Region:Asia

Author(s):Dev

Product Code:KRAA2205

Pages:87

Published On:August 2025

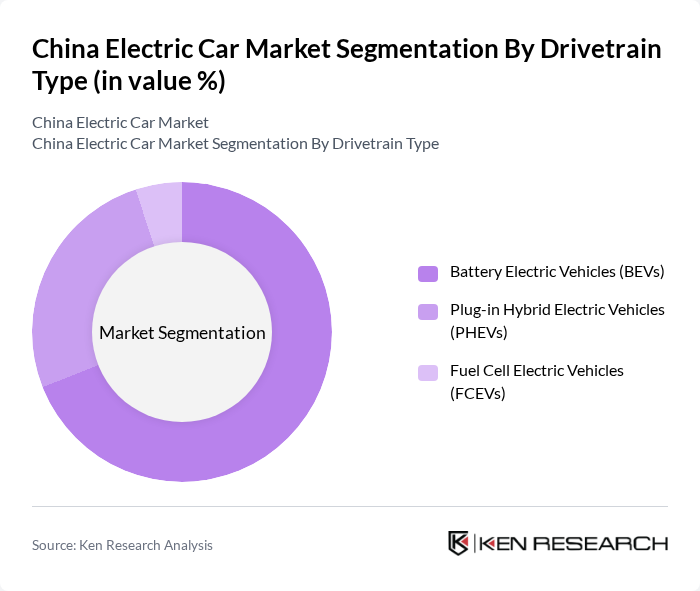

By Drivetrain Type:The market is segmented into three main drivetrain types: Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs). Among these, BEVs dominate the market due to their zero-emission capabilities and continuous advancements in battery technology, which have improved range and reduced costs. PHEVs also hold a significant share as they offer flexibility for users concerned about charging infrastructure, while FCEVs represent a smaller segment due to limited refueling infrastructure and higher costs .

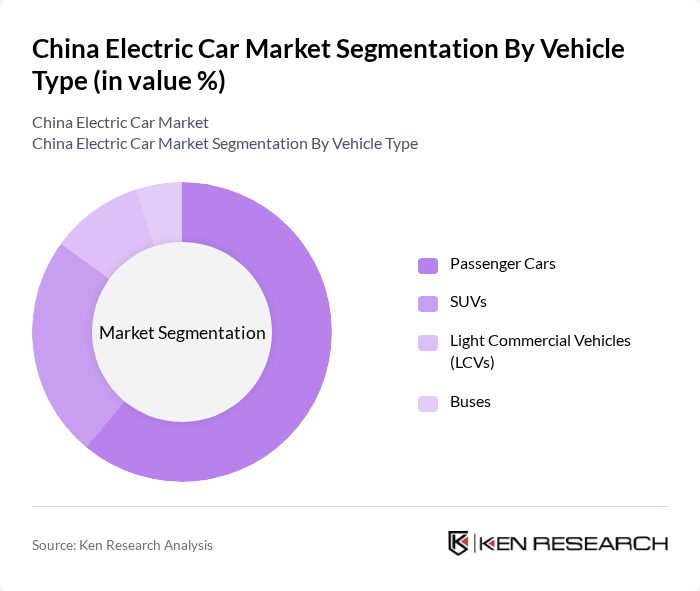

By Vehicle Type:The market is categorized into Passenger Cars, SUVs, Light Commercial Vehicles (LCVs), and Buses. Passenger Cars remain the leading segment, driven by consumer preference for personal electric vehicles and the growing availability of affordable models. SUVs are gaining traction due to their popularity among consumers seeking larger vehicles with electric options. LCVs and Buses are also important segments, particularly in urban areas where public transport electrification is a priority .

The China Electric Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as BYD Company Limited, NIO Inc., XPeng Inc., Li Auto Inc., SAIC Motor Corporation Limited, Geely Automobile Holdings Limited, Great Wall Motor Company Limited, Changan Automobile Co., Ltd., BAIC Motor Corporation Limited, Dongfeng Motor Corporation, Tesla, Inc., GAC Aion New Energy Automobile Co., Ltd., Leapmotor (Zhejiang Leapmotor Technology Co., Ltd.), Seres Group Co., Ltd., Zeekr Intelligent Technology Holding Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric car market in China appears promising, driven by a combination of technological advancements and supportive government policies. As battery costs continue to decline and charging infrastructure expands, consumer adoption is expected to rise significantly. By future, the market is likely to see a substantial increase in electric vehicle sales, with a focus on sustainable mobility solutions and smart technologies. This evolution will be crucial in addressing environmental concerns and enhancing urban air quality.

| Segment | Sub-Segments |

|---|---|

| By Drivetrain Type | Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Fuel Cell Electric Vehicles (FCEVs) |

| By Vehicle Type | Passenger Cars SUVs Light Commercial Vehicles (LCVs) Buses |

| By End-User | Individual Consumers Corporate Fleets Government Agencies Ride-Sharing Services |

| By Price Range | Budget Segment Mid-Range Segment Premium Segment |

| By Sales Channel | Direct Sales Dealerships Online Platforms |

| By Distribution Mode | Urban Distribution Rural Distribution Export Distribution |

| By Charging Type | Home Charging Public Charging Fast Charging |

| By Application | Personal Use Commercial Use Government Use |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Electric Vehicles | 120 | Car Owners, Potential EV Buyers |

| Charging Infrastructure Insights | 60 | Charging Station Operators, Urban Planners |

| Battery Technology Trends | 50 | Battery Manufacturers, R&D Engineers |

| Government Policy Impact | 40 | Policy Makers, Regulatory Authorities |

| Market Dynamics and Competition | 70 | Automotive Analysts, Industry Consultants |

The China Electric Car Market is valued at approximately USD 375 billion, reflecting significant growth driven by government policies, advancements in battery technology, and increasing consumer awareness of environmental sustainability.