Region:Middle East

Author(s):Shubham

Product Code:KRAD0817

Pages:87

Published On:August 2025

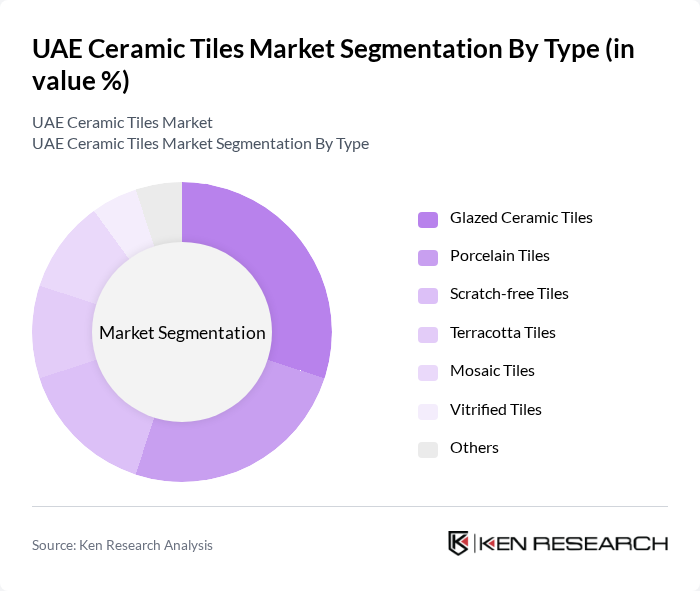

By Type:The ceramic tiles market can be segmented into various types, including Glazed Ceramic Tiles, Porcelain Tiles, Scratch-free Tiles, Terracotta Tiles, Mosaic Tiles, Vitrified Tiles, and Others. Each type serves different consumer preferences and applications, with specific characteristics that cater to various aesthetic and functional needs .

TheGlazed Ceramic Tilessegment dominates the market due to their versatility, aesthetic appeal, and wide range of designs. These tiles are favored for both residential and commercial applications, as they offer a glossy finish that enhances the visual appeal of spaces. Additionally, the ease of maintenance and durability of glazed tiles make them a popular choice among consumers.Porcelain Tilesalso hold a significant market share, known for their strength and resistance to moisture, making them suitable for high-traffic areas .

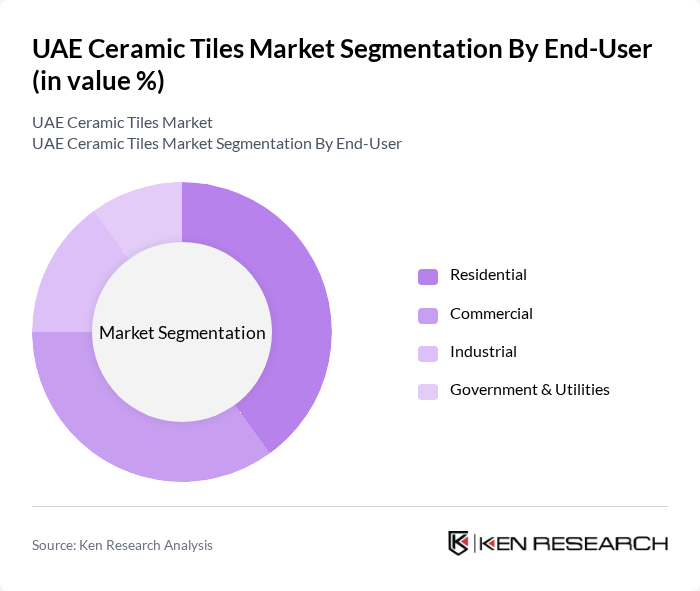

By End-User:The market can be segmented based on end-users, including Residential, Commercial, Industrial, and Government & Utilities. Each segment has distinct requirements and preferences, influencing the types of ceramic tiles utilized in various applications .

TheResidentialsegment leads the market, driven by the increasing number of housing projects and renovations. Homeowners are increasingly opting for ceramic tiles due to their aesthetic appeal and durability. TheCommercialsegment follows closely, as businesses seek high-quality flooring solutions that can withstand heavy foot traffic. The Industrial and Government segments, while smaller, also contribute to the overall demand, particularly in specialized applications .

The UAE Ceramic Tiles Market is characterized by a dynamic mix of regional and international players. Leading participants such as RAK Ceramics PJSC, Al Anwar Ceramic Tile Co. SAOG, Al-Futtaim Group, Emirates Ceramics, Al Maha Ceramics, Porcelanosa Grupo, Mohawk Industries, Marazzi Group, Ceramiche Atlas Concorde, Grupo Lamosa, Johnson Tiles, Somany Ceramics, Kajaria Ceramics, Orient Bell Limited, VitrA, Cersanit contribute to innovation, geographic expansion, and service delivery in this space.

The UAE ceramic tiles market is poised for significant transformation, driven by technological advancements and a growing emphasis on sustainability. As manufacturers adopt eco-friendly practices and innovative production techniques, the market is likely to see an increase in demand for sustainable tile options. Additionally, the ongoing urbanization and expansion of the hospitality sector will further fuel growth, creating opportunities for local producers to enhance their offerings and capture a larger market share.

| Segment | Sub-Segments |

|---|---|

| By Type | Glazed Ceramic Tiles Porcelain Tiles Scratch-free Tiles Terracotta Tiles Mosaic Tiles Vitrified Tiles Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Flooring Wall Cladding Countertops Outdoor Spaces |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Wholesale Distributors |

| By Price Range | Economy Mid-Range Premium |

| By Design Style | Traditional Contemporary Rustic Minimalist |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Tile Market | 120 | Homeowners, Interior Designers |

| Commercial Tile Applications | 100 | Facility Managers, Architects |

| Industrial Tile Usage | 60 | Procurement Managers, Construction Engineers |

| Retail Sector Insights | 80 | Retail Managers, Sales Executives |

| Export Market Analysis | 40 | Export Managers, Trade Analysts |

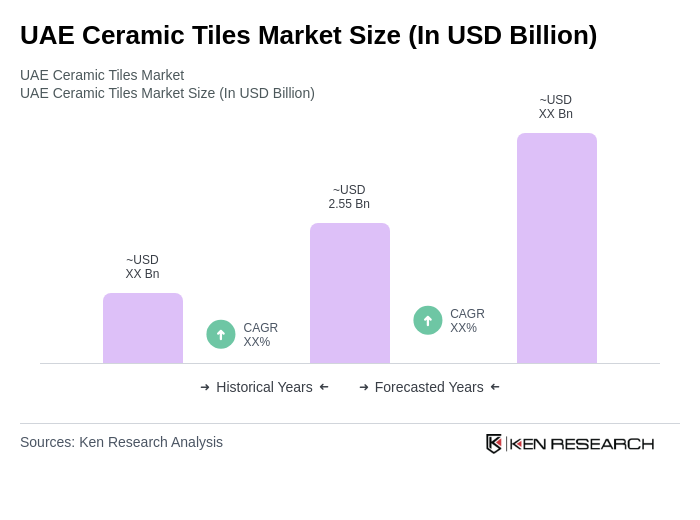

The UAE Ceramic Tiles Market is valued at approximately USD 2.55 billion, driven by a booming construction sector and increasing demand for durable and aesthetically pleasing flooring solutions.