China Coffee Market Overview

- The China Coffee Market is valued at USD 21 billion, based on a five-year historical analysis. This growth is primarily driven by increasing urbanization, rising disposable incomes, a rapidly expanding e-commerce sector, and a growing coffee culture among younger consumers. Demand for various coffee products, including specialty and ready-to-drink coffee, has surged as consumers seek both convenience and quality in their coffee experiences. The proliferation of coffee shops, especially in metropolitan areas, and the influence of Western lifestyles are further accelerating market expansion.

- Key cities such as Shanghai, Beijing, and Guangzhou dominate the market due to their large populations, vibrant café culture, and significant foreign investment in the coffee sector. These urban centers are witnessing a marked rise in coffee consumption, driven by lifestyle changes, a growing number of white-collar workers, and the proliferation of coffee shops and chains catering to diverse consumer preferences.

- In 2023, the Chinese government introduced initiatives to promote sustainable coffee production practices, including guidelines for environmentally friendly farming methods and the establishment of certification programs for organic coffee. These efforts aim to enhance the quality of domestic coffee production, ensure environmental sustainability, and support local farmers, particularly in major producing regions such as Yunnan.

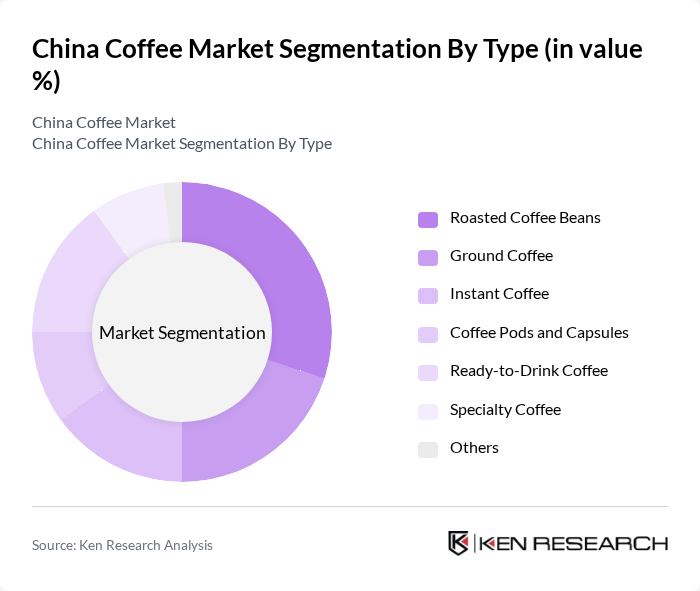

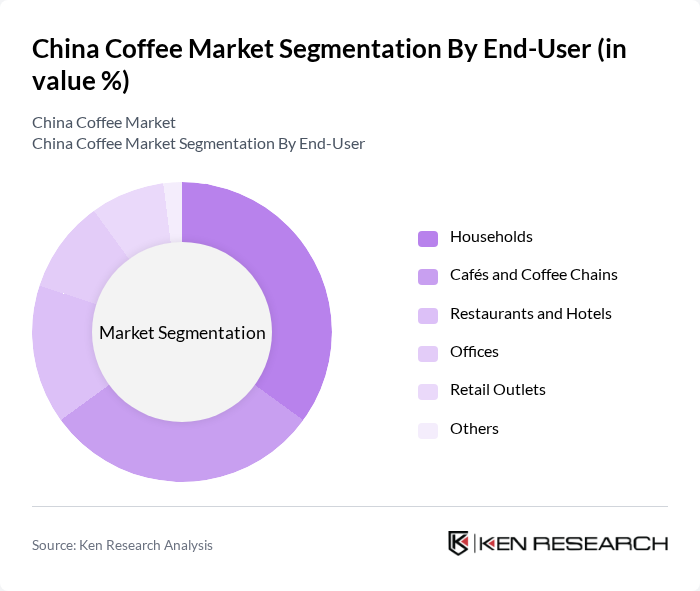

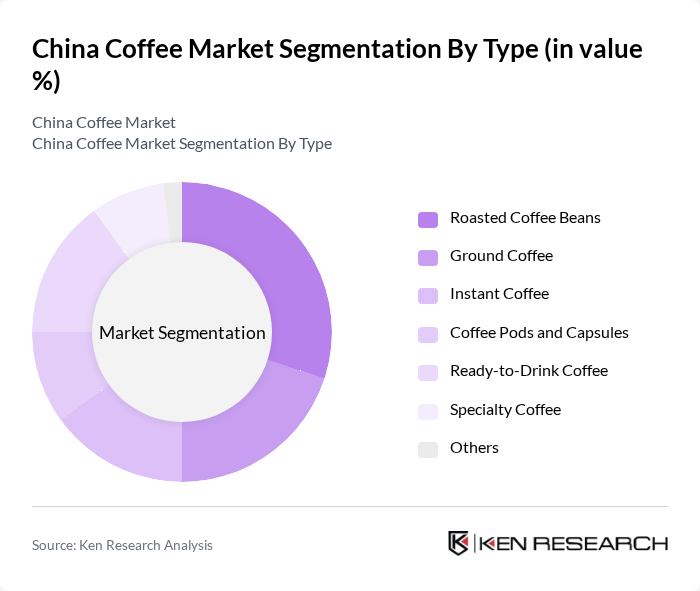

China Coffee Market Segmentation

By Type:The coffee market is segmented into roasted coffee beans, ground coffee, instant coffee, coffee pods and capsules, ready-to-drink coffee, specialty coffee, and others. Among these, roasted coffee beans and ready-to-drink coffee are gaining significant traction due to changing consumer preferences for fresh and convenient options. The trend toward specialty coffee is also accelerating, as consumers increasingly seek unique flavors, premium quality, and artisanal brewing methods. Instant coffee continues to hold a substantial share, reflecting its historical dominance and convenience for at-home consumption.

By End-User:End-user segmentation includes households, cafés and coffee chains, restaurants and hotels, offices, retail outlets, and others. Households and cafés are the leading segments, driven by the increasing trend of coffee consumption at home, the growth of e-commerce coffee sales, and the rapid expansion of coffee shops in urban areas. Café culture is particularly strong in first- and second-tier cities, where consumers prefer to socialize and work in coffee shops, further boosting demand.

China Coffee Market Competitive Landscape

The China Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Starbucks Corporation, Luckin Coffee Inc., Nestlé S.A., China National Cereals, Oils and Foodstuffs Corporation (COFCO), Tim Hortons China (Tims China), JDE Peet's, Pacific Coffee Company, Seesaw Coffee, Manner Coffee, Saturnbird Coffee, Peet's Coffee, Costa Coffee, Lavazza S.p.A., Illycaffè S.p.A., and Blue Bottle Coffee contribute to innovation, geographic expansion, and service delivery in this space.

China Coffee Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Urbanization in China is accelerating, with over 65% of the population expected to reside in urban areas in future, up from 57% in 2020. This shift is driving demand for coffee as urban dwellers seek convenient, on-the-go beverage options. The number of coffee shops in urban centers has surged, with over 30,000 outlets reported in major cities like Shanghai and Beijing, reflecting a growing coffee culture that caters to busy lifestyles and social interactions.

