Region:Europe

Author(s):Shubham

Product Code:KRAC0841

Pages:83

Published On:August 2025

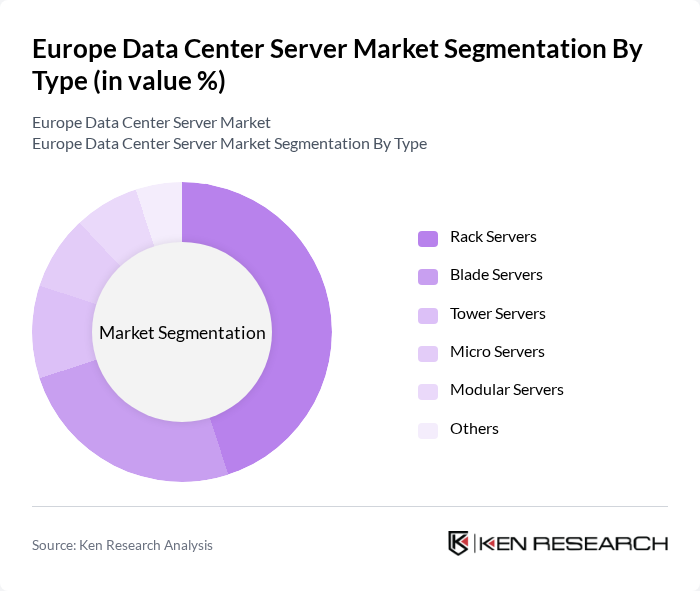

By Type:The market is segmented into Rack Servers, Blade Servers, Tower Servers, Micro Servers, Modular Servers, and Others. Rack Servers remain the most dominant segment, favored for their space efficiency, scalability, and suitability for high-density computing environments. Blade Servers are also prominent, valued for their modular architecture and energy efficiency, which are increasingly critical as data centers seek to optimize power usage and cooling. Micro Servers and Modular Servers are gaining traction for edge deployments and flexible infrastructure, while Tower Servers are primarily used in smaller enterprise settings.

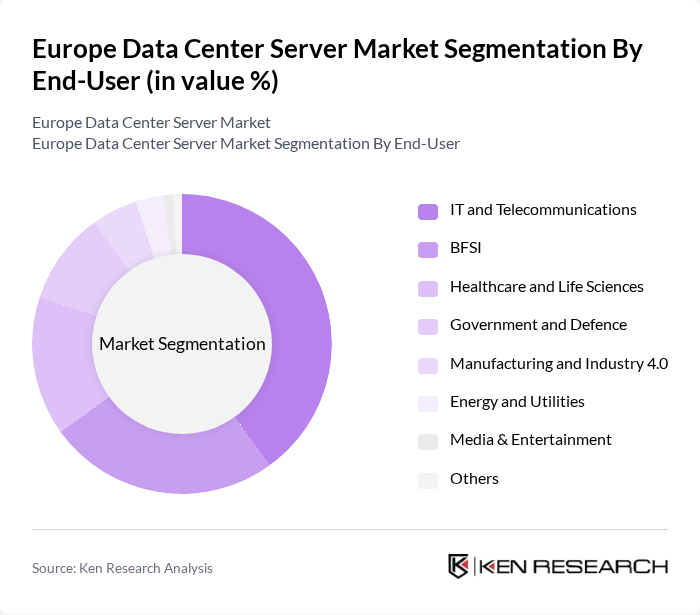

By End-User:The end-user segmentation includes IT and Telecommunications, BFSI, Healthcare and Life Sciences, Government and Defence, Manufacturing and Industry 4.0, Energy and Utilities, Media & Entertainment, and Others. IT and Telecommunications is the leading sector, driven by rapid cloud adoption, 5G network expansion, and the growing need for scalable data storage and processing. BFSI follows, reflecting the sector’s stringent requirements for secure, high-performance data management. Healthcare and Life Sciences are expanding due to increased digital health records and research data, while Government and Defence prioritize secure, compliant infrastructure. Manufacturing, Energy, and Media sectors are adopting advanced server technologies to support automation, analytics, and digital content delivery.

The Europe Data Center Server Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dell Technologies, Hewlett Packard Enterprise, Lenovo Group Limited, Cisco Systems, Inc., IBM Corporation, Fujitsu Limited, Supermicro Computer, Inc., Oracle Corporation, Atos SE, Schneider Electric SE, Digital Realty Trust, Inc., Equinix, Inc., NTT Communications Corporation, Interxion Holding N.V., OVHcloud, Arista Networks, Inc., Quetta Data Centers, EDGNEX Data Centers by DAMAC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe Data Center Server Market is poised for transformative growth, driven by technological advancements and evolving consumer demands. As organizations increasingly adopt hybrid cloud models, the need for flexible and scalable data center solutions will intensify. Additionally, the integration of AI and machine learning into data center operations will enhance efficiency and performance, while sustainability initiatives will shape infrastructure investments, ensuring compliance with environmental regulations and energy efficiency standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Rack Servers Blade Servers Tower Servers Micro Servers Modular Servers Others |

| By End-User | IT and Telecommunications BFSI Healthcare and Life Sciences Government and Defence Manufacturing and Industry 4.0 Energy and Utilities Media & Entertainment Others |

| By Application | Cloud Computing Big Data Analytics Virtualization Disaster Recovery High-Performance Computing (HPC) Edge/IoT Gateways Storage-centric Workloads Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Resellers System Integrators Others |

| By Region | Western Europe (France, Germany, UK, Netherlands, Belgium, Switzerland, Austria) Northern Europe (Sweden, Denmark, Norway, Finland, Ireland) Southern Europe (Italy, Spain, Portugal, Greece) Eastern Europe (Poland, Czech Republic, Hungary, Romania, Bulgaria) Rest of Europe |

| By Component | Hardware Software Services Others |

| By Price Range | Low-End Servers Mid-Range Servers High-End Servers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Colocation Services | 100 | Data Center Managers, IT Directors |

| Hyperscale Data Centers | 60 | Infrastructure Architects, Operations Managers |

| Energy Efficiency Solutions | 40 | Energy Managers, Sustainability Officers |

| Cloud Services Adoption | 80 | Cloud Architects, CIOs |

| Data Center Security Measures | 50 | Security Managers, Compliance Officers |

The Europe Data Center Server Market is valued at approximately USD 13 billion, reflecting a robust growth trajectory driven by cloud services, AI workloads, and edge computing expansion, alongside digital transformation initiatives across various industries.