Region:Europe

Author(s):Shubham

Product Code:KRAB0717

Pages:87

Published On:August 2025

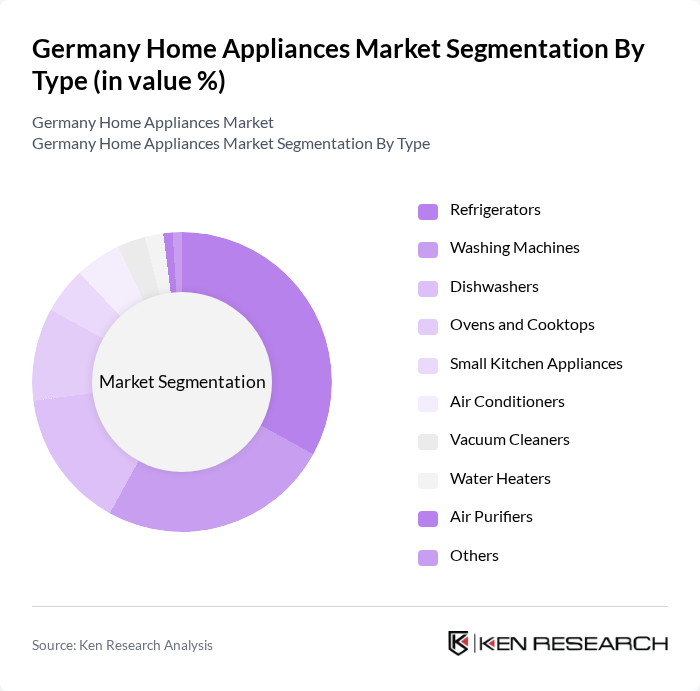

By Type:The market is segmented into various types of home appliances, including refrigerators, washing machines, dishwashers, ovens and cooktops, small kitchen appliances, air conditioners, vacuum cleaners, water heaters, air purifiers, and others. Among these, refrigerators and washing machines are the most dominant segments, with refrigerators accounting for the largest share due to their essential role in daily household activities and frequent replacement cycles driven by energy-efficiency legislation. The integration of smart technology and increased focus on sustainability have further propelled demand for these appliances, as consumers seek products that offer convenience, connectivity, and reduced energy consumption.

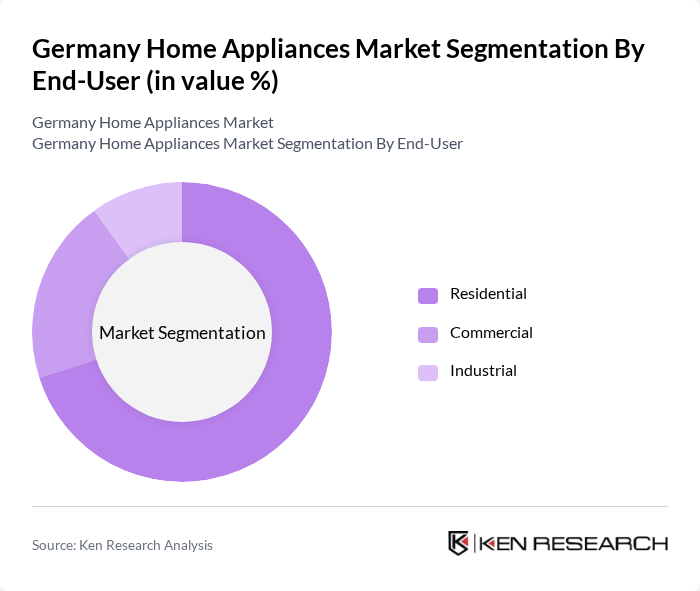

By End-User:The home appliances market is segmented by end-user into residential, commercial, and industrial categories. The residential segment holds the largest share, driven by the increasing number of households and the growing trend of home renovations. Consumers are investing in modern appliances that enhance living standards and provide convenience. The commercial segment is also expanding, particularly in the hospitality and food service industries, where efficient appliances are essential for operations.

The Germany Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as BSH Hausgeräte GmbH (Bosch & Siemens), Miele & Cie. KG, AEG Hausgeräte GmbH (Electrolux Group), Electrolux AB, Whirlpool Corporation, Samsung Electronics GmbH, LG Electronics Deutschland GmbH, Panasonic Deutschland GmbH, Haier Europe, Gorenje d.d., Sharp Electronics (Europe) GmbH, Philips GmbH, Arçelik A.?., SMEG S.p.A., Bauknecht Hausgeräte GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the German home appliances market appears promising, driven by technological advancements and a strong focus on sustainability. As consumers increasingly prioritize energy efficiency and smart technology, manufacturers are expected to innovate continuously. The market will likely see a rise in subscription-based services and customizable solutions, catering to diverse consumer needs. Furthermore, the integration of eco-friendly practices in production will enhance brand reputation and consumer trust, positioning companies favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators Washing Machines Dishwashers Ovens and Cooktops Small Kitchen Appliances Air Conditioners Vacuum Cleaners Water Heaters Air Purifiers Others |

| By End-User | Residential Commercial Industrial |

| By Sales Channel | Online Retail Offline Retail Direct Sales Distributors |

| By Price Range | Budget Appliances Mid-Range Appliances Premium Appliances |

| By Brand | National Brands Private Labels International Brands |

| By Functionality | Basic Functionality Smart Functionality Multi-Functional Appliances |

| By Energy Efficiency Rating | A+++ Rating A++ Rating A+ Rating Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Kitchen Appliances Market | 120 | Product Managers, Retail Buyers |

| Laundry Appliances Segment | 90 | Sales Directors, Category Managers |

| Consumer Electronics Integration | 60 | Marketing Executives, Brand Managers |

| Smart Home Appliances | 50 | Technology Officers, Innovation Managers |

| Energy-Efficient Appliances | 70 | Sustainability Managers, Product Development Leads |

The Germany Home Appliances Market is valued at approximately USD 36.5 billion, reflecting a significant growth trend driven by consumer demand for energy-efficient and smart appliances, as well as a shift towards home automation and sustainability.