Region:North America

Author(s):Dev

Product Code:KRAA1614

Pages:81

Published On:August 2025

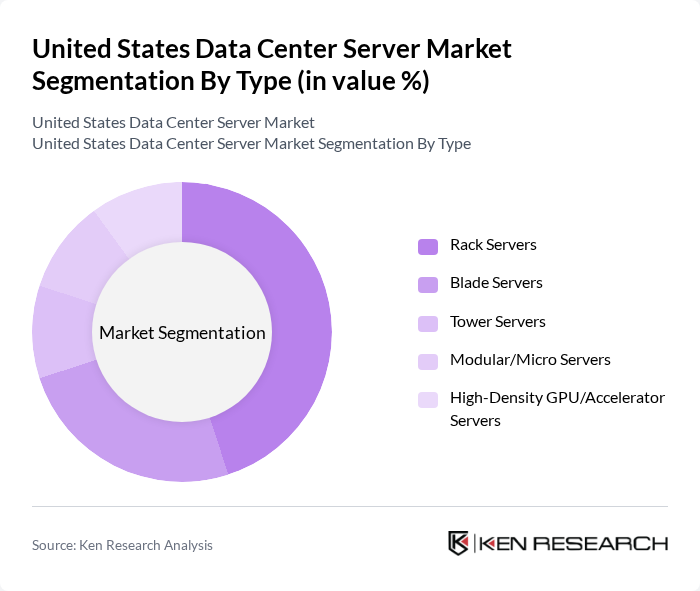

By Type:The data center server market is segmented into various types, including rack servers, blade servers, tower servers, modular/micro servers, and high-density GPU/accelerator servers. Among these, rack servers dominate the market due to their space efficiency, standardization, and scalability, making them ideal for large-scale and colocation facilities. Blade servers are gaining traction in environments prioritizing dense compute and unified management, while high-density GPU/accelerator servers are rapidly increasing in share due to AI training and inference demand in hyperscale and enterprise AI clusters .

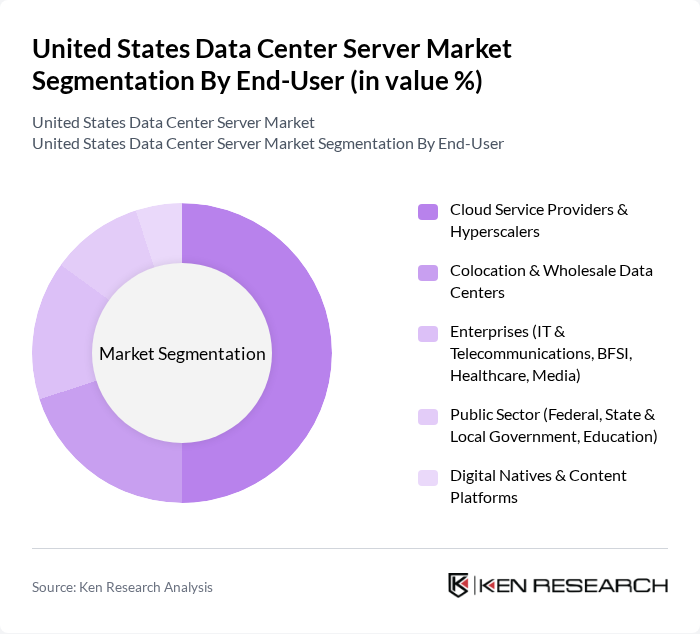

By End-User:The end-user segmentation includes cloud service providers & hyperscalers, colocation & wholesale data centers, enterprises (IT & telecommunications, BFSI, healthcare, media), public sector (federal, state & local government, education), and digital natives & content platforms. Cloud service providers and hyperscalers lead the market, driven by expansion of AI infrastructure, growing cloud service consumption, and large-scale investments in GPU-rich clusters; colocation/wholesale providers follow as enterprises pursue hybrid cloud and capacity leasing to meet latency and power constraints .

The United States Data Center Server Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dell Technologies, Hewlett Packard Enterprise (HPE), Cisco Systems, Inc., Lenovo Group Limited, International Business Machines Corporation (IBM), Super Micro Computer, Inc. (Supermicro), Oracle Corporation, Fujitsu Limited, Inspur Electronic Information Industry Co., Ltd. (Inspur), NEC Corporation, Hitachi, Ltd., Arista Networks, Inc., Equinix, Inc., Digital Realty Trust, Inc. (Digital Realty), Amazon Web Services, Inc. (AWS), Microsoft Corporation (Azure), Google LLC (Google Cloud), Meta Platforms, Inc., NVIDIA Corporation, Advanced Micro Devices, Inc. (AMD), Intel Corporation, Broadcom Inc., Seagate Technology Holdings plc, Western Digital Corporation, Micron Technology, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the U.S. data center server market is poised for transformative growth, driven by technological advancements and evolving consumer demands. As organizations increasingly adopt hybrid and multi-cloud strategies, the need for flexible, scalable server solutions will intensify. Additionally, the push for sustainability will lead to greater investments in energy-efficient technologies and green data centers, aligning with regulatory pressures and consumer expectations for environmentally responsible practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Rack Servers Blade Servers Tower Servers Modular/Micro Servers High-Density GPU/Accelerator Servers |

| By End-User | Cloud Service Providers & Hyperscalers Colocation & Wholesale Data Centers Enterprises (IT & Telecommunications, BFSI, Healthcare, Media) Public Sector (Federal, State & Local Government, Education) Digital Natives & Content Platforms |

| By Application/Workload | AI/ML Training & Inference Cloud & Virtualization Big Data & Analytics Databases & Transaction Processing Edge & Content Delivery/Streaming |

| By Component | Server Hardware (CPU, GPU/Accelerators, Memory, Storage, NIC) Systems Software (OS, Virtualization, HCI Software) Services (Deployment, Managed & Support) |

| By Processor Architecture | x86 (Intel, AMD) ARM-based Other (Power, RISC-V) |

| By Form Factor/Deployment Location | On-Premises Enterprise Data Centers Colocation Facilities Hyperscale Campuses |

| By Price Tier | Entry-Level/General Purpose Mid-Range High-End/Mission Critical |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Data Center Operations | 120 | IT Managers, Data Center Administrators |

| Colocation Services | 100 | Sales Directors, Operations Managers |

| Hyperscale Data Center Trends | 80 | Infrastructure Architects, Cloud Strategists |

| Energy Efficiency Initiatives | 70 | Facility Managers, Sustainability Officers |

| Regulatory Compliance in Data Centers | 60 | Compliance Officers, Risk Management Executives |

The United States Data Center Server Market is valued at approximately USD 31 billion, driven by investments in AI/ML workloads, hyperscale cloud expansion, and big data analytics, which are accelerating server refresh cycles and high-density deployments.