Region:Middle East

Author(s):Geetanshi

Product Code:KRAA2067

Pages:91

Published On:August 2025

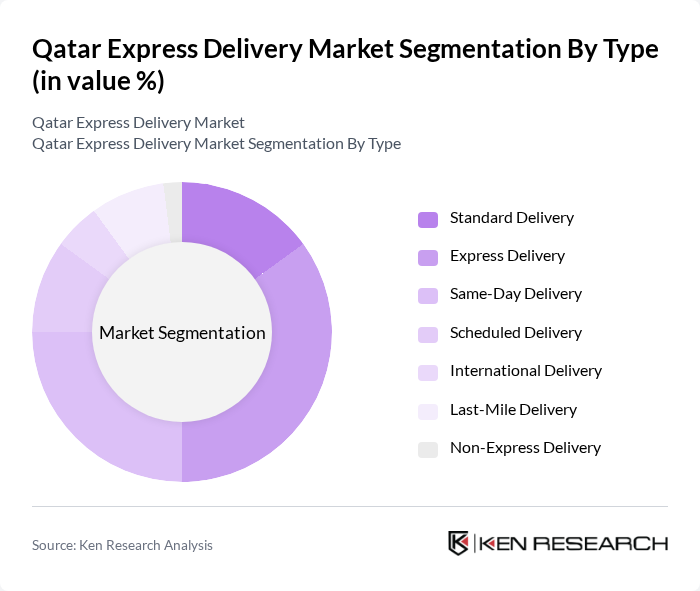

By Type:The express delivery market can be segmented into various types, including Standard Delivery, Express Delivery, Same-Day Delivery, Scheduled Delivery, International Delivery, Last-Mile Delivery, and Non-Express Delivery. Each of these segments caters to different consumer needs and preferences, with express and same-day delivery witnessing the highest demand due to the increasing expectation for rapid service. The rise of e-commerce has particularly boosted the express delivery segment, as consumers seek quick and reliable shipping options .

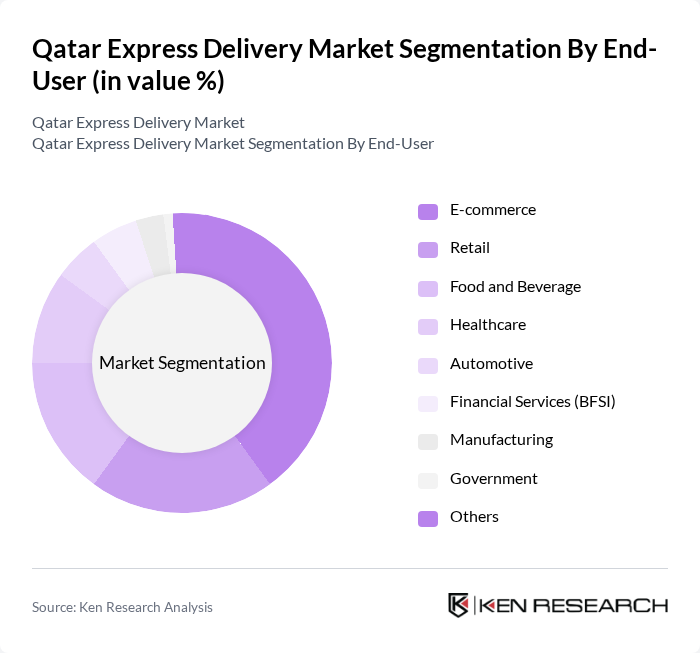

By End-User:The express delivery market serves a diverse range of end-users, including E-commerce, Retail, Food and Beverage, Healthcare, Automotive, Financial Services (BFSI), Manufacturing, Government, and Others. The E-commerce sector is the most significant contributor, driven by the increasing trend of online shopping and the demand for fast delivery options. Retail and Food and Beverage sectors also show substantial growth, as businesses seek to enhance customer satisfaction through timely deliveries .

The Qatar Express Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Post, Aramex, DHL Express, FedEx, UPS, QExpress, Naqel Express, Fetchr, TCS Express, Zajel, Mena Logistics, Al-Futtaim Logistics, Gulf Warehousing Company (GWC), Qatar Logistics, Qatari Express, Qatar Airways Cargo, Barq Express, Jeeb, Speedex Qatar, SMSA Express contribute to innovation, geographic expansion, and service delivery in this space.

The future of the express delivery market in Qatar appears promising, driven by ongoing technological advancements and evolving consumer preferences. As e-commerce continues to thrive, logistics companies are expected to enhance their service offerings, focusing on speed and reliability. The integration of sustainable practices and green technologies will likely become a priority, aligning with global trends. Additionally, partnerships with local businesses and e-commerce platforms will facilitate market expansion, ensuring that delivery services meet the growing demands of consumers across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Delivery Express Delivery Same-Day Delivery Scheduled Delivery International Delivery Last-Mile Delivery Non-Express Delivery |

| By End-User | E-commerce Retail Food and Beverage Healthcare Automotive Financial Services (BFSI) Manufacturing Government Others |

| By Delivery Mode | Road Delivery Air Delivery Sea Delivery Rail Delivery Multi-Modal Delivery Others |

| By Package Size | Small Packages Medium Packages Large Packages Bulk Delivery Others |

| By Pricing Model | Flat Rate Pricing Variable Pricing Subscription Pricing Pay-per-Delivery Pricing Others |

| By Customer Type | Individual Customers Corporate Clients Government Contracts Non-Profit Organizations Others |

| By Service Level | Economy Service Standard Service Premium Service Customized Service Others |

| By Destination | Domestic International |

| By Customer Segment | Business-to-Business (B2B) Business-to-Consumer (B2C) Consumer-to-Consumer (C2C) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Delivery Services | 60 | Logistics Managers, E-commerce Operations Heads |

| Retail Express Delivery | 50 | Supply Chain Directors, Retail Operations Managers |

| Healthcare Logistics | 40 | Pharmacy Managers, Healthcare Supply Chain Coordinators |

| Food Delivery Services | 45 | Operations Managers, Restaurant Supply Chain Managers |

| International Shipping and Logistics | 50 | Export Managers, Freight Forwarding Specialists |

The Qatar Express Delivery Market is valued at approximately USD 140 million, reflecting significant growth driven by the expansion of e-commerce and increased consumer demand for fast delivery services, particularly during the pandemic.