Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0302

Pages:83

Published On:August 2025

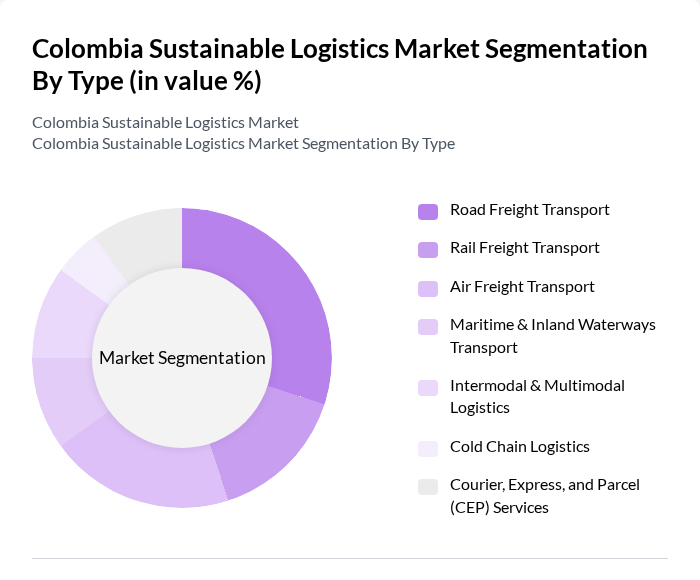

By Type:The market is segmented into various types of logistics services, including road freight transport, rail freight transport, air freight transport, maritime and inland waterways transport, intermodal and multimodal logistics, cold chain logistics, and courier, express, and parcel (CEP) services. Each type plays a crucial role in meeting the diverse needs of businesses and consumers, with specific advantages in terms of speed, cost, and environmental impact. Road freight transport remains the dominant mode, given Colombia’s geography and infrastructure, while CEP services are rapidly expanding due to e-commerce growth. Cold chain logistics is gaining importance in response to rising demand from the pharmaceutical and food sectors .

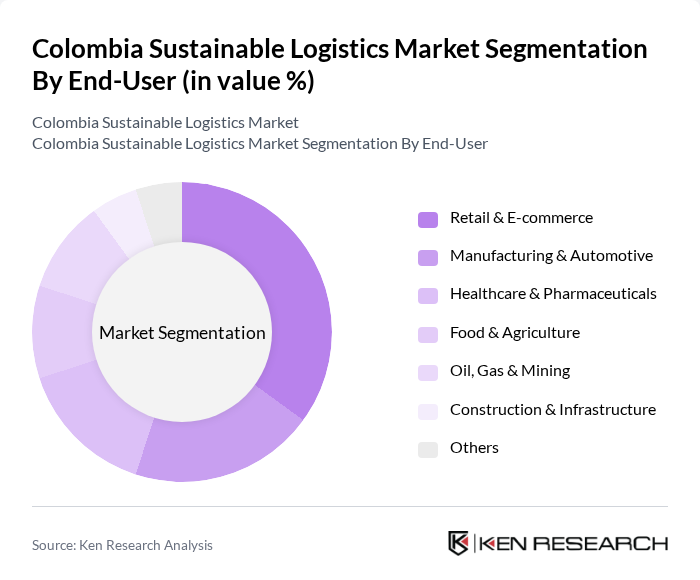

By End-User:The end-user segmentation includes retail and e-commerce, manufacturing and automotive, healthcare and pharmaceuticals, food and agriculture, oil, gas and mining, construction and infrastructure, and others. Each sector has unique logistics requirements, influencing the demand for sustainable logistics solutions tailored to their specific needs. Retail and e-commerce drive the largest share, propelled by Colombia’s rapidly growing online shopping sector. Manufacturing, automotive, and agriculture also represent significant demand due to the country’s industrial and export activities .

The Colombia Sustainable Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Servientrega, Inter Rapidísimo, Coordinadora Mercantil, TCC S.A., DHL Supply Chain Colombia, FedEx Express Colombia, UPS Colombia, Kuehne + Nagel Colombia, Carga Express S.A.S., Grupo Éxito (Logistics Division), Rappi, Logística de Colombia S.A.S., Blu Logistics, OPL Carga S.A.S., Alianza Logística Regional contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sustainable logistics market in Colombia appears promising, driven by increasing consumer demand for eco-friendly solutions and supportive government policies. As companies invest in green technologies and infrastructure, the market is expected to evolve significantly. In future, the integration of AI and IoT in logistics operations will likely enhance efficiency and sustainability, while the expansion of e-commerce will further drive the need for innovative last-mile delivery solutions, creating a dynamic and competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Transport Rail Freight Transport Air Freight Transport Maritime & Inland Waterways Transport Intermodal & Multimodal Logistics Cold Chain Logistics Courier, Express, and Parcel (CEP) Services |

| By End-User | Retail & E-commerce Manufacturing & Automotive Healthcare & Pharmaceuticals Food & Agriculture Oil, Gas & Mining Construction & Infrastructure Others |

| By Region | Bogotá Medellín Cali Barranquilla Cartagena Other Regions |

| By Technology | Automated Warehousing & Robotics Fleet Management & Telematics Green Packaging & Reverse Logistics Renewable Energy Integration (Solar, Biofuels, etc.) Digital Freight Platforms & IoT Others |

| By Application | Last-Mile Delivery Freight Transportation Supply Chain Management Inventory & Warehouse Management Reverse Logistics Others |

| By Investment Source | Private Investments Government Funding International Aid & Development Finance Public-Private Partnerships Others |

| By Policy Support | Tax Incentives Grants for Sustainable Projects Regulatory Support for Green Initiatives Emission Trading & Carbon Credits Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Sustainable Practices | 100 | Logistics Managers, Sustainability Coordinators |

| Manufacturing Supply Chain Optimization | 70 | Operations Managers, Supply Chain Analysts |

| E-commerce Logistics Solutions | 80 | eCommerce Directors, Fulfillment Managers |

| Transportation Sector Innovations | 60 | Fleet Managers, Environmental Compliance Officers |

| Warehouse Management Systems | 50 | Warehouse Managers, IT Systems Analysts |

The Colombia Sustainable Logistics Market is valued at approximately USD 22 billion, reflecting a significant growth driven by the demand for eco-friendly transportation solutions, government sustainability initiatives, and the rise of e-commerce.