Management | 60 | Municipal Waste Managers, Environmental Policy Makers |

| Organic Waste Processing Facilities | 50 | Facility Operators, Technical Managers |

| Agricultural Sector Waste Management | 40 | Farm Managers, Agricultural Consultants |

| Food Industry Waste Practices | 45 | Food Production Managers, Sustainability Officers |

| Consumer Attitudes Towards Organic Waste | 80 | Household Representatives, Community Leaders |

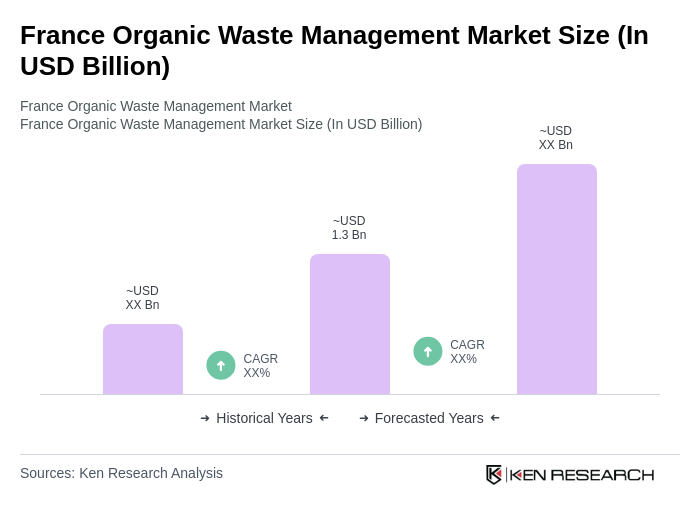

The France Organic Waste Management Market is valued at approximately USD 1.3 billion, reflecting a significant growth trend driven by environmental awareness, government regulations, and the demand for organic fertilizers and renewable energy from organic waste.