Region:Asia

Author(s):Shubham

Product Code:KRAC0582

Pages:87

Published On:August 2025

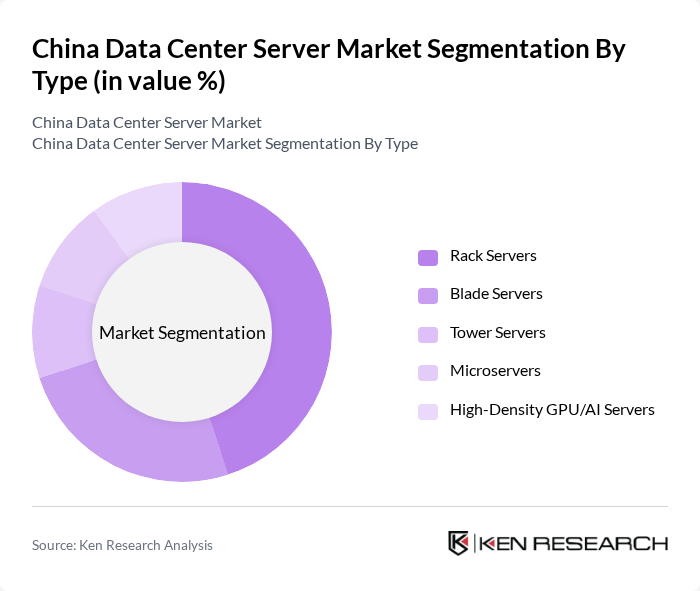

By Type:The market is segmented into various types of servers, including Rack Servers, Blade Servers, Tower Servers, Microservers, and High-Density GPU/AI Servers. Among these, Rack Servers are the most widely used due to their scalability and efficient space utilization, making them ideal for large data centers. Blade Servers are also gaining traction for their high performance and energy efficiency, particularly in environments requiring significant computational power.

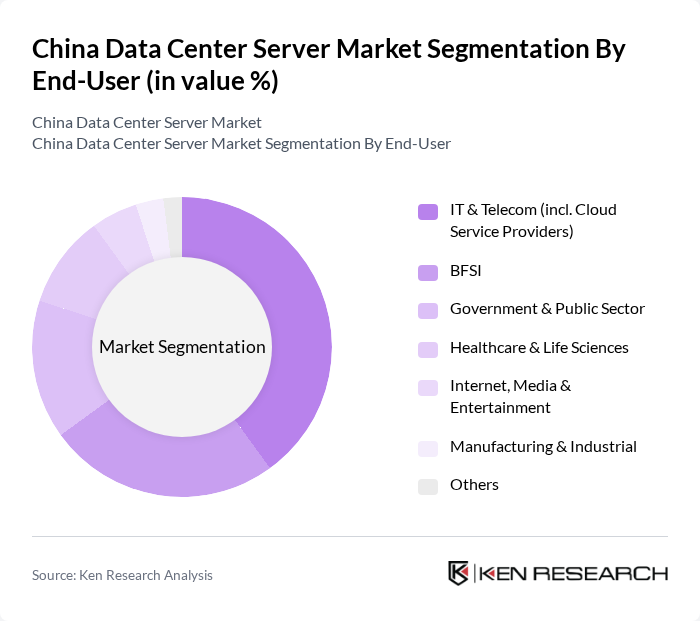

By End-User:The end-user segmentation includes IT & Telecom (including Cloud Service Providers), BFSI, Government & Public Sector, Healthcare & Life Sciences, Internet, Media & Entertainment, Manufacturing & Industrial, and Others. The IT & Telecom sector is the largest consumer of data center servers, driven by strong cloud infrastructure spending by leading hyperscalers and carriers, while BFSI demand is sustained by secure compute for core systems and analytics.

The China Data Center Server Market is characterized by a dynamic mix of regional and international players. Leading participants such as Huawei Technologies Co., Ltd., Inspur Electronic Information Industry Co., Ltd. (Inspur Information), Lenovo Group Limited, Dell Technologies Inc., Hewlett Packard Enterprise Company (HPE), Alibaba Cloud (Alibaba Cloud Computing Co., Ltd.), Tencent Cloud (Tencent Cloud Computing (Beijing) Co., Ltd.), Baidu AI Cloud (Beijing Baidu Netcom Science & Technology Co., Ltd.), China Telecom, China Unicom, ZTE Corporation, Sugon Information Industry Co., Ltd. (Dawning Information Industry Co., Ltd.), H3C (New H3C Group Co., Ltd.), VNET Group, Inc. (formerly 21Vianet Group, Inc.), GDS Holdings Limited, China Mobile, JD Cloud (Beijing Jingdong Shangke Information Technology Co., Ltd.), ByteDance (Volcengine) Cloud, Hygon (Chengdu Haiguang IC Design Co., Ltd.), Cambricon Technologies Corporation Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China Data Center Server Market is poised for significant transformation, driven by technological advancements and evolving consumer demands. As businesses increasingly adopt AI and machine learning, the need for advanced data processing capabilities will rise. Additionally, the push for sustainability will lead to the development of more energy-efficient data centers, aligning with global environmental goals. These trends will shape the market landscape, fostering innovation and competitive dynamics among key players.

| Segment | Sub-Segments |

|---|---|

| By Type | Rack Servers Blade Servers Tower Servers Microservers High-Density GPU/AI Servers |

| By End-User | IT & Telecom (incl. Cloud Service Providers) BFSI Government & Public Sector Healthcare & Life Sciences Internet, Media & Entertainment Manufacturing & Industrial Others |

| By Application | Cloud Computing Big Data & Analytics Virtualization & Software-Defined Infrastructure Disaster Recovery & Business Continuity High-Performance Computing (HPC) and AI Training/Inference Edge Computing |

| By Component | Hardware (CPU/GPU, Memory, Storage, NICs) System Software & Firmware Services (Integration, Managed Services, Support) |

| By Sales Channel | Direct (Vendor to Hyperscaler/IDC Operator) Value-Added Resellers/Distributors Online & Marketplace |

| By Form Factor | U/2U General-Purpose Servers Multi-Node and Composable/Disaggregated Systems OCP/OEM Custom and Liquid-Cooled Systems |

| By Price Band | Entry-Level Mid-Range High-End/Enterprise |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Colocation Services | 120 | Data Center Managers, IT Directors |

| Cloud Infrastructure Providers | 90 | Cloud Architects, Operations Managers |

| Enterprise Data Centers | 80 | Chief Information Officers, Facility Managers |

| Data Center Energy Efficiency | 60 | Sustainability Officers, Energy Managers |

| Data Center Security Solutions | 90 | Security Managers, Compliance Officers |

The China Data Center Server Market is valued at approximately USD 3133 billion, driven by demand from cloud build-outs, AI workloads, and hyperscale expansions, according to recent industry analyses and historical revenue data.