Region:Asia

Author(s):Dev

Product Code:KRAC0490

Pages:96

Published On:August 2025

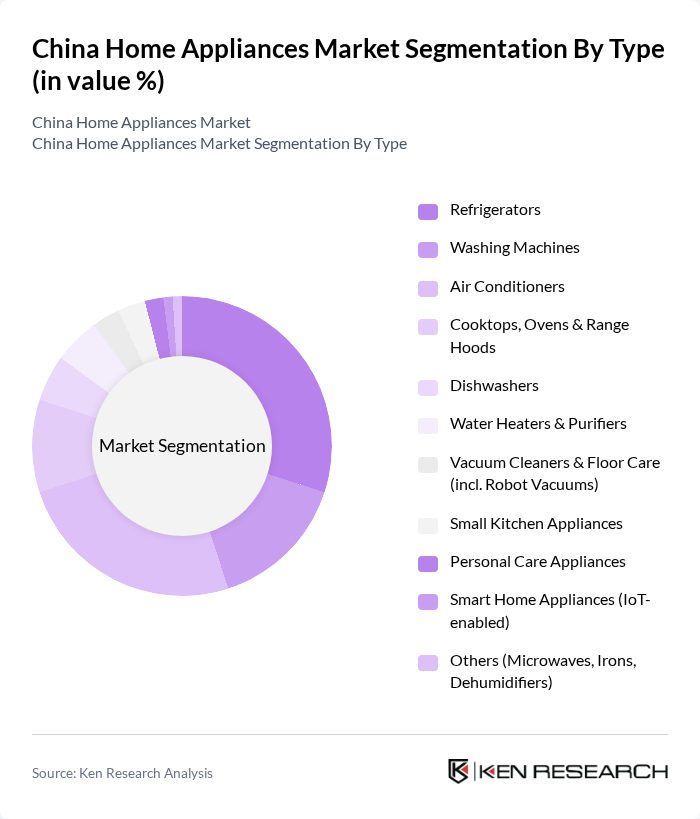

By Type:The market is segmented into various types of home appliances, including refrigerators, washing machines, air conditioners, cooktops, ovens & range hoods, dishwashers, water heaters & purifiers, vacuum cleaners & floor care (including robot vacuums), small kitchen appliances (rice cookers, blenders, kettles, etc.), personal care appliances (hair dryers, trimmers, etc.), smart home appliances (IoT-enabled), and others (microwaves, irons, dehumidifiers). Among these, refrigerators and air conditioners are the leading segments due to their essential role in modern households and the increasing demand for energy-efficient and smart models. Growth is also boosted by smart cleaning devices and cordless innovations in small appliances and floor care.

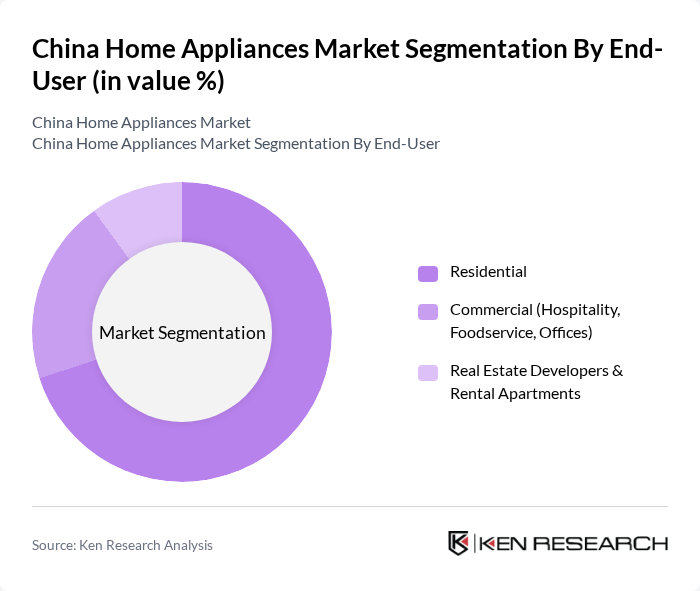

By End-User:The end-user segmentation includes residential, commercial (hospitality, foodservice, offices), and real estate developers & rental apartments. The residential segment dominates the market, supported by large household bases, urban renovations, and the prominence of online retail in household purchases. Trade?in subsidies and replacement demand further reinforce residential upgrades toward higher?efficiency models.

The China Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Haier Group (Haier Smart Home Co., Ltd.), Midea Group Co., Ltd., Gree Electric Appliances, Inc. of Zhuhai, TCL Electronics Holdings Limited, Hisense Home Appliances Group Co., Ltd. (formerly Qingdao Hisense), Whirlpool Corporation (China), Panasonic Corporation (China), Samsung Electronics (China), LG Electronics (China), Electrolux AB (China), BSH Hausgeräte GmbH (Bosch, Siemens), Sharp Corporation (China), Koninklijke Philips N.V. (Philips Domestic Appliances), Arçelik A.?. (Beko, Grundig), Roborock Technology Co., Ltd., Ecovacs Robotics Co., Ltd., Joyoung Co., Ltd., Zhejiang Supor Co., Ltd. (SEB Group), Galanz Group Co., Ltd., AUX Group (AUX Air Conditioner Co., Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China home appliances market appears promising, driven by ongoing urbanization and technological advancements. As disposable incomes continue to rise, consumers are expected to prioritize energy-efficient and smart appliances. Additionally, the shift towards online retailing is likely to reshape purchasing behaviors, making it easier for consumers to access a wider range of products. Companies that adapt to these trends will be well-positioned to capture emerging market segments and enhance their competitive edge in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators Washing Machines Air Conditioners Cooktops, Ovens & Range Hoods Dishwashers Water Heaters & Purifiers Vacuum Cleaners & Floor Care (incl. Robot Vacuums) Small Kitchen Appliances (Rice Cookers, Blenders, Kettles, etc.) Personal Care Appliances (Hair Dryers, Trimmers, etc.) Smart Home Appliances (IoT-enabled) Others (Microwaves, Irons, Dehumidifiers) |

| By End-User | Residential Commercial (Hospitality, Foodservice, Offices) Real Estate Developers & Rental Apartments |

| By Sales Channel | Online Retail (Tmall, JD, Pinduoduo, Brand DTC) Offline Retail (Brand Stores, Hypermarkets, Specialty Chains) Distributor/Dealer Network B2B & Project Sales |

| By Price Range | Budget Mid-Range Premium/Luxury |

| By Energy Efficiency Label | China Energy Label Level 1 China Energy Label Level 2 China Energy Label Level 3 and Below |

| By Product Features | Energy Efficient/Low-Consumption Smart Connectivity (App/Voice Control) Health & Hygiene (HEPA, Sterilization, Antibacterial) Multi-Functionality/Convertible |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms Live Commerce/Social Commerce |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Purchases | 150 | Homeowners, Renters, First-time Buyers |

| Retail Sales Insights | 100 | Store Managers, Sales Associates |

| Market Trends in Smart Appliances | 80 | Product Managers, Technology Specialists |

| Post-Purchase Consumer Satisfaction | 120 | Recent Buyers, Customer Service Representatives |

| Distribution Channel Effectiveness | 90 | Logistics Coordinators, Supply Chain Analysts |

The China Home Appliances Market is valued at approximately USD 130 billion, driven by factors such as rising disposable incomes, urbanization, and the increasing demand for smart and energy-efficient appliances among consumers.