Region:Europe

Author(s):Rebecca

Product Code:KRAC0322

Pages:86

Published On:August 2025

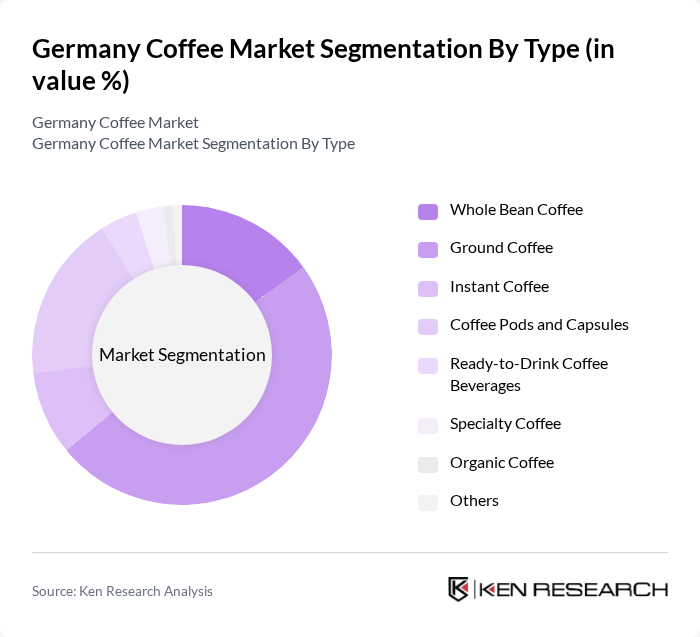

By Type:The coffee market can be segmented into various types, including Whole Bean Coffee, Ground Coffee, Instant Coffee, Coffee Pods and Capsules, Ready-to-Drink Coffee Beverages, Specialty Coffee, Organic Coffee, and Others. Among these,Ground Coffeeis the most popular choice among consumers, accounting for nearly half of the market share, due to its convenience and versatility in preparation. The trend towards specialty and organic options is also gaining traction, reflecting a shift in consumer preferences towards higher quality and ethically sourced products. Coffee pods and capsules maintain a strong presence, driven by demand for convenience and innovations in sustainable packaging .

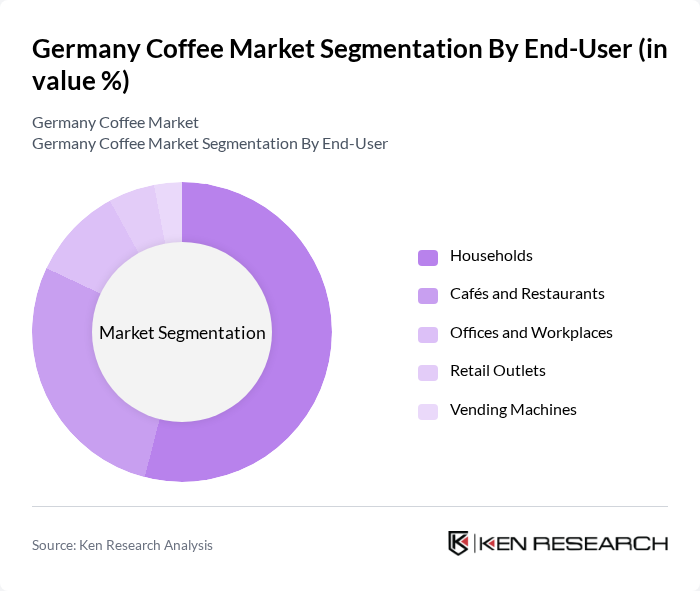

By End-User:The coffee market is segmented by end-users, including Households, Cafés and Restaurants, Offices and Workplaces, Retail Outlets, and Vending Machines.Householdsrepresent the largest segment, driven by the increasing trend of home brewing and the convenience of coffee consumption at home. Cafés and Restaurants also play a significant role, as they cater to the growing demand for specialty coffee experiences among consumers. Offices and workplaces have seen stable demand, while vending and retail channels are adapting to changing consumer preferences .

The Germany Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tchibo GmbH, Dallmayr (Alois Dallmayr KG), Lavazza Deutschland GmbH, JACOBS DOUWE EGBERTS (JDE Peet's), Melitta Group, Starbucks Corporation, Nestlé Nespresso S.A., Illycaffè S.p.A., Paulig Group, Coffee Circle GmbH, Kaffeekommune, Kaffeekultur, Segafredo Zanetti Deutschland GmbH, Arvid Nordquist, and Caffè Nero contribute to innovation, geographic expansion, and service delivery in this space.

The future of the German coffee market appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability and ethical sourcing is likely to shape purchasing decisions, with consumers willing to pay a premium for responsibly sourced products. Additionally, innovations in coffee brewing technology and the expansion of subscription services are expected to enhance customer engagement and convenience, further solidifying coffee's role in daily life.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Bean Coffee Ground Coffee Instant Coffee Coffee Pods and Capsules Ready-to-Drink Coffee Beverages Specialty Coffee Organic Coffee Others |

| By End-User | Households Cafés and Restaurants Offices and Workplaces Retail Outlets Vending Machines |

| By Sales Channel | Online Retail Supermarkets and Hypermarkets Specialty Coffee Shops Convenience Stores HoReCa (Hotels, Restaurants, Cafés) |

| By Price Range | Premium Coffee Mid-Range Coffee Budget Coffee |

| By Packaging Type | Bags Cans Bottles Capsules/Pods Packaging |

| By Flavor Profile | Classic Flavored Decaffeinated Single-Origin |

| By Region | Northern Germany Southern Germany Eastern Germany Western Germany Central Germany |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Coffee Sales | 100 | Store Managers, Retail Buyers |

| Consumer Coffee Preferences | 120 | Coffee Drinkers, Lifestyle Consumers |

| Specialty Coffee Market Insights | 100 | Baristas, Coffee Shop Owners |

| Import and Distribution Channels | 80 | Import Managers, Distribution Executives |

| Trends in Coffee Consumption | 90 | Market Analysts, Industry Experts |

The Germany Coffee Market is valued at approximately USD 12 billion, reflecting a significant growth trend driven by increasing coffee consumption, particularly in specialty and organic segments, as well as a rising coffee culture among consumers.