Region:Asia

Author(s):Rebecca

Product Code:KRAD0254

Pages:80

Published On:August 2025

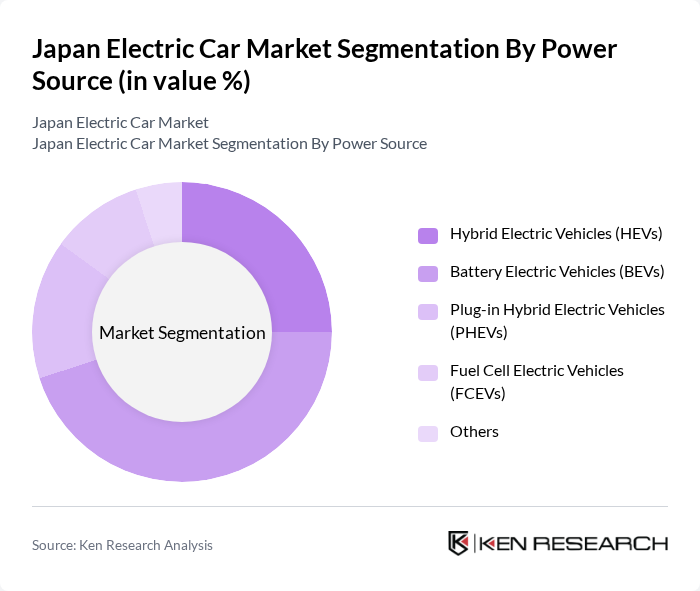

By Power Source:The electric car market in Japan is segmented by power source into Hybrid Electric Vehicles (HEVs), Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Fuel Cell Electric Vehicles (FCEVs), and others. Among these, Battery Electric Vehicles (BEVs) are gaining significant traction due to ongoing advancements in battery technology, which enhance range and reduce charging times. The growing consumer preference for fully electric options, driven by environmental concerns and government incentives, positions BEVs as the leading subsegment in the market.

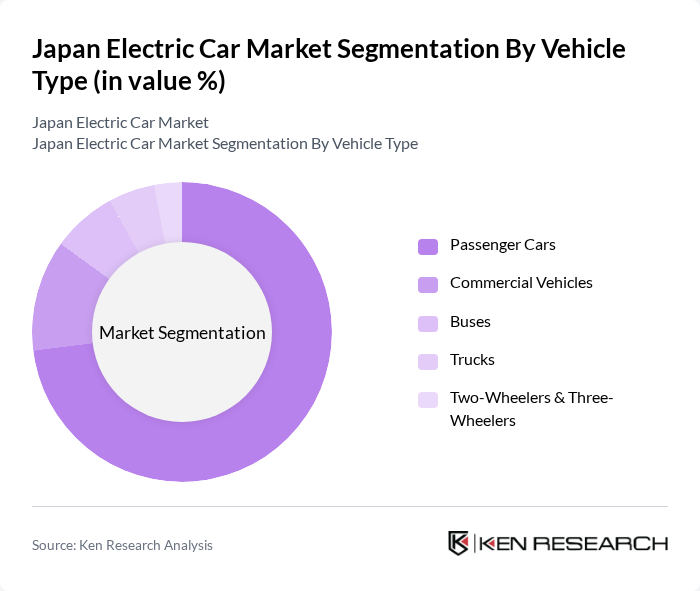

By Vehicle Type:The segmentation by vehicle type includes Passenger Cars, Commercial Vehicles, Buses, Trucks, and Two-Wheelers & Three-Wheelers. Passenger Cars dominate the market, accounting for the largest share due to strong consumer demand for personal mobility solutions and the increasing availability of electric models from major manufacturers. The rise in urbanization and the need for eco-friendly transportation options further bolster the growth of this segment, making it the most significant contributor to the overall electric car market.

The Japan Electric Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Corporation, Nissan Motor Co., Ltd., Honda Motor Co., Ltd., Mitsubishi Motors Corporation, Subaru Corporation, Mazda Motor Corporation, Suzuki Motor Corporation, Daihatsu Motor Co., Ltd., Panasonic Corporation, Hitachi, Ltd., Aisin Corporation, Denso Corporation, Chubu Electric Power Co., Inc., Tokyo Electric Power Company Holdings, Inc., ENEOS Corporation, GS Yuasa Corporation, CATL Japan K.K., BYD Auto Japan Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric car market in Japan appears promising, driven by a combination of technological advancements and supportive government policies. As battery technology continues to evolve, consumers can expect longer ranges and lower costs, enhancing the appeal of electric vehicles. Additionally, the expansion of charging infrastructure is anticipated to alleviate range anxiety, further encouraging adoption. With a strong focus on sustainability and innovation, the market is poised for significant growth in the coming years, aligning with global trends towards cleaner transportation solutions.

| Segment | Sub-Segments |

|---|---|

| By Power Source | Hybrid Electric Vehicles (HEVs) Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Fuel Cell Electric Vehicles (FCEVs) Others |

| By Vehicle Type | Passenger Cars Commercial Vehicles Buses Trucks Two-Wheelers & Three-Wheelers |

| By End-User | Individual Consumers Corporate Fleets Government Agencies Ride-Sharing Services |

| By Sales Channel | Direct Sales Dealerships Online Platforms Others |

| By Price Range | Economy Segment Mid-Range Segment Luxury Segment |

| By Charging Type | Home Charging Public Charging Fast Charging |

| By Battery Capacity | Below 30 kWh 60 kWh Above 60 kWh |

| By Drive Type | Front Wheel Drive Rear Wheel Drive All-Wheel Drive |

| By Region | Kanto Kansai Chubu Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Electric Vehicles | 120 | Car Owners, Potential EV Buyers |

| Industry Insights from Manufacturers | 60 | Product Managers, R&D Managers |

| Government Policy Impact Assessment | 40 | Policy Makers, Regulatory Officials |

| Charging Infrastructure Stakeholder Feedback | 50 | Infrastructure Developers, Utility Managers |

| Environmental Impact Perspectives | 45 | Environmental Scientists, Sustainability Advocates |

The Japan Electric Car Market is valued at approximately USD 15 billion, driven by government support, expanding charging infrastructure, and advancements in battery technology. This market is expected to grow significantly as consumer awareness of environmental sustainability increases.