Region:Africa

Author(s):Shubham

Product Code:KRAA0937

Pages:91

Published On:August 2025

By Type:The market is segmented into various types of inventory management consulting services, including Strategic Inventory Consulting, Operational Inventory Management, Technology Integration Services, Inventory Optimization Solutions, Training and Development Services, Audit & Compliance Consulting, and Others. Each of these sub-segments addresses specific client needs, such as strategic planning, process optimization, digital integration, compliance with evolving regulations, and workforce upskilling, all of which are critical for enhancing operational efficiency in Egypt’s dynamic business environment .

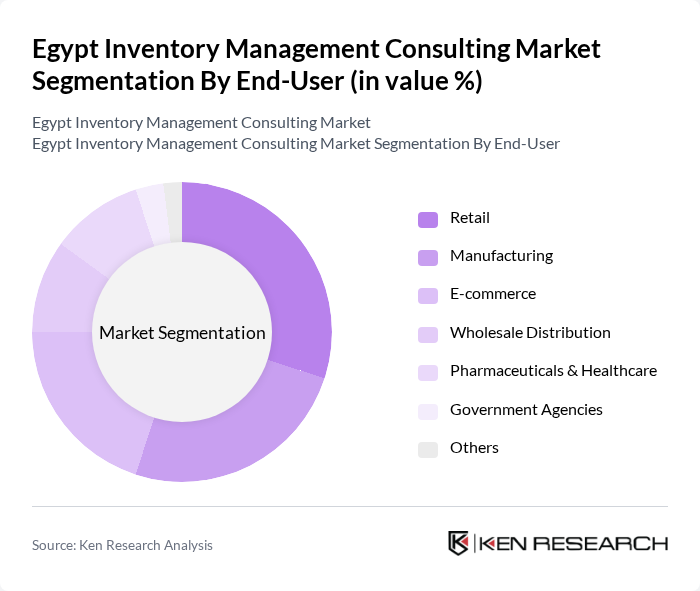

By End-User:The end-user segmentation includes Retail, Manufacturing, E-commerce, Wholesale Distribution, Pharmaceuticals & Healthcare, Government Agencies, and Others. Each sector faces distinct inventory management challenges: Retail and E-commerce demand real-time inventory visibility and rapid fulfillment; Manufacturing requires process integration and waste reduction; Wholesale Distribution focuses on logistics optimization; Pharmaceuticals & Healthcare need compliance and traceability; Government Agencies emphasize transparency and cost control. Consulting services are tailored to address these sector-specific requirements, driving operational efficiency and customer satisfaction .

The Egypt Inventory Management Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as PwC Egypt (PricewaterhouseCoopers), KPMG Hazem Hassan, EY Egypt (Ernst & Young), Deloitte Egypt, Logic Consulting, RSM Egypt, EGYBYTE Consulting, Nile Consulting Group, Integrated Solutions for Business (ISB), Value Consulting Egypt, Accenture Egypt, TSM Consulting, Protiviti Egypt, BDO Khaled & Co., and Grant Thornton Egypt contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Egyptian inventory management consulting market appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly recognize the importance of efficient inventory management, the demand for consulting services is expected to rise. Additionally, the integration of AI and machine learning into inventory solutions will likely enhance decision-making processes, leading to improved operational efficiency. This trend, coupled with the growth of e-commerce, positions the market for significant expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategic Inventory Consulting Operational Inventory Management Technology Integration Services Inventory Optimization Solutions Training and Development Services Audit & Compliance Consulting Others |

| By End-User | Retail Manufacturing E-commerce Wholesale Distribution Pharmaceuticals & Healthcare Government Agencies Others |

| By Service Model | On-site Consulting Remote Consulting Hybrid Consulting |

| By Industry Vertical | Consumer Goods Pharmaceuticals Automotive Electronics Food and Beverage Textiles & Apparel Others |

| By Consulting Duration | Short-term Projects Long-term Engagements |

| By Pricing Model | Fixed Pricing Hourly Billing Performance-based Pricing |

| By Geographic Focus | Cairo & Greater Cairo Alexandria Suez Canal Region Upper Egypt National Coverage |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Supply Chain Analysts |

| Manufacturing Supply Chain Optimization | 80 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Strategies | 90 | Logistics Coordinators, E-commerce Operations Managers |

| Warehouse Management Systems | 70 | Warehouse Managers, IT Systems Analysts |

| Inventory Technology Solutions | 60 | Technology Officers, Procurement Managers |

The Egypt Inventory Management Consulting Market is valued at approximately USD 55 million, reflecting a growing demand for efficient inventory management solutions across various sectors, including retail, manufacturing, and e-commerce.