South Korea Data Center Server Market Overview

- The South Korea Data Center Server Market is valued at USD 2.7 billion, based on a five-year historical analysis of server revenues within data centers. This growth is primarily driven by the increasing adoption of cloud-based solutions, the expansion of digital infrastructure, and rising demand for remote work and virtual services. Additional drivers include the proliferation of e-commerce, online gaming, and heightened cybersecurity concerns, all contributing to the need for scalable and secure data processing and storage solutions. Government initiatives supporting digital transformation and data security further reinforce market expansion.

- Seoul remains the dominant city in the South Korea Data Center Server Market, attributed to its advanced technological infrastructure and high concentration of IT companies. Busan and Incheon are emerging as key players, supported by strategic investments in hyperscale data center facilities and partnerships with local governments. The robust telecommunications network and presence of major tech firms continue to strengthen these cities' market positions.

- In 2023, the South Korean government implemented the "Data Center Green Growth Strategy," issued by the Ministry of Science and ICT. This regulation mandates that new data centers must comply with strict energy consumption standards and utilize renewable energy sources, including requirements for energy efficiency certification and minimum renewable energy thresholds for facility operations. The strategy aims to promote sustainable practices and reduce the carbon footprint of data center operations nationwide.

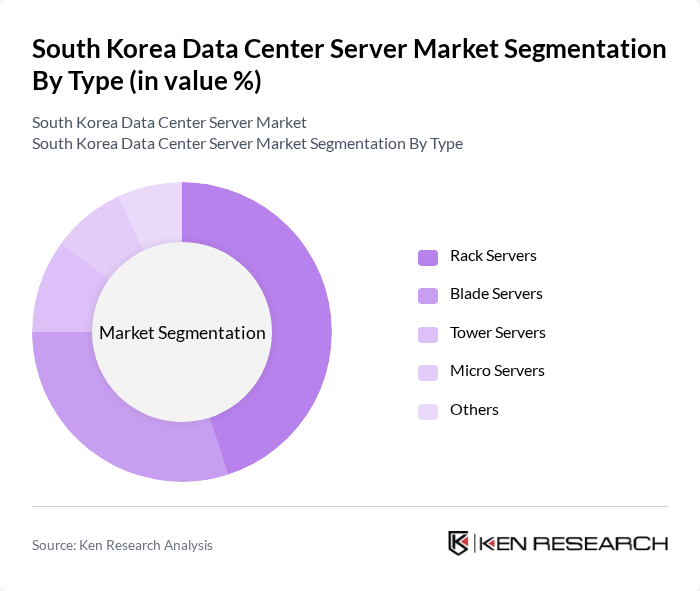

South Korea Data Center Server Market Segmentation

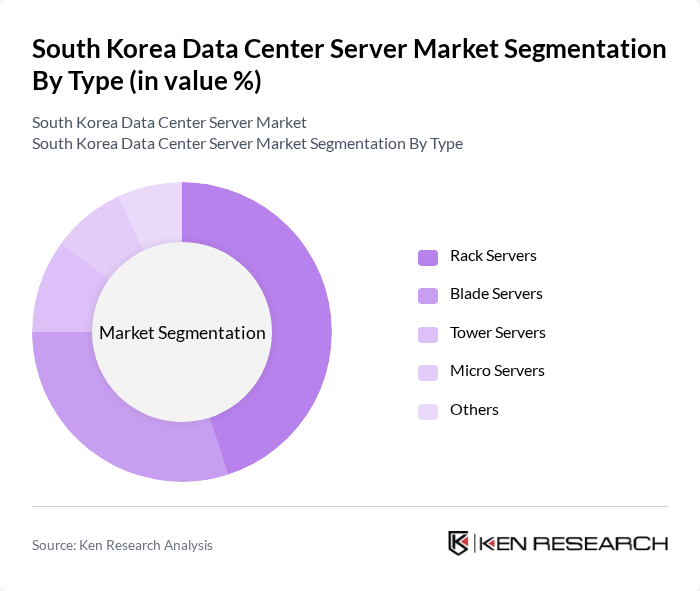

By Type:The segmentation by type includes various server configurations that cater to different operational needs. The primary subsegments are Rack Servers, Blade Servers, Tower Servers, Micro Servers, and Others. Rack Servers are widely adopted due to their space efficiency and scalability, making them the leading choice among enterprises for high-density deployments. Blade Servers offer modularity and high-density computing for data-intensive workloads, particularly in large-scale and cloud environments. Tower Servers and Micro Servers are increasingly favored by small to medium-sized businesses seeking cost-effective and flexible solutions for localized data processing and edge computing.

