Region:Asia

Author(s):Dev

Product Code:KRAB0507

Pages:96

Published On:August 2025

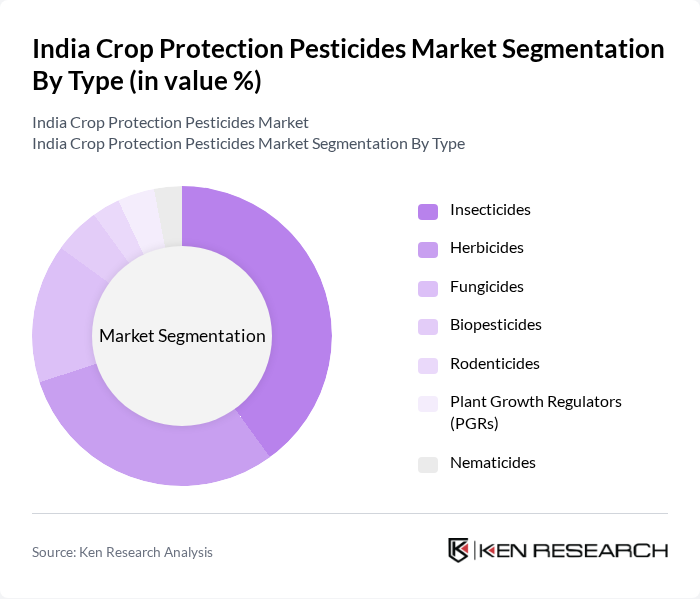

By Type:The market is segmented into various types of pesticides, including insecticides, herbicides, fungicides, biopesticides, rodenticides, plant growth regulators (PGRs), and nematicides. Among these, insecticides and herbicides are the most widely used due to their effectiveness in controlling pests and weeds, which are significant threats to crop production. The increasing awareness of sustainable agriculture has also led to a rise in the adoption of biopesticides.

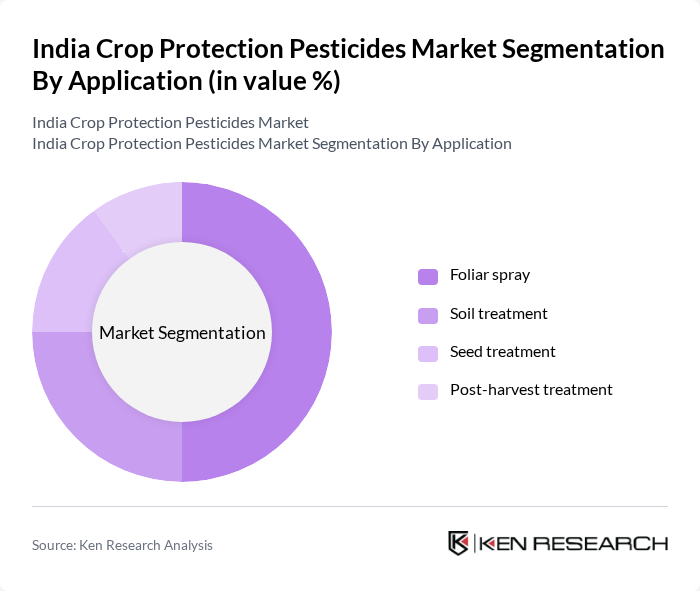

By Application:The application of pesticides is categorized into foliar spray, soil treatment, seed treatment, and post-harvest treatment. Foliar spray is the most dominant application method due to its effectiveness in delivering pesticides directly to the plant surface, ensuring better absorption and pest control. The increasing focus on crop quality and yield has further propelled the demand for advanced application techniques.

The India Crop Protection Pesticides Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer CropScience Limited (India), Syngenta India Limited, UPL Limited, BASF India Limited, Rallis India Limited, ADAMA India Private Limited, FMC India Private Limited, Dhanuka Agritech Limited, Insecticides (India) Limited, PI Industries Limited, Sumitomo Chemical India Limited, Gharda Chemicals Limited, Coromandel International Limited (Gromor Crop Protection), Corteva Agriscience (India) Private Limited, Safex Chemicals India Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India crop protection pesticides market appears promising, driven by technological advancements and a shift towards sustainable practices. The integration of precision agriculture is expected to enhance pesticide application efficiency, reducing waste and environmental impact. Additionally, the increasing focus on bio-pesticides and organic farming will likely reshape the market landscape, providing opportunities for innovation and growth. As farmers seek effective solutions to combat pest resistance, the demand for advanced formulations will continue to rise, fostering a dynamic market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Insecticides Herbicides Fungicides Biopesticides Rodenticides Plant Growth Regulators (PGRs) Nematicides |

| By Application | Foliar spray Soil treatment Seed treatment Post-harvest treatment |

| By Crop | Cereals & grains (rice, wheat, maize) Oilseeds & pulses (soybean, groundnut, pulses) Fruits & vegetables (horticulture) Commercial crops (cotton, sugarcane, plantation crops) |

| By Origin | Synthetic Biological (microbial, biochemical, botanical) |

| By Formulation | Liquid (EC, SC, SL, OD) Solid (WP, WG/WDG, GR) Aerosol and fumigant |

| By Distribution Channel | Company-dealer-distributor network Retail agri-input outlets E-commerce and digital platforms Direct-to-farmer and institutional sales |

| By Region | North India South India East India West India |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agrochemical Retailers | 150 | Store Managers, Sales Representatives |

| Farmers Using Pesticides | 150 | Crop Farmers, Agricultural Cooperatives |

| Pesticide Manufacturers | 100 | Product Managers, R&D Heads |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Agro-Consultants | 80 | Agricultural Advisors, Crop Specialists |

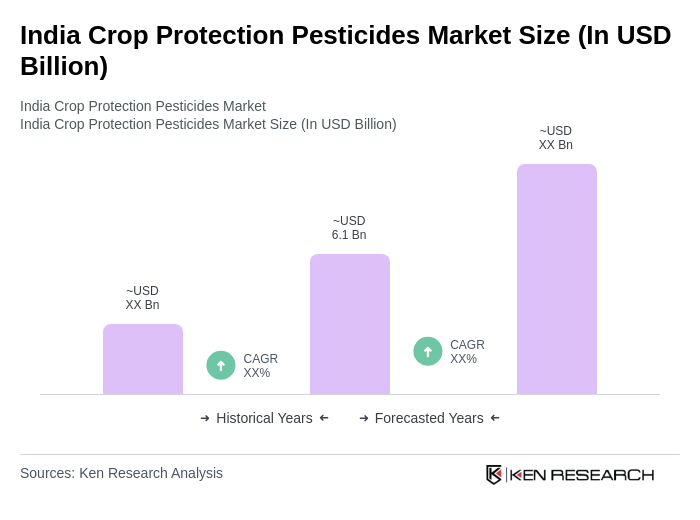

The India Crop Protection Pesticides Market is valued at approximately USD 6.1 billion, reflecting a significant growth driven by the increasing demand for food security and agricultural productivity, alongside the adoption of modern farming techniques.