China Express Delivery Market Overview

- The China Express Delivery Market is valued at approximately USD 120 billion, based on a five-year historical analysis. This growth is primarily driven by the rapid expansion of e-commerce, increasing consumer demand for fast delivery services, and advancements in logistics technology. The market has seen a significant rise in the volume of parcels delivered, with over 110 billion parcels handled in the latest annual period, reflecting the changing consumer behavior towards online shopping and the need for efficient delivery solutions .

- Key cities such as Beijing, Shanghai, and Guangzhou dominate the market due to their high population density, robust infrastructure, and concentration of businesses. These urban centers serve as major logistics hubs, facilitating efficient distribution networks and attracting significant investments from express delivery companies. The presence of a large consumer base in these cities further drives the demand for express delivery services .

- In 2023, the State Post Bureau of China issued the "Green Packaging Standards for Express Delivery, 2023," mandating delivery companies to adopt green practices such as the use of recyclable packaging materials, deployment of electric vehicles, and optimization of delivery routes to reduce carbon emissions. The regulation requires express delivery firms to comply with specific packaging standards and report annually on their sustainability measures, aiming to promote environmental sustainability while ensuring that the growing demand for express delivery services is met .

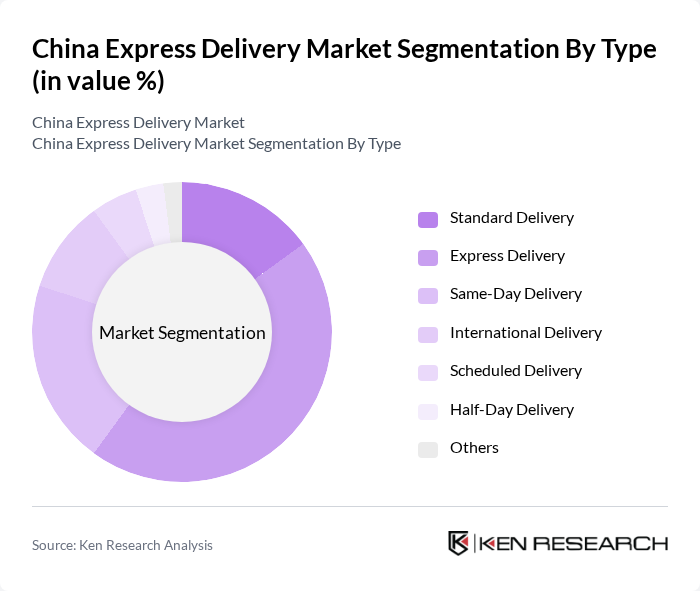

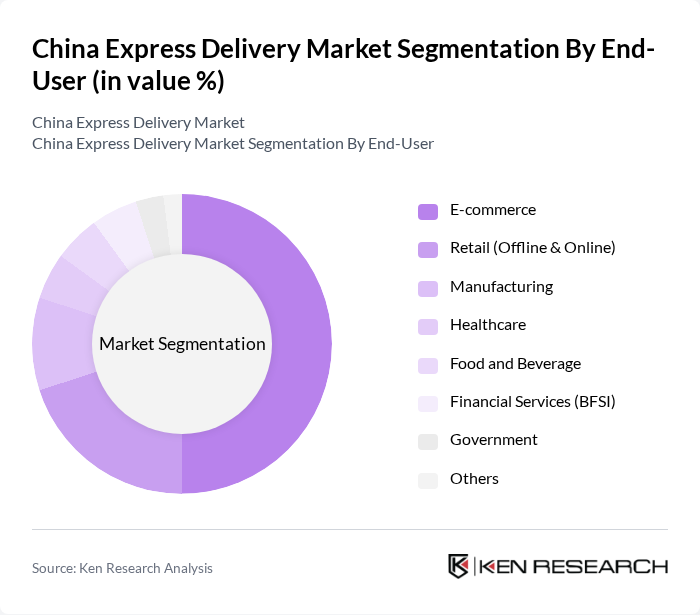

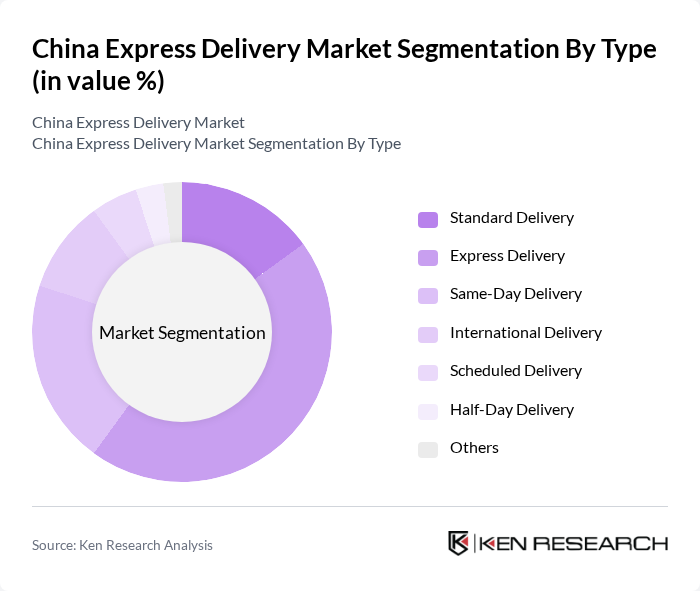

China Express Delivery Market Segmentation

By Type:The express delivery market can be segmented into various types, including Standard Delivery, Express Delivery, Same-Day Delivery, International Delivery, Scheduled Delivery, Half-Day Delivery, and Others. Among these, Express Delivery is the most dominant segment, driven by the increasing consumer preference for faster delivery options. The rise of e-commerce and the proliferation of livestreaming sales have significantly contributed to the demand for express services, as consumers expect quick and reliable delivery of their online purchases .

By End-User:The express delivery market serves various end-users, including E-commerce, Retail (Offline & Online), Manufacturing, Healthcare, Food and Beverage, Financial Services (BFSI), Government, and Others. The E-commerce segment is the leading end-user, as the surge in online shopping and the expansion of digital platforms have created a substantial demand for reliable and fast delivery services. Retailers are increasingly leveraging express delivery to enhance customer satisfaction and compete effectively in the market .

China Express Delivery Market Competitive Landscape

The China Express Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as SF Express, ZTO Express, YTO Express, STO Express, JD Logistics, Cainiao Network, Best Logistics, Deppon Logistics, Yunda Express, EMS China, China Post, Tmall Supermarket, Dada Group, Suning Logistics, 4PX Express, FedEx Express China, DHL Express China, SF Holding Co., Ltd., Zhongtong Express (ZTO Express), Shentong Express (STO Express) contribute to innovation, geographic expansion, and service delivery in this space.

China Express Delivery Market Industry Analysis

Growth Drivers

- Increasing E-commerce Penetration:The rapid growth of e-commerce in China is a significant driver for the express delivery market. In future, e-commerce sales reached approximately 15 trillion yuan, reflecting a year-on-year increase of 12%. This surge is expected to continue, with online retail sales projected to account for over 35% of total retail sales in future. The increasing consumer preference for online shopping necessitates efficient delivery services, thereby boosting demand for express delivery solutions.

