Region:North America

Author(s):Shubham

Product Code:KRAC0647

Pages:97

Published On:August 2025

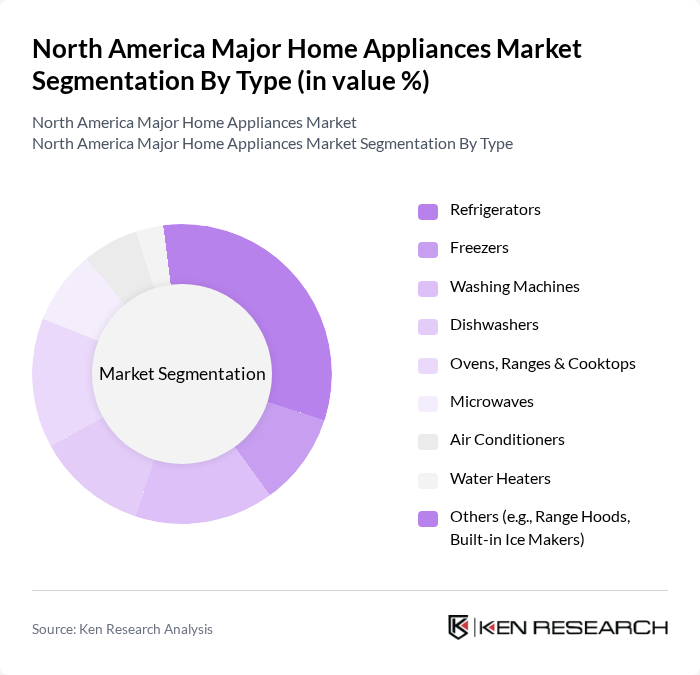

By Type:The market is segmented into various types of appliances, including refrigerators, freezers, washing machines, dishwashers, ovens, ranges & cooktops, microwaves, air conditioners, water heaters, and others. Each of these segments caters to specific consumer needs and preferences, with varying levels of demand based on lifestyle changes and technological advancements. Major appliances typically include refrigeration, laundry, cooking (ranges/ovens/cooktops), and dishwashers, with smart connectivity and energy-efficiency features increasingly embedded across categories .

By End-User:The market is divided into residential and commercial segments. The residential segment is the largest, driven by increasing consumer spending on home appliances for convenience and energy efficiency. The commercial segment, including hospitality and multifamily units, is also growing as businesses invest in modern appliances to enhance customer experience and operational efficiency. The dominance of residential demand aligns with regional spending power and ongoing upgrades to connected, premium appliances in households .

The North America Major Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Whirlpool Corporation, GE Appliances, a Haier company, Samsung Electronics America, Inc., LG Electronics USA, Inc., Electrolux North America (includes Frigidaire), BSH Home Appliances (Bosch, Thermador), Haier US Appliance Solutions, Inc., Miele, Inc., Sub?Zero Group, Inc. (Sub?Zero, Wolf, Cove), Viking Range, LLC, Danby Products Limited, Sharp Electronics Corporation, Hisense USA, Panasonic Corporation of North America (microwave/selected categories), BlueStar (Prizer-Painter Stove Works, Inc.) contribute to innovation, geographic expansion, and service delivery in this space .

The North American major home appliances market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As smart home integration becomes mainstream, manufacturers are expected to invest heavily in connected appliances that enhance user experience. Additionally, the focus on sustainability will likely lead to the development of eco-friendly product lines, aligning with consumer demand for energy-efficient solutions. These trends indicate a dynamic market landscape that prioritizes innovation and environmental responsibility in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators Freezers Washing Machines Dishwashers Ovens, Ranges & Cooktops Microwaves Air Conditioners Water Heaters Others (e.g., Range Hoods, Built-in Ice Makers) |

| By End-User | Residential Commercial (e.g., Hospitality, Multifamily, Light Commercial) |

| By Sales Channel | Multi-brand Retailers (e.g., Home Improvement, Electronics Chains) Exclusive/Brand Stores Specialty & Independent Dealers Online/E-commerce |

| By Price Range | Budget Mid-Range Premium/Luxury |

| By Technology | Conventional Smart/Connected (Wi?Fi, App-Enabled, Voice Control) |

| By Energy Performance | ENERGY STAR Certified Non-ENERGY STAR |

| By Country | United States Canada Mexico |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Refrigerator Market Insights | 120 | Product Managers, Retail Buyers |

| Washing Machine Consumer Preferences | 110 | Home Appliance Retailers, Consumer Insights Analysts |

| Oven and Cooking Appliances Trends | 90 | Kitchen Designers, Product Development Teams |

| Market Dynamics in Smart Appliances | 80 | Technology Officers, Marketing Executives |

| Energy Efficiency Standards Impact | 70 | Regulatory Affairs Specialists, Sustainability Managers |

The North America Major Home Appliances Market is valued at approximately USD 80 billion, reflecting a significant segment of the broader home appliances market, which ranges between USD 8085 billion. This valuation is based on a five-year historical analysis.