Region:Asia

Author(s):Dev

Product Code:KRAB0628

Pages:80

Published On:August 2025

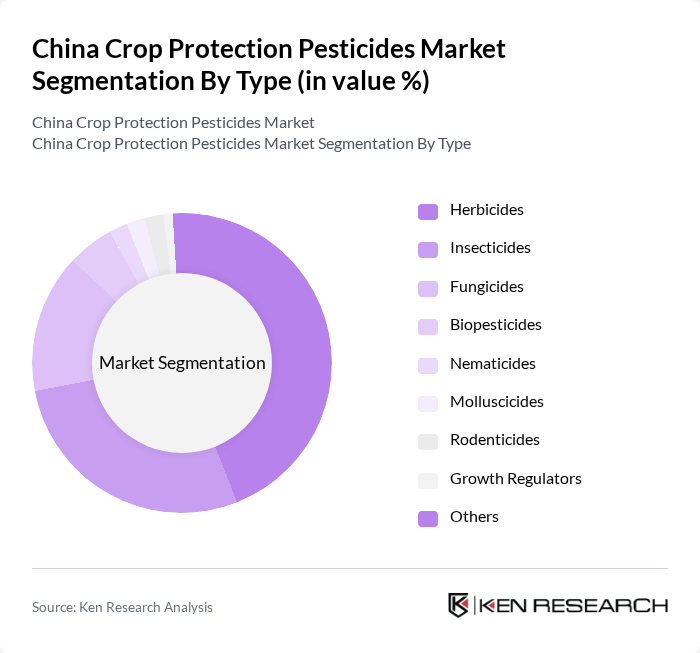

By Type:The market is segmented into herbicides, insecticides, fungicides, biopesticides, nematicides, molluscicides, rodenticides, growth regulators, and others.Herbicidesandinsecticidesremain the most widely used types due to their proven effectiveness in controlling weeds and pests, which pose significant threats to crop production. The increasing focus on sustainable agriculture and regulatory support is driving demand forbiopesticides, which are perceived as safer and more environmentally friendly alternatives .

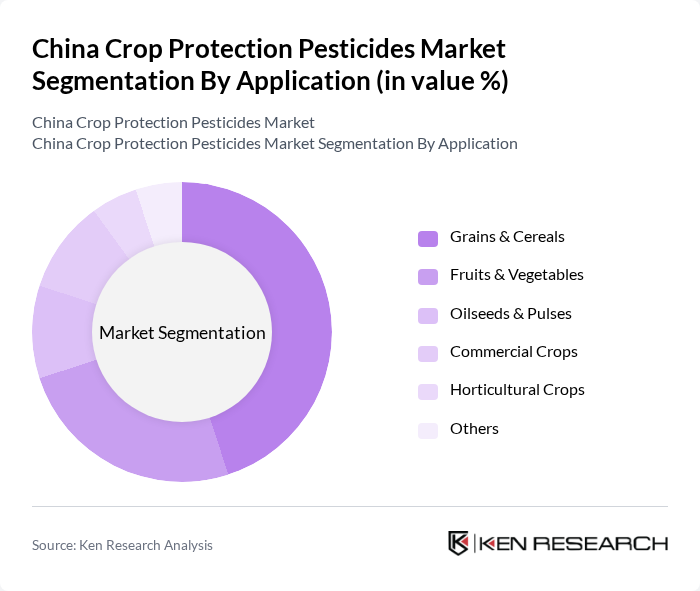

By Application:Pesticide application in China is categorized into grains & cereals, fruits & vegetables, oilseeds & pulses, commercial crops (such as cotton and sugarcane), horticultural crops, and others.Grains and cerealsdominate the segment due to their importance in food security and high demand for staple foods. The rising consumption of fruits and vegetables is also driving growth, as farmers increasingly seek to protect these crops from pests and diseases. Government initiatives prioritize biopesticide use in rice, corn, wheat, fruits, and vegetables, with subsidies supporting sustainable practices .

The China Crop Protection Pesticides Market is characterized by a dynamic mix of regional and international players. Leading participants such as Syngenta Group, Bayer AG, BASF SE, FMC Corporation, Corteva Agriscience, ADAMA Ltd., UPL Limited, Nufarm Limited, Sumitomo Chemical Co., Ltd., Jiangsu Yangnong Chemical Group Co., Ltd., Zhejiang Wynca Chemical Group Co., Ltd., Rainbow Agro, Lianyungang Liben Crop Technology Co., Ltd., Shandong Qiaochang Chemical Co., Ltd., Zhejiang Yongnong Biosciences Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the China crop protection pesticides market is poised for transformation, driven by technological advancements and a shift towards sustainable practices. As the government continues to invest in agricultural innovation, the market will likely see increased adoption of biopesticides and integrated pest management strategies. Additionally, the rise of e-commerce platforms for agricultural inputs will enhance accessibility for farmers, facilitating the adoption of modern pest control solutions and improving overall agricultural efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbicides Insecticides Fungicides Biopesticides Nematicides Molluscicides Rodenticides Growth Regulators Others |

| By Application | Grains & Cereals Fruits & Vegetables Oilseeds & Pulses Commercial Crops (e.g., cotton, sugarcane) Horticultural Crops Others |

| By End-User | Large-Scale Farms Smallholder Farmers Agricultural Cooperatives Government & Institutional Buyers Others |

| By Distribution Channel | Direct Sales Agrochemical Retailers Online Sales Distributors/Dealers Cooperatives Others |

| By Packaging Type | Bulk Packaging Retail Packaging Sachets/Small Packs Others |

| By Formulation Type | Liquid Granular Powder Emulsifiable Concentrate Suspension Concentrate Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Herbicide Usage in Major Crops | 120 | Farmers, Agronomists, Crop Advisors |

| Insecticide Application Trends | 90 | Pesticide Retailers, Agricultural Extension Officers |

| Fungicide Market Dynamics | 60 | Crop Protection Specialists, University Researchers |

| Regulatory Impact on Pesticide Sales | 50 | Policy Makers, Industry Analysts |

| Consumer Attitudes Towards Pesticide Use | 70 | Farmers, Agricultural Cooperatives, Environmental Advocates |

The China Crop Protection Pesticides Market is valued at approximately USD 4.2 billion, driven by increasing food security demands, advancements in agricultural technology, and the adoption of integrated pest management practices.