Region:Central and South America

Author(s):Shubham

Product Code:KRAA0740

Pages:93

Published On:August 2025

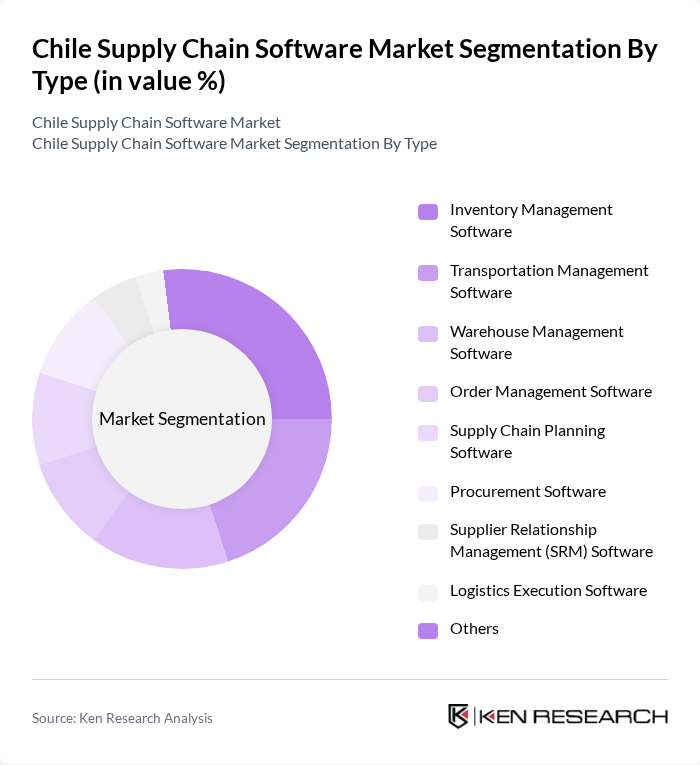

By Type:The market is segmented into various types of software solutions that address different aspects of supply chain management. The key subsegments include Inventory Management Software, Transportation Management Software, Warehouse Management Software, Order Management Software, Supply Chain Planning Software, Procurement Software, Supplier Relationship Management (SRM) Software, Logistics Execution Software, and Others. Each of these subsegments plays a vital role in enhancing operational efficiency, supporting digital transformation, and streamlining processes for businesses of all sizes .

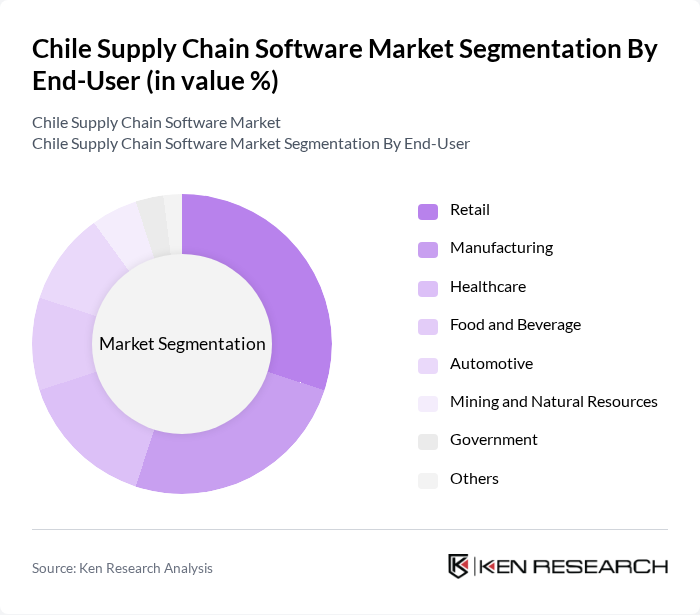

By End-User:The end-user segmentation includes various industries that utilize supply chain software to enhance their operations. Key subsegments are Retail, Manufacturing, Healthcare, Food and Beverage, Automotive, Mining and Natural Resources, Government, and Others. Each sector has unique requirements and challenges, driving the demand for tailored software solutions that enable operational agility, compliance, and visibility .

The Chile Supply Chain Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP, Oracle, Blue Yonder (formerly JDA Software), Infor, Manhattan Associates, Kinaxis, IBM, Microsoft, Epicor, Coupa Software, Zycus, IFS, E2open, Logility, TOTVS (Latin America), Softland Chile, Defontana, Sonda S.A., Oracle NetSuite contribute to innovation, geographic expansion, and service delivery in this space.

The Chilean supply chain software market is poised for transformative growth, driven by technological advancements and evolving consumer expectations. As companies increasingly adopt cloud-based solutions and artificial intelligence, operational efficiencies will improve significantly. Furthermore, the focus on sustainability and transparency will shape future investments, with businesses prioritizing eco-friendly practices. The integration of blockchain technology is expected to enhance supply chain transparency, fostering trust among stakeholders and driving further innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Inventory Management Software Transportation Management Software Warehouse Management Software Order Management Software Supply Chain Planning Software Procurement Software Supplier Relationship Management (SRM) Software Logistics Execution Software Others |

| By End-User | Retail Manufacturing Healthcare Food and Beverage Automotive Mining and Natural Resources Government Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Region | Santiago Valparaíso Concepción Antofagasta Others |

| By Industry Vertical | Consumer Goods Pharmaceuticals Electronics Chemicals Logistics & Transportation Mining |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Software Adoption | 100 | Supply Chain Managers, IT Directors |

| Retail Supply Chain Solutions | 60 | Logistics Coordinators, Operations Managers |

| Transportation Management Systems | 50 | Fleet Managers, Procurement Officers |

| Inventory Management Software | 70 | Warehouse Managers, Inventory Analysts |

| Software for E-commerce Logistics | 55 | E-commerce Managers, Fulfillment Supervisors |

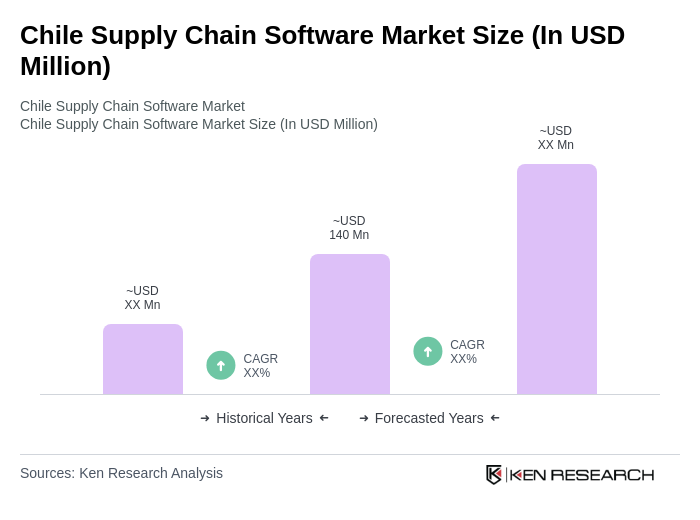

The Chile Supply Chain Software Market is valued at approximately USD 140 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient logistics and inventory management solutions across various sectors.