Region:Asia

Author(s):Shubham

Product Code:KRAC0644

Pages:87

Published On:August 2025

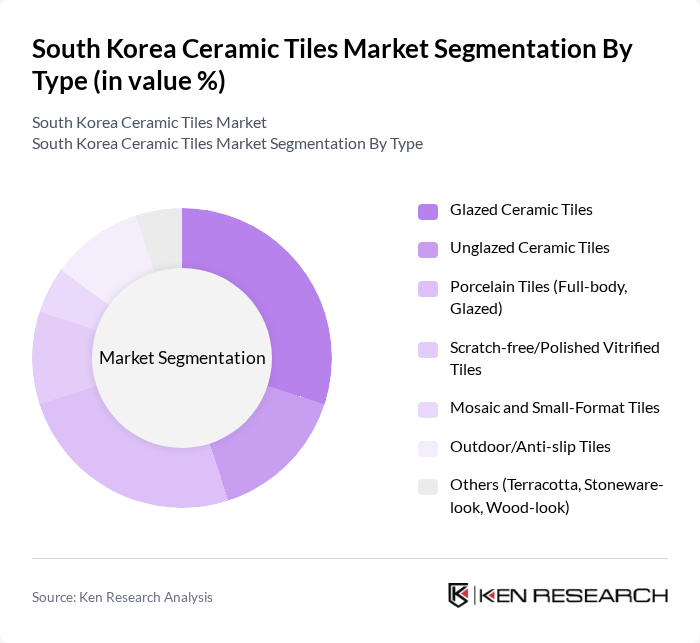

By Type:The ceramic tiles market can be segmented into various types, including Glazed Ceramic Tiles, Unglazed Ceramic Tiles, Porcelain Tiles (Full-body, Glazed), Scratch-free/Polished Vitrified Tiles, Mosaic and Small-Format Tiles, Outdoor/Anti-slip Tiles, and Others (Terracotta, Stoneware-look, Wood-look). Each of these subsegments caters to different consumer preferences and applications, with specific characteristics that appeal to various market segments.

The Glazed Ceramic Tiles segment is currently dominating the market due to their versatility, aesthetic appeal, and wide range of applications in both residential and commercial settings. These tiles are favored for their glossy finish, which enhances the visual appeal of spaces, making them a popular choice among homeowners and designers. Additionally, the ease of maintenance and durability of glazed tiles contribute to their strong market presence. The growing trend of interior design that emphasizes aesthetics further supports the demand for this subsegment.

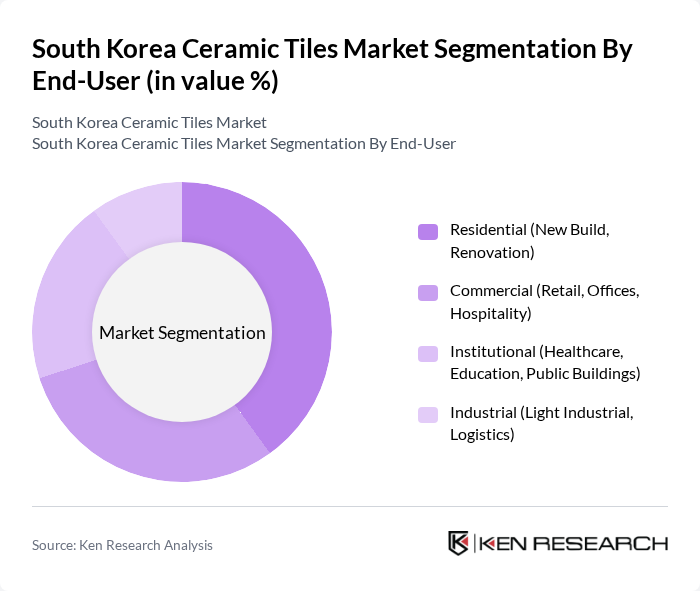

By End-User:The market can be segmented based on end-users into Residential (New Build, Renovation), Commercial (Retail, Offices, Hospitality), Institutional (Healthcare, Education, Public Buildings), and Industrial (Light Industrial, Logistics). Each segment has unique requirements and preferences, influencing the types of ceramic tiles that are in demand.

