Region:Asia

Author(s):Dev

Product Code:KRAB0436

Pages:96

Published On:August 2025

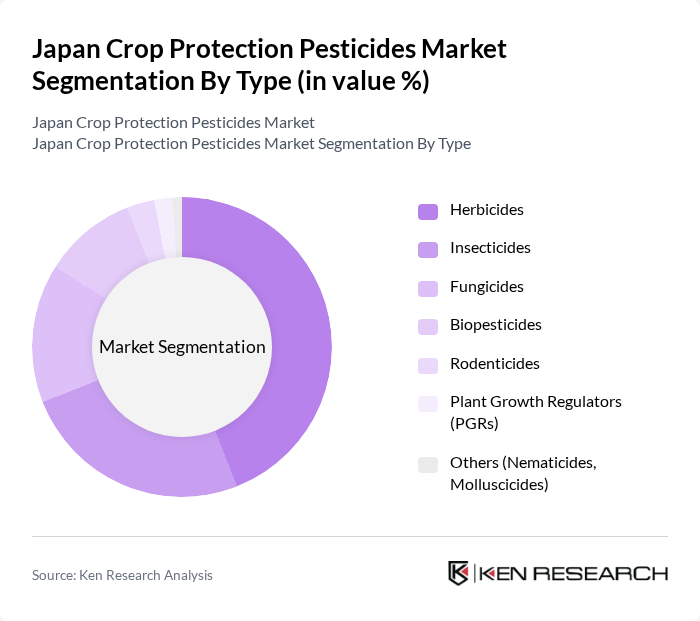

By Type:The market is segmented into various types of crop protection pesticides, including herbicides, insecticides, fungicides, biopesticides, rodenticides, plant growth regulators (PGRs), and others such as nematicides and molluscicides. Each of these subsegments plays a crucial role in pest management and crop protection, catering to the diverse needs of farmers and agricultural producers.

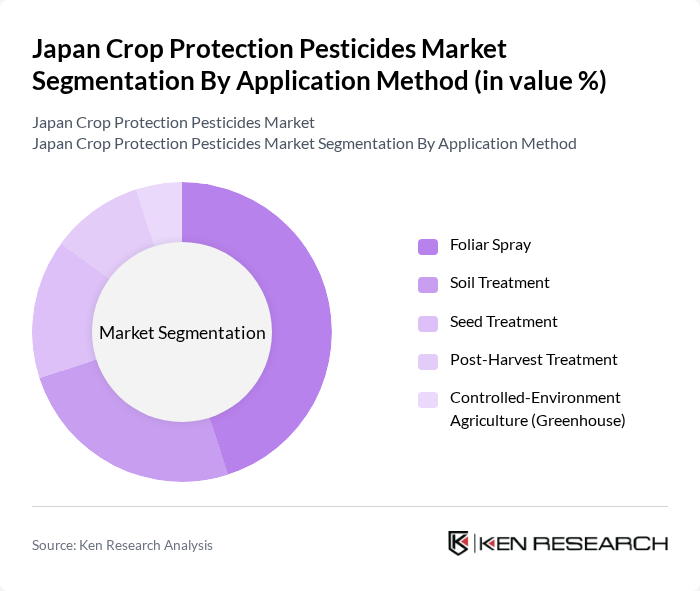

By Application Method:The application methods for crop protection pesticides include foliar spray, soil treatment, seed treatment, post-harvest treatment, and controlled-environment agriculture (greenhouse). Each method is tailored to specific agricultural practices and crop types, ensuring effective pest control and optimal crop health.

The Japan Crop Protection Pesticides Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer CropScience K.K. (Bayer AG), Syngenta Japan K.K., BASF Japan Ltd., Corteva Agriscience Japan, Ltd., FMC Chemical Co., Ltd. (FMC Japan), Sumitomo Chemical Co., Ltd., Mitsui Chemicals Agro, Inc. (MCAG), UPL Japan Ltd. (including legacy Arysta LifeScience), Nufarm Japan Co., Ltd., ADAMA Japan K.K. (ADAMA Ltd.), Nihon Nohyaku Co., Ltd. (Nissan Chemical Group), Kumiai Chemical Industry Co., Ltd., SDS Biotech K.K., Hokko Chemical Industry Co., Ltd., K-I Chemical Research Institute Co., Ltd. (part of Kumiai group) contribute to innovation, geographic expansion, and service delivery in this space.

The Japan crop protection pesticides market is poised for transformation as it adapts to evolving agricultural practices and consumer preferences. The integration of digital agriculture solutions is expected to enhance efficiency and sustainability in pest management. Additionally, the focus on biopesticides and organic farming will likely gain momentum, driven by regulatory support and consumer demand for environmentally friendly products. These trends will shape the future landscape of the market, fostering innovation and growth opportunities for stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbicides Insecticides Fungicides Biopesticides Rodenticides Plant Growth Regulators (PGRs) Others (Nematicides, Molluscicides) |

| By Application Method | Foliar Spray Soil Treatment Seed Treatment Post-Harvest Treatment Controlled-Environment Agriculture (Greenhouse) |

| By End-User | Row-Crop Farmers Horticulture & Specialty Crop Growers Forestry & Non-Crop Land Management Public Health & Vector Control |

| By Distribution Channel | Direct Sales (Manufacturers to Large Growers/Co-ops) Agri-Retailers & Cooperatives E-commerce/Online Sales Regional Distributors/Wholesalers Government & Institutional Procurement |

| By Formulation | Liquid (EC, SC, SL) Granular (GR, WG/WDG) Powder (WP, SP) Microencapsulated & Controlled-Release |

| By Crop Type | Cereals and Grains (Rice, Wheat, Barley) Fruits and Vegetables (Citrus, Apples, Leafy Greens) Oilseeds & Pulses (Soybean, Rapeseed) Specialty & Cash Crops (Tea, Flowers, Sugar Beet) |

| By Origin | Synthetic Bio-based (Microbial, Botanical, Semiochemicals) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Crop Protection Product Distributors | 100 | Sales Managers, Distribution Coordinators |

| Farmers Using Pesticides | 140 | Crop Farmers, Agricultural Technicians |

| Agrochemical Retailers | 80 | Store Managers, Product Specialists |

| Regulatory Bodies and Policy Makers | 50 | Regulatory Officers, Environmental Analysts |

| Research and Development Experts | 70 | R&D Managers, Agronomy Researchers |

The Japan Crop Protection Pesticides Market is valued at approximately USD 2.6 billion, reflecting a five-year historical analysis. This growth is driven by increasing food safety demands, aging farmer demographics, and advancements in agricultural technology.