Region:Asia

Author(s):Geetanshi

Product Code:KRAD0097

Pages:92

Published On:August 2025

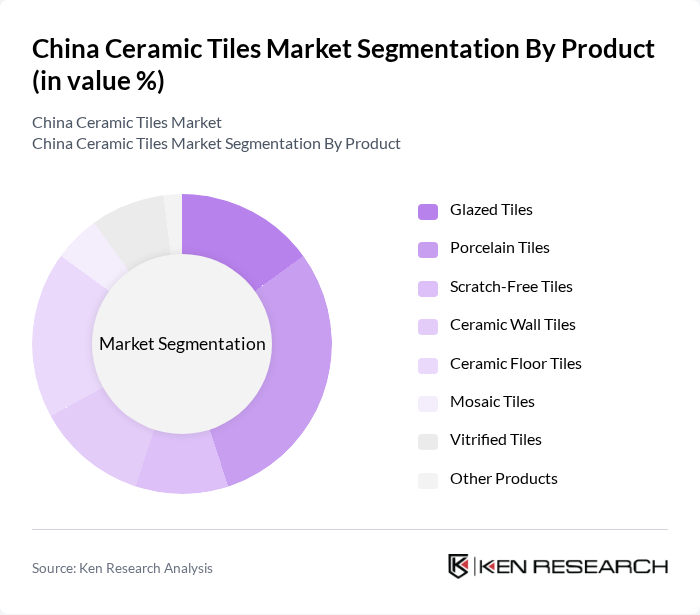

By Product:The product segmentation of the market includes various types of ceramic tiles, each catering to different consumer needs and preferences. The major subsegments are Glazed Tiles, Porcelain Tiles, Scratch-Free Tiles, Ceramic Wall Tiles, Ceramic Floor Tiles, Mosaic Tiles, Vitrified Tiles, and Other Products. Among these, Porcelain Tiles continue to gain significant traction due to their superior durability, water resistance, and aesthetic appeal, making them a preferred choice for both residential and commercial applications. Glazed tiles are also widely used for their versatility in design and color options, while vitrified tiles are favored for high-traffic areas due to their strength and low porosity .

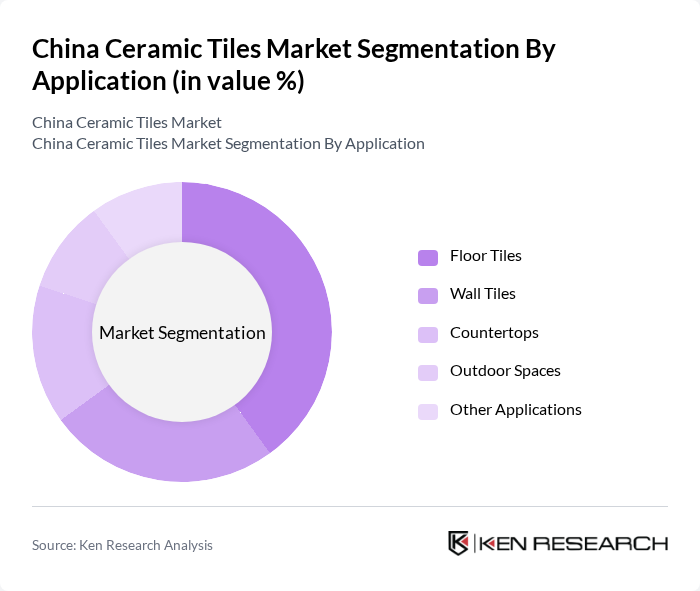

By Application:The application segmentation of the market includes Floor Tiles, Wall Tiles, Countertops, Outdoor Spaces, and Other Applications. Floor Tiles remain the most dominant segment, driven by the increasing demand for stylish, durable, and easy-to-maintain flooring solutions in both residential and commercial spaces. The trend towards open-concept living, the need for hygienic surfaces, and the growing use of ceramic tiles in outdoor and high-traffic areas further enhance the popularity of floor tiles .

The China Ceramic Tiles Market is characterized by a dynamic mix of regional and international players. Leading participants such as China National Building Material Group Corporation (CNBM), Guangdong Dongpeng Holdings Co., Ltd., Marco Polo (Guangdong) Ceramic Co., Ltd., Monalisa Group Co., Ltd., Foshan Oceano Ceramics Co., Ltd., Guangdong Newpearl Ceramics Group Co., Ltd., Guangdong BODE Fine Building Material Co., Ltd., Guangdong Winto Ceramics Co., Ltd., Guangdong Grifine Ceramics Co., Ltd., Guangdong Huiya Ceramics Co., Ltd., Foshan Wondrous Building Materials Co., Ltd., Shanghai CIMIC Tiles Co., Ltd., Guangdong Jiamei Ceramics Co., Ltd., Champion Building Materials Co., Ltd., Dongguan Champion Ceramics Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China ceramic tiles market appears promising, driven by urbanization and technological advancements. As the urban population grows, the demand for aesthetically pleasing and durable tiles will increase. Additionally, the integration of smart technology in tiles and a focus on sustainable manufacturing practices will likely shape product offerings. Companies that adapt to these trends and invest in innovation will be well-positioned to capture market share and meet evolving consumer preferences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product | Glazed Tiles Porcelain Tiles Scratch-Free Tiles Ceramic Wall Tiles Ceramic Floor Tiles Mosaic Tiles Vitrified Tiles Other Products |

| By Application | Floor Tiles Wall Tiles Countertops Outdoor Spaces Other Applications |

| By Construction Type | New Construction Replacement & Renovation |

| By End-User | Residential Commercial Industrial |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Wholesale Distributors |

| By Price Range | Economy Mid-Range Premium |

| By Design Style | Traditional Modern Rustic Contemporary |

| By Material Type | Natural Clay Recycled Materials Composite Materials Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Tile Market | 100 | Homeowners, Interior Designers |

| Commercial Tile Applications | 90 | Facility Managers, Architects |

| Export Market Insights | 60 | Export Managers, Trade Analysts |

| Tile Retail Sector | 80 | Retail Managers, Sales Executives |

| Construction Industry Stakeholders | 70 | Contractors, Project Managers |

The China Ceramic Tiles Market is valued at approximately USD 30 billion, driven by factors such as rapid urbanization, a booming construction sector, and increasing consumer preferences for durable and aesthetically pleasing flooring solutions.