Region:Asia

Author(s):Shubham

Product Code:KRAB0800

Pages:91

Published On:August 2025

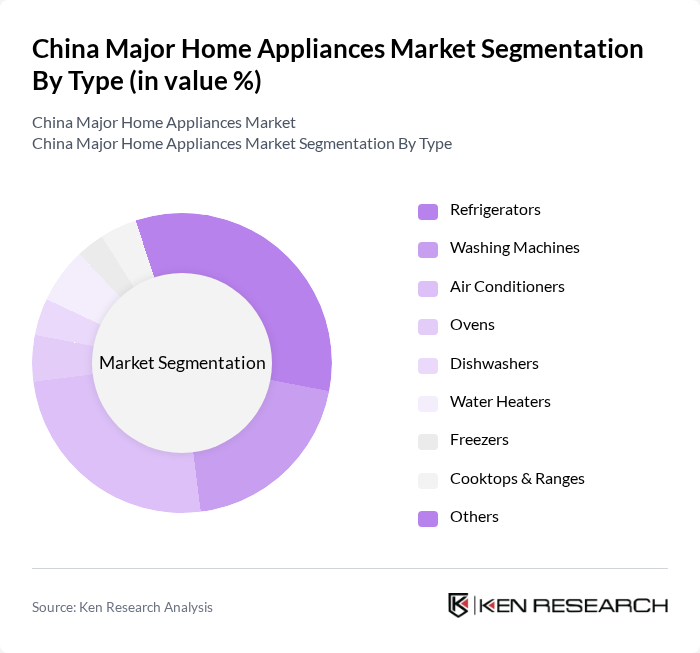

By Type:The major segments in this category include Refrigerators, Washing Machines, Air Conditioners, Ovens, Dishwashers, Water Heaters, Freezers, Cooktops & Ranges, and Others. Among these, Refrigerators and Air Conditioners are particularly dominant due to their essential role in modern households. The increasing demand for energy-efficient and smart appliances is driving innovation and competition in these segments. Refrigerators lead with the largest revenue share, followed by Air Conditioners and Washing Machines, reflecting their necessity and high replacement rates in urban households .

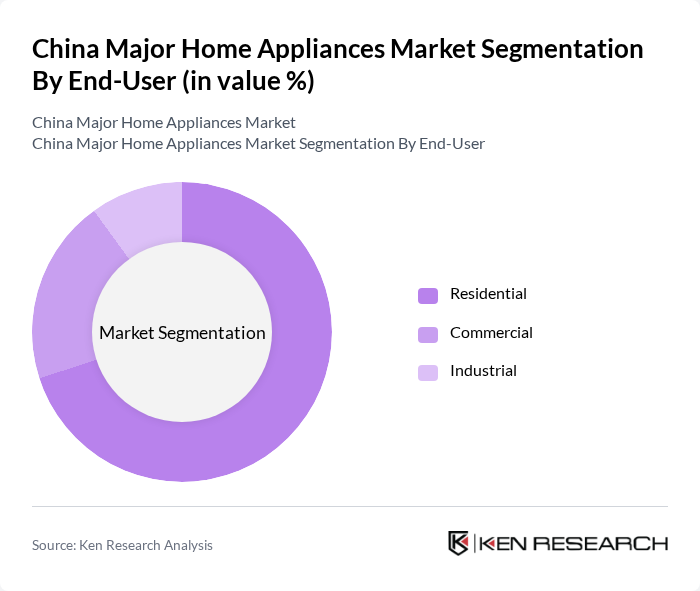

By End-User:The end-user segments include Residential, Commercial, and Industrial. The Residential segment is the largest, driven by the increasing number of households, urban migration, and the demand for modern conveniences. The trend towards smart home technology and government incentives for energy-efficient upgrades are also influencing consumer preferences, leading to higher adoption rates of advanced appliances in residential settings .

The China Major Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Haier Group, Midea Group, Gree Electric Appliances Inc., TCL Technology, Hisense Group, Whirlpool Corporation, Panasonic Corporation, Samsung Electronics, LG Electronics, Electrolux AB, BSH Hausgeräte GmbH, Sharp Corporation, Koninklijke Philips N.V., Arçelik A.?., and Gaggenau Hausgeräte GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China major home appliances market appears promising, driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for smart and energy-efficient appliances is expected to rise significantly. Companies that adapt to these trends by investing in innovation and sustainability will likely thrive. Additionally, the integration of smart home technologies will reshape consumer expectations, leading to a more connected and efficient home environment, further propelling market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators Washing Machines Air Conditioners Ovens Dishwashers Water Heaters Freezers Cooktops & Ranges Others |

| By End-User | Residential Commercial Industrial |

| By Sales Channel | Online Retail (E-commerce Platforms) Electronic Stores Supermarkets & Hypermarkets Specialty Stores Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Domestic Brands International Brands Private Labels |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms |

| By Application | Household Use Commercial Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Major Appliances | 100 | Store Managers, Sales Representatives |

| Consumer Preferences in Home Appliances | 120 | Homeowners, Renters |

| Market Trends in Smart Appliances | 100 | Product Managers, Technology Analysts |

| Impact of E-commerce on Appliance Sales | 80 | E-commerce Managers, Digital Marketing Specialists |

| After-sales Service and Customer Satisfaction | 60 | Customer Service Managers, Warranty Administrators |

The China Major Home Appliances Market is valued at approximately USD 84 billion, driven by factors such as rising disposable incomes, urbanization, and a growing middle class seeking modern conveniences and energy-efficient appliances.