Region:Europe

Author(s):Geetanshi

Product Code:KRAA1173

Pages:93

Published On:August 2025

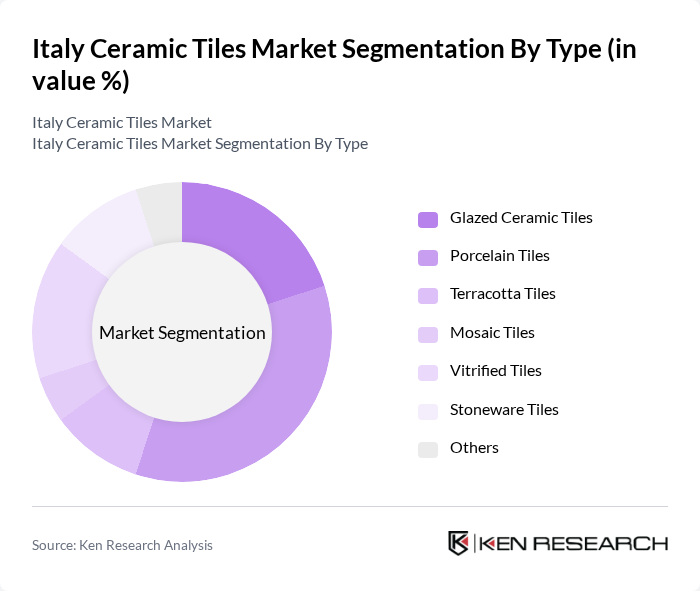

By Type:The ceramic tiles market in Italy is segmented into Glazed Ceramic Tiles, Porcelain Tiles, Terracotta Tiles, Mosaic Tiles, Vitrified Tiles, Stoneware Tiles, and Others. Among these, Porcelain Tiles are the leading segment, favored for their superior durability, water resistance, and design versatility. These attributes make porcelain tiles a preferred choice for both residential and commercial applications. The growing consumer demand for high-quality, low-maintenance, and aesthetically appealing flooring solutions continues to drive the dominance of porcelain tiles in the Italian market .

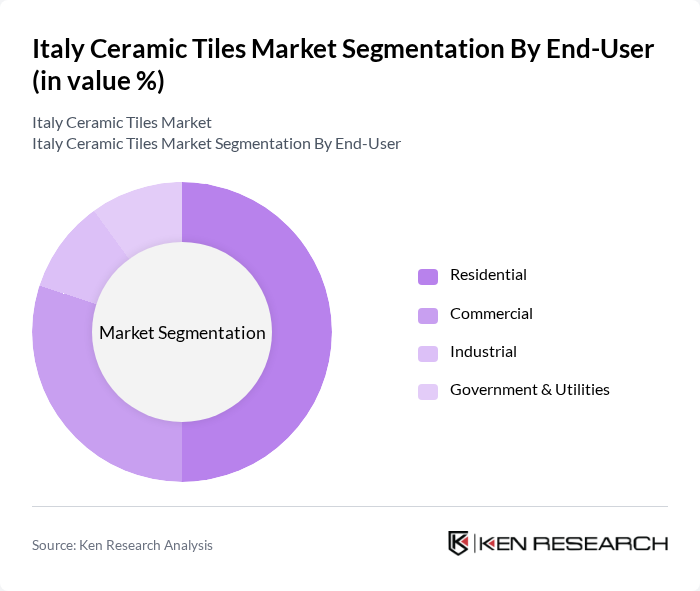

By End-User:The market is also segmented by end-users: Residential, Commercial, Industrial, and Government & Utilities. The Residential segment leads the market, driven by the ongoing trend of home renovations, increasing disposable incomes, and a preference for durable, visually appealing flooring solutions. The Commercial segment follows, supported by investments in hospitality, retail, and office spaces that require robust and stylish tile applications .

The Italy Ceramic Tiles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Marazzi Group S.r.l., Florim S.p.A., Ceramiche Ricchetti S.p.A., Cotto d'Este S.p.A., Atlas Concorde S.p.A., Casalgrande Padana S.p.A., Fap Ceramiche S.p.A., Emilgroup S.r.l., Panaria Group Industrie Ceramiche S.p.A., Serenissima Cir S.p.A., La Fabbrica S.r.l., Cerdisa S.p.A., Marca Corona S.p.A., Cooperativa Ceramica d'Imola S.c., and Gruppo Romani S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italian ceramic tiles market appears promising, driven by ongoing trends in sustainability and design innovation. As the construction sector continues to expand, manufacturers are likely to focus on developing eco-friendly products that meet regulatory standards. Additionally, the integration of smart technology in tiles is expected to gain traction, enhancing functionality and appeal. Companies that adapt to these trends will likely capture a larger share of the market, positioning themselves for long-term success.

| Segment | Sub-Segments |

|---|---|

| By Type | Glazed Ceramic Tiles Porcelain Tiles Terracotta Tiles Mosaic Tiles Vitrified Tiles Stoneware Tiles Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Flooring Wall Cladding Countertops Outdoor Spaces |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Wholesale Distributors |

| By Price Range | Economy Mid-Range Premium |

| By Design Style | Traditional Contemporary Rustic Minimalist |

| By Finish Type | Matte Finish Glossy Finish Textured Finish Others |

| By Construction Type | New Construction Replacement & Renovation |

| By Product | Floor Tiles Wall Tiles Others |

| By Region | Northern Italy (Emilia-Romagna, Veneto, etc.) Central Italy Southern Italy Islands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Tile Market | 100 | Homeowners, Interior Designers |

| Commercial Tile Applications | 80 | Facility Managers, Architects |

| Export Market Insights | 40 | Export Managers, Trade Analysts |

| Tile Retail Sector | 60 | Retail Managers, Sales Executives |

| Construction Industry Stakeholders | 50 | Contractors, Builders |

The Italy Ceramic Tiles Market is valued at approximately USD 1.5 billion, reflecting a robust growth trend driven by increasing demand for high-quality tiles in both residential and commercial sectors, as well as home renovation activities.