Region:Global

Author(s):Shubham

Product Code:KRAA0835

Pages:83

Published On:August 2025

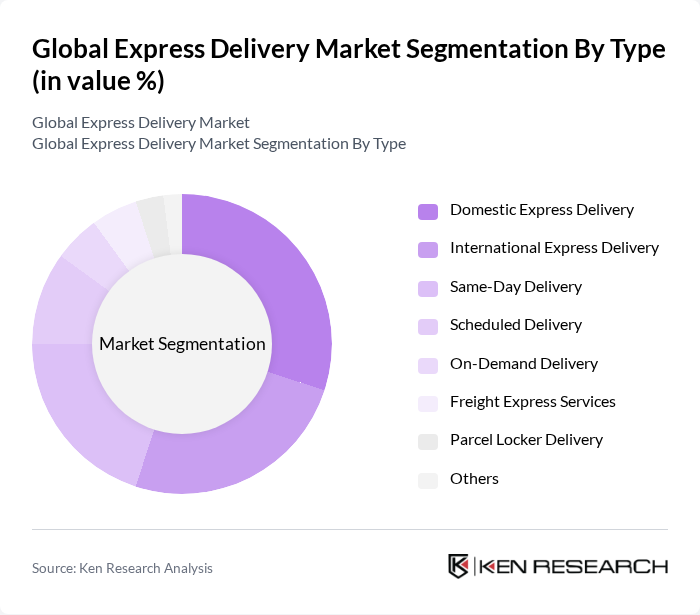

By Type:The express delivery market can be segmented into various types, including Domestic Express Delivery, International Express Delivery, Same-Day Delivery, Scheduled Delivery, On-Demand Delivery, Freight Express Services, Parcel Locker Delivery, and Others. Each of these segments caters to different consumer needs and preferences, with specific operational requirements and service levels. The market is witnessing increased demand for same-day and on-demand delivery services, driven by rising consumer expectations for speed and flexibility. Logistics providers are also expanding parcel locker networks and integrating digital tracking to enhance convenience and transparency.

The Domestic Express Delivery segment is currently leading the market, driven by the increasing demand for quick and reliable delivery services within countries. This segment benefits from the growth of local e-commerce platforms and the rising consumer expectation for fast shipping options. The convenience of domestic express services, coupled with the expansion of logistics networks and adoption of digital route optimization, has made it a preferred choice for both businesses and consumers.

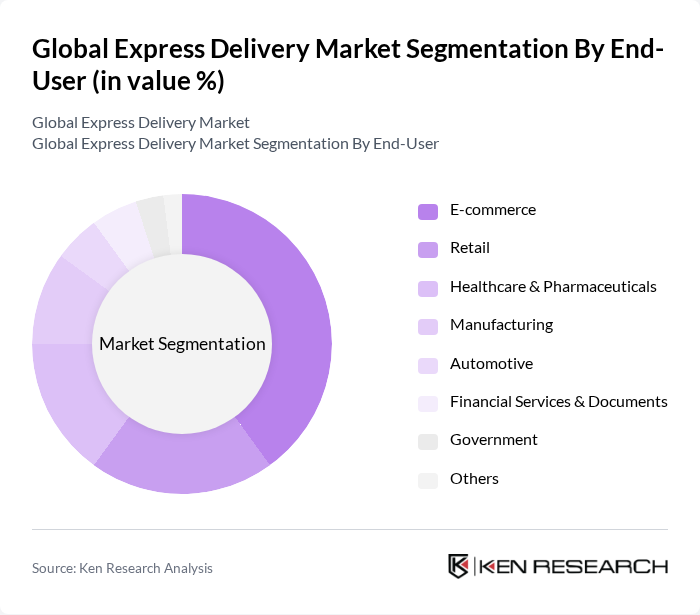

By End-User:The express delivery market can also be segmented by end-user categories, including E-commerce, Retail, Healthcare & Pharmaceuticals, Manufacturing, Automotive, Financial Services & Documents, Government, and Others. Each end-user segment has unique requirements and influences the demand for express delivery services. The healthcare and pharmaceuticals segment is experiencing notable growth due to the increasing need for time-sensitive and temperature-controlled deliveries.

The E-commerce segment is the dominant force in the express delivery market, accounting for a significant share. This is largely due to the rapid growth of online shopping, which has created a heightened demand for fast and reliable delivery services. E-commerce companies are increasingly investing in logistics capabilities, automation, and last-mile delivery innovations to meet consumer expectations for quick delivery, further solidifying their position in the express delivery landscape.

The Global Express Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Express, FedEx Corporation, UPS (United Parcel Service), SF Express, Aramex, DB Schenker, DPDgroup (GeoPost), Yamato Holdings, Japan Post, Royal Mail, Blue Dart Express, Poste Italiane, Canada Post, La Poste (France), Australia Post contribute to innovation, geographic expansion, and service delivery in this space.

The future of the express delivery market is poised for transformative growth, driven by technological advancements and evolving consumer expectations. As companies increasingly adopt automation and AI, operational efficiencies will improve, enabling faster delivery times. Additionally, the rise of sustainable practices will shape the industry, with a focus on reducing carbon footprints. Companies that embrace these trends will likely gain a competitive edge, positioning themselves favorably in a rapidly changing market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Express Delivery International Express Delivery Same-Day Delivery Scheduled Delivery On-Demand Delivery Freight Express Services Parcel Locker Delivery Others |

| By End-User | E-commerce Retail Healthcare & Pharmaceuticals Manufacturing Automotive Financial Services & Documents Government Others |

| By Distribution Mode | Road Transport Air Transport Rail Transport Sea Transport Multimodal Transport Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Dynamic Pricing Others |

| By Service Level | Standard Delivery Express Delivery Next-Day Delivery Same-Day Delivery Time-Definite Delivery Others |

| By Package Size | Small Packages Medium Packages Large Packages Bulk Shipments Oversized Freight Others |

| By Customer Type | Individual Customers Small Businesses Large Enterprises Government Agencies E-commerce Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Global E-commerce Delivery Services | 120 | Logistics Managers, E-commerce Directors |

| Last-Mile Delivery Solutions | 80 | Operations Managers, Delivery Coordinators |

| International Express Shipping | 60 | Supply Chain Managers, Freight Forwarders |

| Same-Day Delivery Services | 50 | Retail Operations Managers, Customer Experience Leads |

| Technology Integration in Delivery | 40 | IT Managers, Logistics Technology Specialists |

The Global Express Delivery Market is valued at approximately USD 430 billion, driven by the growth of e-commerce, consumer demand for fast delivery, and advancements in logistics technology.