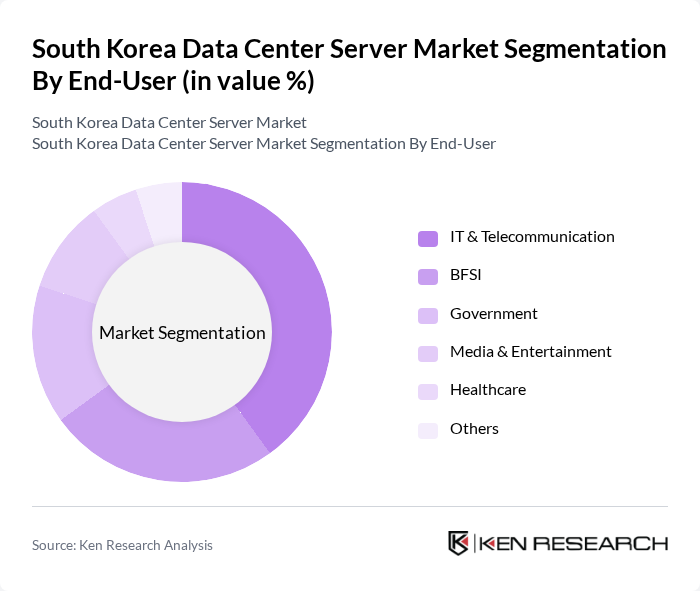

By End-User:The end-user segmentation encompasses various industries utilizing data center servers, including IT & Telecommunication, BFSI, Government, Media & Entertainment, Healthcare, and Others. The IT & Telecommunication sector is the largest consumer, driven by the need for robust data processing, cloud services, and storage capabilities. BFSI follows closely, as financial institutions increasingly rely on data centers for secure transactions, regulatory compliance, and advanced analytics. The Government sector is expanding its use of data centers to enhance public services, digital governance, and data security, while Media & Entertainment and Healthcare are leveraging servers for content delivery, streaming, and health data management.

South Korea Data Center Server Market Competitive Landscape

The South Korea Data Center Server Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., LG Electronics Inc., SK hynix Inc., Naver Cloud Corporation, KT Corporation, Kakao Corp., Daewoo Engineering & Construction Co., Ltd., CJ Logistics Corporation, Hanwha Vision Co., Ltd., POSCO ICT Co., Ltd., NHN Corporation, LG CNS Co., Ltd., SK Telecom Co., Ltd., Samsung SDS Co., Ltd., Megazone Cloud Corporation contribute to innovation, geographic expansion, and service delivery in this space.

South Korea Data Center Server Market Industry Analysis

Growth Drivers

- Increasing Demand for Cloud Services:The South Korean cloud services market is projected to reach approximately $6.5 billion in future, driven by a surge in remote work and digital transformation initiatives. The country's cloud adoption rate is expected to exceed 30 percent in future, reflecting a growing reliance on cloud-based solutions. This demand is further supported by the increasing number of small and medium enterprises (SMEs) transitioning to cloud platforms, which are anticipated to account for 40 percent of cloud service consumption in the region.

- Expansion of E-commerce Platforms:South Korea's e-commerce market is expected to grow to $100 billion in future, fueled by a 20 percent annual increase in online shopping activities. This growth is driving the need for robust data center infrastructure to support transaction processing and data storage. The rise of mobile commerce, which is projected to represent 60 percent of total e-commerce sales, further emphasizes the necessity for scalable and efficient data center solutions to handle increased traffic and data loads.

- Rise in Data Generation and Analytics:With South Korea generating over 1.5 billion gigabytes of data daily, the demand for data analytics and storage solutions is surging. The data analytics market is expected to reach $2.3 billion in future, as businesses increasingly leverage data-driven insights for decision-making. This trend is supported by the proliferation of IoT devices, which are projected to exceed 30 million units in the country, further contributing to the data generation landscape and necessitating advanced data center capabilities.

Market Challenges

- High Operational Costs:Operating a data center in South Korea incurs significant expenses, with average operational costs estimated at $1.2 million per year for a mid-sized facility. Factors contributing to these costs include energy consumption, which accounts for nearly 40 percent of total operational expenses, and the need for advanced cooling systems. As energy prices continue to rise, maintaining profitability while ensuring efficient operations poses a substantial challenge for data center operators.

- Regulatory Compliance Complexities:South Korea's stringent data protection laws, including the Personal Information Protection Act (PIPA), impose rigorous compliance requirements on data center operators. Non-compliance can result in fines exceeding $1 million, creating a significant burden for businesses. Additionally, navigating the complexities of international data transfer regulations adds another layer of challenge, as companies must ensure adherence to both local and global standards to avoid legal repercussions.

South Korea Data Center Server Market Future Outlook

The South Korea data center server market is poised for significant evolution, driven by technological advancements and increasing digitalization. The integration of AI and machine learning into data center operations is expected to enhance efficiency and reduce operational costs. Furthermore, the development of 5G infrastructure will facilitate faster data transmission, enabling real-time analytics and edge computing solutions. As businesses prioritize sustainability, investments in green data centers will likely rise, aligning with global environmental goals and regulatory frameworks.

Market Opportunities

- Growth in AI and Machine Learning Applications:The AI market in South Korea is projected to reach $1.5 billion in future, creating opportunities for data centers to offer specialized services. This growth will drive demand for high-performance computing resources, enabling data centers to cater to businesses seeking advanced analytics and machine learning capabilities, thus enhancing their service offerings and revenue potential.

- Increasing Investment in Green Data Centers:With the South Korean government aiming for a 30 percent reduction in carbon emissions by 2030, investments in green data centers are expected to rise significantly. Companies are projected to allocate over $500 million towards sustainable technologies, including energy-efficient cooling systems and renewable energy sources, positioning themselves as environmentally responsible while reducing operational costs in the long term.