Region:Europe

Author(s):Geetanshi

Product Code:KRAA2059

Pages:81

Published On:August 2025

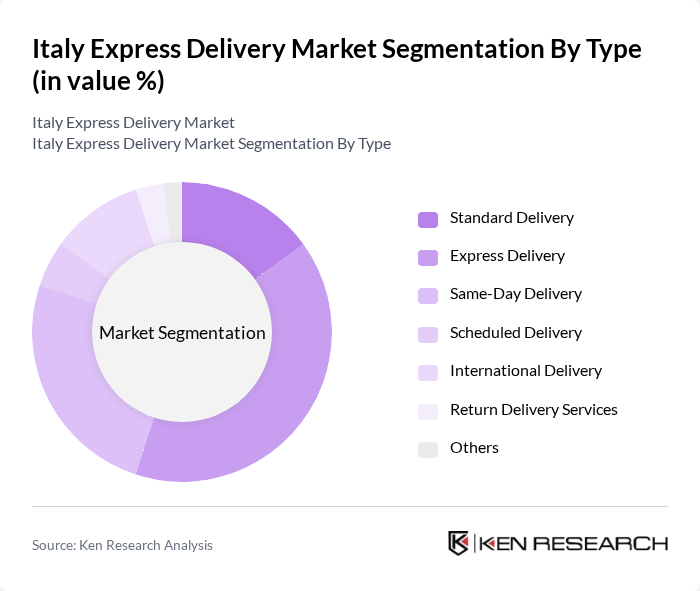

By Type:

The express delivery market in Italy is segmented into various types, including Standard Delivery, Express Delivery, Same-Day Delivery, Scheduled Delivery, International Delivery, Return Delivery Services, and Others. Among these, Express Delivery has emerged as the leading sub-segment, driven by the increasing consumer preference for faster shipping options. The rise of e-commerce has significantly influenced this trend, as customers expect quick and reliable delivery services. Additionally, Same-Day Delivery is gaining traction, particularly in urban areas, where consumers are willing to pay a premium for immediate service. The demand for International Delivery is also on the rise, fueled by cross-border e-commerce activities .

By End-User:

The end-user segmentation of the express delivery market includes E-commerce, Retail, Food and Beverage, Pharmaceuticals, Automotive, Financial Services (BFSI), Healthcare, Manufacturing, Primary Industry, Wholesale and Retail Trade (Offline), and Others. The E-commerce sector is the dominant end-user, accounting for a significant portion of the market share. The rapid growth of online shopping has led to an increased demand for express delivery services, as consumers expect quick and efficient shipping. Retail and Food and Beverage sectors also contribute substantially, driven by the need for timely deliveries to meet customer expectations. The Pharmaceuticals sector is witnessing growth due to the rising demand for fast delivery of medical supplies and products .

The Italy Express Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Express, FedEx Express, UPS (United Parcel Service), TNT Express, GLS (General Logistics Systems), Poste Italiane, SDA Express Courier, BRT (Bartolini), DPDgroup (Dynamic Parcel Distribution), Amazon Logistics, Nexive, Aramex, Chrono Express, GLS Italy, and TNT Italia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the express delivery market in Italy appears promising, driven by the ongoing digital transformation and consumer demand for faster services. As e-commerce continues to expand, companies are likely to invest in innovative delivery solutions, including automation and sustainable practices. The integration of advanced technologies will enhance operational efficiency, while partnerships with e-commerce platforms will create synergies that benefit both sectors. Overall, the market is poised for growth, adapting to changing consumer preferences and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Delivery Express Delivery Same-Day Delivery Scheduled Delivery International Delivery Return Delivery Services Others |

| By End-User | E-commerce Retail Food and Beverage Pharmaceuticals Automotive Financial Services (BFSI) Healthcare Manufacturing Primary Industry Wholesale and Retail Trade (Offline) Others |

| By Delivery Mode | Road Transport Air Transport Rail Transport Maritime Transport Others |

| By Package Size | Small Packages Medium Packages Large Packages Bulk Deliveries |

| By Pricing Model | Flat Rate Pricing Variable Pricing Subscription Pricing Pay-per-Delivery Pricing |

| By Customer Type | Individual Customers Small Businesses Large Enterprises Government Agencies |

| By Service Level | Economy Service Standard Service Premium Service Express Service |

| By Business Model | Business-to-Business (B2B) Business-to-Consumer (B2C) Consumer-to-Consumer (C2C) |

| By Destination | Domestic International |

| By Speed of Delivery | Express Non-Express |

| By Shipment Weight | Heavy Weight Shipments Light Weight Shipments Medium Weight Shipments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Express Delivery Services | 100 | Logistics Managers, Operations Directors |

| Rural Delivery Challenges | 60 | Regional Managers, Delivery Coordinators |

| Consumer Preferences in E-commerce | 100 | Online Shoppers, Customer Experience Managers |

| Last-Mile Delivery Innovations | 40 | Technology Officers, Supply Chain Analysts |

| Impact of Sustainability on Delivery Choices | 80 | Sustainability Managers, Marketing Directors |

The Italy Express Delivery Market is valued at approximately USD 10 billion, driven by the growth of e-commerce, consumer demand for fast delivery, and advancements in logistics technology.