- Urbanization and Population Density:China's urbanization rate is projected to reach 70% in future, with over 1 billion people living in urban areas. This demographic shift leads to higher population density in cities, creating a greater demand for express delivery services. Urban areas, which account for 82% of the country's GDP, require efficient logistics solutions to meet the needs of consumers who expect quick and reliable delivery options, further driving market growth.

- Technological Advancements in Logistics:The integration of advanced technologies in logistics is transforming the express delivery landscape. In future, investments in logistics technology in China reached 250 billion yuan, focusing on automation, AI, and data analytics. These innovations enhance operational efficiency, reduce delivery times, and improve customer satisfaction. As companies adopt these technologies, the express delivery market is expected to benefit from increased efficiency and reduced costs, fostering further growth.

Market Challenges

- Intense Competition Among Providers:The express delivery market in China is characterized by fierce competition, with over 1,200 registered delivery companies. Major players like SF Express and JD Logistics dominate the market, leading to price wars and reduced profit margins. In future, the average delivery cost per package fell to 14 yuan, down from 18 yuan previously. This competitive pressure challenges smaller providers to maintain profitability while striving to differentiate their services.

- Infrastructure Limitations in Rural Areas:Despite rapid urbanization, rural areas in China still face significant infrastructure challenges. Approximately 35% of rural regions lack adequate transportation networks, which hampers efficient delivery services. In future, only 32% of rural households had access to express delivery services, limiting market penetration. Addressing these infrastructure gaps is crucial for expanding express delivery capabilities and ensuring equitable service across urban and rural landscapes.

China Express Delivery Market Future Outlook

The future of the express delivery market in China appears promising, driven by ongoing technological advancements and evolving consumer expectations. As e-commerce continues to thrive, the demand for faster and more reliable delivery options will intensify. Companies are likely to invest in automation and AI to streamline operations, while sustainability initiatives will gain traction. Additionally, the expansion into underserved rural markets presents a significant opportunity for growth, enabling providers to tap into new customer bases and enhance service accessibility.

Market Opportunities

- Expansion into Tier 2 and Tier 3 Cities:With over 450 million people residing in Tier 2 and Tier 3 cities, there is a substantial opportunity for express delivery services. These cities are experiencing rapid economic growth, with disposable income increasing by 12% annually. Targeting these markets can lead to significant revenue growth for delivery companies, as consumer demand for efficient logistics solutions rises.

- Integration of AI and Automation:The integration of AI and automation in logistics operations presents a transformative opportunity. In future, it is estimated that AI-driven logistics solutions could reduce operational costs by up to 25%. Companies that adopt these technologies can enhance delivery efficiency, optimize route planning, and improve customer service, positioning themselves competitively in the evolving market landscape.