- Rising Disposable Income:China's disposable income per capita is projected to reach approximately 39,218 CNY (around $5,600) in future, up from 36,000 CNY in 2020. This increase enables consumers to spend more on premium products, including specialty coffee. As consumers prioritize quality over quantity, the demand for high-end coffee products is expected to rise, with a notable increase in sales of gourmet and artisanal coffee brands across the country.

- Expansion of Coffee Retail Outlets:The coffee retail sector in China is experiencing rapid growth, with an estimated annual increase in the number of coffee shops. By future, the total number of coffee outlets is expected to exceed 49,500. Major players like Starbucks and local brands are expanding aggressively, particularly in tier-2 and tier-3 cities, making coffee more accessible to a broader audience and fostering a vibrant coffee-drinking culture.

Market Challenges

- Intense Competition:The coffee market in China is characterized by fierce competition, with over 1,000 brands vying for market share. This saturation leads to price wars and reduced profit margins, particularly for smaller players. Major brands like Starbucks and Luckin Coffee dominate the market, making it challenging for new entrants to establish a foothold. The competitive landscape necessitates innovation and differentiation to attract and retain customers.

- Supply Chain Disruptions:The coffee supply chain in China faces significant challenges, including logistical issues and sourcing difficulties. In future, global coffee production is expected to be impacted by climate change, with Brazil and Vietnam, two major suppliers, experiencing adverse weather conditions. These disruptions can lead to shortages and increased costs, affecting the availability and pricing of coffee products in the Chinese market, ultimately impacting consumer choices.

China Coffee Market Future Outlook

The future of the coffee market in China appears promising, driven by evolving consumer preferences and innovative product offerings. As urbanization continues, coffee consumption is expected to rise, particularly among younger demographics. The trend towards health-conscious products and sustainable sourcing will likely shape the market landscape, encouraging brands to adapt their strategies. Additionally, the integration of technology in retail, such as mobile ordering and delivery services, will enhance customer experiences and drive growth in the sector.

Market Opportunities

- E-commerce Growth:The e-commerce sector in China is projected to reach $2 trillion in future, providing a significant opportunity for coffee brands to expand their online presence. With over 800 million online shoppers, leveraging digital platforms for sales and marketing can enhance brand visibility and accessibility, catering to the growing preference for online shopping among consumers.

- Specialty Coffee Segment:The specialty coffee segment is gaining traction, with sales expected to increase by approximately 20% annually in future. As consumers become more discerning, the demand for unique flavors and high-quality beans sourced from sustainable farms is rising. This trend presents an opportunity for brands to differentiate themselves by offering premium products that cater to the evolving tastes of coffee enthusiasts.