The Residential segment is the largest end-user category, driven by ongoing urbanization and a growing trend towards home renovations. Homeowners are increasingly investing in high-quality ceramic tiles for aesthetic and functional purposes, leading to a robust demand in this segment. The rise in disposable income and changing consumer preferences towards stylish and durable flooring options further bolster the growth of the residential market.

The South Korea Ceramic Tiles Market is characterized by a dynamic mix of regional and international players. Leading participants such as KCC Corporation (KCC), IS DONGSEO Co., Ltd. (IS??), Sungil Ceramics Co., Ltd. (??????), Daelim B&Co., Ltd. (??B&Co.), LX Hausys Co., Ltd. (formerly LG Hausys), Hanil Ceramics Co., Ltd. (??????), KCC Glass Corporation, Niro Ceramic Group (Niro Granite), Dongpeng Holdings Group Co., Ltd., Kajaria Ceramics Ltd. (South Korea import/distribution), LIXIL Corporation (INAX brand in Korea), Hyundai L&C (?????), Samhwa Tiles Co., Ltd. (????), Hwasung Ceramic Co., Ltd. (?????), SPC Group Ceramics Division contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean ceramic tiles market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As sustainability becomes a priority, manufacturers are likely to invest in eco-friendly production methods and materials. Additionally, the integration of smart home technologies will influence tile design and functionality, catering to a tech-savvy consumer base. The market is expected to adapt to these trends, fostering innovation and enhancing product offerings to meet the demands of modern consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Glazed Ceramic Tiles Unglazed Ceramic Tiles Porcelain Tiles (Full-body, Glazed) Scratch-free/Polished Vitrified Tiles Mosaic and Small-Format Tiles Outdoor/Anti-slip Tiles Others (Terracotta, Stoneware-look, Wood-look) |

| By End-User | Residential (New Build, Renovation) Commercial (Retail, Offices, Hospitality) Institutional (Healthcare, Education, Public Buildings) Industrial (Light Industrial, Logistics) |

| By Application | Floor Tiles Wall Tiles Backsplashes and Countertops Outdoor & Facades (Balconies, Patios, Exterior Cladding) |

| By Distribution Channel | Direct Sales (Projects/Contractors) Specialty Retailers & Showrooms Home Improvement Chains Online/E-commerce Wholesale Distributors |

| By Price Range | Economy Mid-Range Premium/Luxury |

| By Design | Traditional/Korean-inspired Contemporary/Minimal Custom/Designer Collaborations |

| By Material | Ceramic Porcelain/Vitrified Stone-look/Composite Others (Recycled/eco-friendly blends) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Tile Market | 140 | Homeowners, Interior Designers |

| Commercial Tile Applications | 100 | Facility Managers, Architects |

| Industrial Tile Usage | 80 | Procurement Managers, Construction Engineers |

| Tile Retail Sector Insights | 120 | Retail Managers, Sales Executives |

| Trends in Sustainable Tiles | 70 | Sustainability Officers, Product Development Managers |

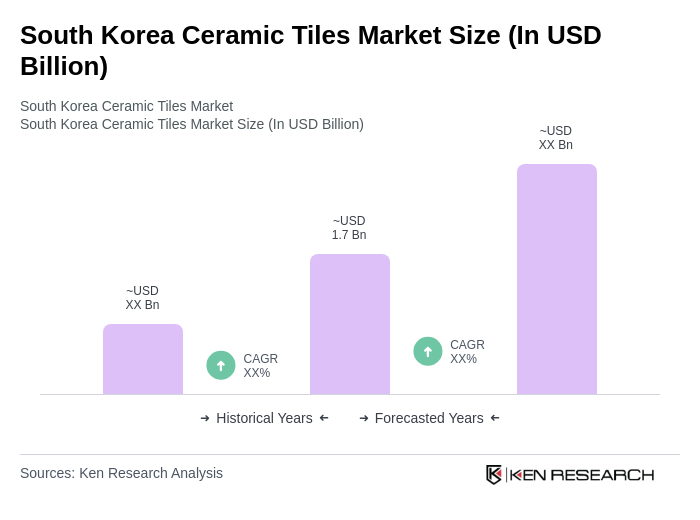

The South Korea Ceramic Tiles Market is valued at approximately USD 1.7 billion, driven by growth in the construction sector, urbanization, and demand for durable flooring solutions in both residential and commercial projects.