Region:Europe

Author(s):Dev

Product Code:KRAA0428

Pages:91

Published On:August 2025

By Type:The market can be segmented into various types of consulting services that address different aspects of inventory management. The subsegments include Strategic Consulting, which focuses on long-term inventory planning and alignment with business goals; Operational Consulting, which optimizes day-to-day inventory processes; IT & Digital Transformation Consulting, which implements digital tools and automation; Supply Chain & Logistics Consulting, which enhances end-to-end supply chain efficiency; Risk & Compliance Consulting, which ensures regulatory adherence and risk mitigation; Sustainability & ESG Consulting, which integrates environmental and social governance into inventory practices; and Others, covering niche and emerging consulting needs .

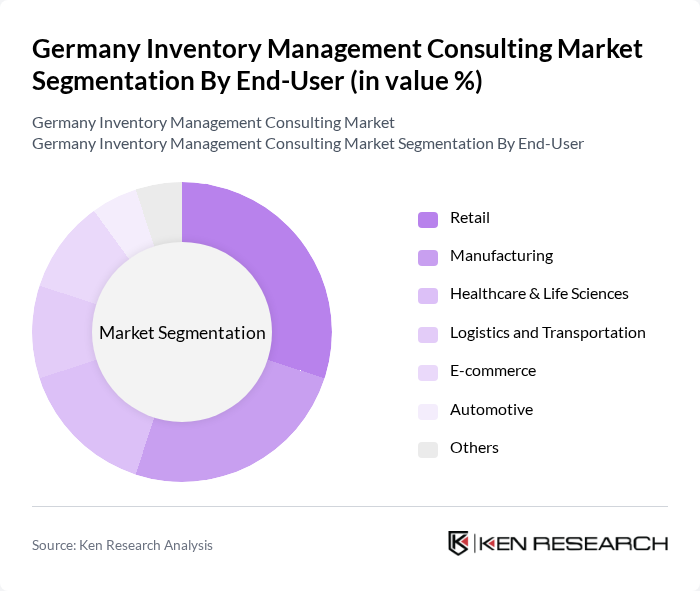

By End-User:The end-user segmentation includes various industries that utilize inventory management consulting services. The subsegments are Retail, which faces challenges in omnichannel inventory and demand forecasting; Manufacturing, which requires optimization of raw material and finished goods inventory; Healthcare & Life Sciences, which demands regulatory compliance and critical stock management; Logistics and Transportation, which focuses on supply chain visibility and efficiency; E-commerce, which emphasizes real-time inventory tracking and fulfillment; Automotive, which manages complex supply chains and just-in-time inventory; and Others, covering additional sectors with specialized needs .

The Germany Inventory Management Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture, Deloitte, PwC, KPMG, EY, Capgemini, McKinsey & Company, Boston Consulting Group, Roland Berger, BearingPoint, Oliver Wyman, Simon-Kucher & Partners, Barkawi Management Consultants (a Genpact company), Miebach Consulting, and Camelot Management Consultants contribute to innovation, geographic expansion, and service delivery in this space .

The future of the inventory management consulting market in Germany appears promising, driven by technological advancements and evolving consumer behaviors. As businesses increasingly recognize the importance of efficient inventory practices, the demand for specialized consulting services is expected to grow. Additionally, the focus on sustainability and real-time data analytics will shape consulting strategies, enabling firms to offer tailored solutions that meet the unique needs of their clients in a rapidly changing landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategic Consulting Operational Consulting IT & Digital Transformation Consulting Supply Chain & Logistics Consulting Risk & Compliance Consulting Sustainability & ESG Consulting Others |

| By End-User | Retail Manufacturing Healthcare & Life Sciences Logistics and Transportation E-commerce Automotive Others |

| By Industry Vertical | Consumer Goods Automotive Pharmaceuticals & Healthcare Electronics & High Tech Food and Beverage Aerospace & Defense Others |

| By Service Model | On-site Consulting Remote/Virtual Consulting Hybrid Consulting Subscription-based Services Project-based Services Managed Services Others |

| By Consulting Duration | Short-term Engagements Long-term Engagements Ongoing Support & Retainer Project-based Engagements Others |

| By Client Size | Small Enterprises Medium Enterprises Large Enterprises Startups Multinational Corporations Others |

| By Geographic Focus | National (Germany-wide) Regional (Bundesland/State-level) International (DACH/Europe/global) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Inventory Management | 100 | Inventory Managers, Operations Directors |

| Retail Supply Chain Optimization | 60 | Supply Chain Managers, Logistics Coordinators |

| E-commerce Inventory Strategies | 50 | eCommerce Operations Managers, Fulfillment Specialists |

| Warehouse Management Practices | 40 | Warehouse Managers, Process Improvement Leads |

| Technology Adoption in Inventory Management | 45 | IT Managers, Digital Transformation Officers |

The Germany Inventory Management Consulting Market is valued at approximately USD 370 million, reflecting a significant growth driven by the increasing complexity of supply chains and the adoption of advanced technologies in inventory management practices.