Region:Asia

Author(s):Dev

Product Code:KRAC0449

Pages:96

Published On:August 2025

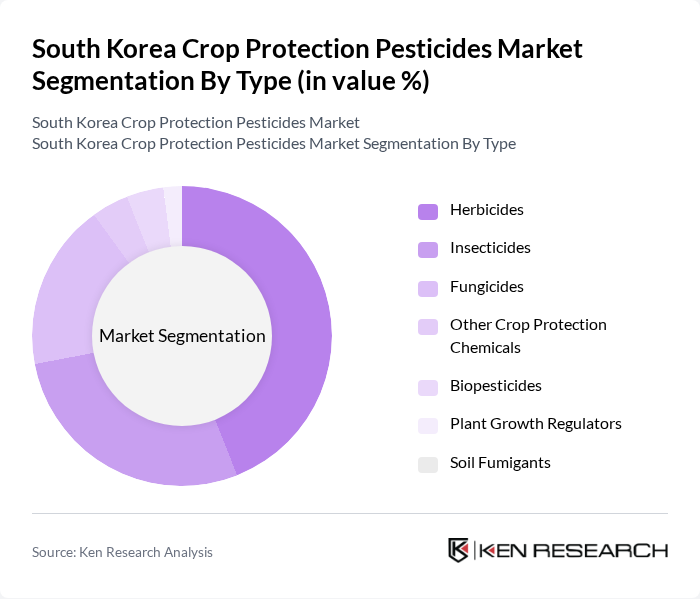

By Type:The market is segmented into various types of crop protection pesticides, including herbicides, insecticides, fungicides, biopesticides, plant growth regulators, soil fumigants, and other crop protection chemicals. Among these, herbicides and insecticides are the most widely used due to their effectiveness in controlling weeds and pests, which are critical for maintaining crop yields. The increasing adoption of precision agriculture techniques is also driving the demand for specialized formulations in these categories.

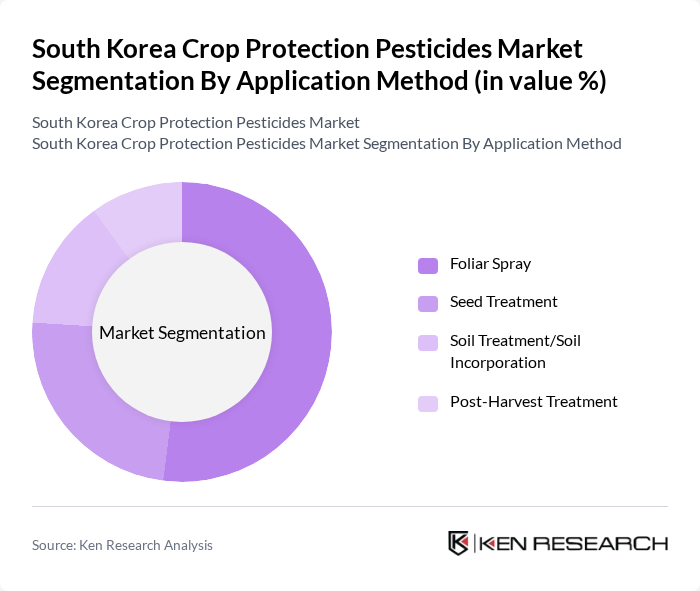

By Application Method:The application methods for crop protection pesticides include foliar spray, seed treatment, soil treatment, and post-harvest treatment. Foliar spray is the most prevalent method due to its effectiveness in delivering pesticides directly to the plant surface, ensuring better absorption and efficacy. The trend towards more efficient application techniques, such as drone-assisted spraying, is also gaining traction, enhancing the overall efficiency of pesticide use.

The South Korea Crop Protection Pesticides Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer CropScience Korea Ltd., Syngenta Korea Co., Ltd., BASF Korea Ltd., Corteva Agriscience Korea Ltd., FMC Korea Ltd., ADAMA Korea Co., Ltd., Nufarm Korea Co., Ltd., Sumitomo Chemical Korea Co., Ltd., UPL Korea Co., Ltd., Arysta LifeScience Korea (now part of UPL), Cheminova Korea Ltd. (now part of FMC), Isagro Korea Co., Ltd. (part of Gowan Group), Dongbang Agro Co., Ltd., FarmHannong Co., Ltd. (LG Chem affiliate), Kyung Nong Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean crop protection pesticides market is poised for transformation as sustainability becomes a central focus. In future, the shift towards eco-friendly products is expected to reshape consumer preferences, driving demand for biopesticides and organic solutions. Additionally, advancements in precision agriculture will enhance pest management efficiency, allowing farmers to optimize pesticide use. As these trends evolve, the market will likely see increased investment in research and development, fostering innovation and ensuring compliance with environmental standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbicides Insecticides Fungicides Other Crop Protection Chemicals Biopesticides Plant Growth Regulators Soil Fumigants |

| By Application Method | Foliar Spray Seed Treatment Soil Treatment/Soil Incorporation Post-Harvest Treatment |

| By Crop Type | Grains & Cereals (Rice, Barley, Other Grains) Fruits & Vegetables Pulses & Oilseeds Commercial Crops (e.g., Cotton, Tobacco) |

| By Distribution Channel | Direct Sales to Cooperatives/Large Farms Agro-retailers/Dealers Online Sales Distributors/Importers |

| By Formulation Type | Liquid (EC, SC, SL) Granular (GR, WG) Powder (WP, SP) Other Novel Formulations (CS, OD) |

| By Packaging Type | Bottles/HDPE Containers Bags/Sachets Bulk Packaging (Drums/IBC) |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Herbicide Usage in Major Crops | 120 | Farmers, Agronomists |

| Insecticide Market Trends | 100 | Pesticide Distributors, Retailers |

| Fungicide Application Practices | 80 | Crop Protection Specialists, Agricultural Advisors |

| Regulatory Impact on Pesticide Sales | 60 | Regulatory Officials, Industry Experts |

| Consumer Attitudes Towards Pesticide Use | 90 | Environmental Activists, Consumer Advocacy Groups |

The South Korea Crop Protection Pesticides Market is valued at approximately USD 1.1 billion, reflecting a five-year historical analysis. This growth is driven by increasing food security demands and advancements in agricultural technology.