Region:Africa

Author(s):Shubham

Product Code:KRAA0705

Pages:87

Published On:August 2025

By Type:The market is segmented into various types of consulting services, including Strategic Consulting, Operational Consulting, Technology Consulting, Process Improvement Consulting, Supply Chain Optimization Consulting, Inventory Analytics Consulting, and Others. Each of these sub-segments plays a crucial role in addressing specific client needs and challenges. Strategic Consulting focuses on aligning inventory management with long-term business objectives, while Operational Consulting targets process efficiency and cost reduction. Technology Consulting is increasingly important as businesses adopt digital tools and automation for inventory control. Process Improvement Consulting addresses workflow optimization, and Supply Chain Optimization Consulting helps clients streamline logistics and distribution. Inventory Analytics Consulting leverages data-driven insights to improve stock management, and the Others category includes specialized and niche consulting services .

The Strategic Consulting sub-segment is currently dominating the market due to its focus on long-term planning and alignment of inventory management strategies with overall business objectives. Companies are increasingly recognizing the value of strategic insights to navigate market uncertainties and enhance their competitive edge. Operational Consulting also holds a significant share, as businesses seek to streamline their processes and improve efficiency. The demand for Technology Consulting is on the rise, driven by the need for digital transformation and the integration of advanced technologies in inventory management, including artificial intelligence, machine learning, and real-time analytics .

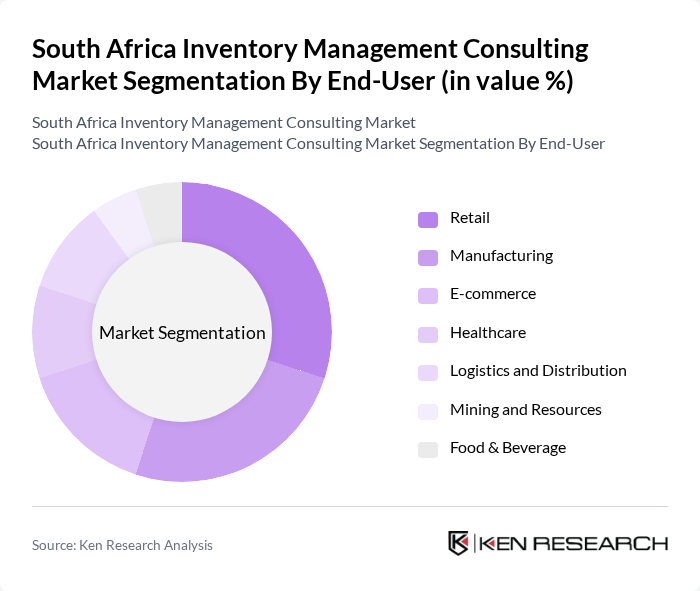

By End-User:The market is segmented by end-users, including Retail, Manufacturing, E-commerce, Healthcare, Logistics and Distribution, Mining and Resources, Food & Beverage, and Others. Each end-user segment has unique requirements and challenges that consulting services aim to address. Retail and E-commerce require omnichannel inventory visibility and rapid fulfillment; Manufacturing focuses on production efficiency and waste reduction; Healthcare emphasizes compliance and critical stock management; Logistics and Distribution need optimized warehousing and transport; Mining and Resources require specialized inventory controls due to the scale and regulatory environment; Food & Beverage emphasizes perishability and traceability; Others include sectors with niche inventory needs .

The Retail segment is the largest end-user of inventory management consulting services, driven by the need for effective stock management and customer satisfaction. The Manufacturing sector follows closely, as companies seek to optimize their production processes and inventory levels. E-commerce is rapidly growing, with businesses requiring specialized consulting to manage their online inventory effectively. The Healthcare sector is also emerging as a significant user of these services, focusing on compliance and efficiency in inventory management. Logistics and Distribution, Mining and Resources, and Food & Beverage segments also contribute to market growth, each with sector-specific inventory challenges .

The South Africa Inventory Management Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deloitte Consulting, PwC Advisory Services, KPMG South Africa, EY Advisory, Accenture South Africa, BCG (Boston Consulting Group), Bain & Company, McKinsey & Company, Capgemini South Africa, Oliver Wyman, Roland Berger South Africa, Grant Thornton South Africa, Mazars South Africa, Barloworld Logistics, Imperial Logistics, Argon Consulting, IQbusiness South Africa, Letsema Consulting, Supply Chain Partner (SCP), XGRC Consulting contribute to innovation, geographic expansion, and service delivery in this space .

The South African inventory management consulting market is poised for significant transformation, driven by technological advancements and evolving consumer behaviors. As businesses increasingly recognize the importance of efficient inventory practices, demand for consulting services is expected to rise. The integration of AI and machine learning will further enhance inventory optimization, while the shift towards sustainable practices will shape future strategies. Additionally, the growth of e-commerce will necessitate innovative solutions to manage complex supply chains effectively, creating a dynamic landscape for consulting firms.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategic Consulting Operational Consulting Technology Consulting Process Improvement Consulting Supply Chain Optimization Consulting Inventory Analytics Consulting Others |

| By End-User | Retail Manufacturing E-commerce Healthcare Logistics and Distribution Mining and Resources Food & Beverage Others |

| By Service Model | On-site Consulting Remote Consulting Hybrid Consulting |

| By Industry Vertical | Consumer Goods Automotive Pharmaceuticals Electronics Agriculture Others |

| By Project Duration | Short-term Projects Long-term Projects |

| By Geographic Focus | National Level Regional Level |

| By Pricing Model | Fixed Pricing Hourly Billing Retainer Agreements Performance-Based Fees Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Supply Chain Analysts |

| Manufacturing Sector Inventory Control | 80 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Strategies | 60 | Logistics Coordinators, eCommerce Managers |

| Pharmaceutical Inventory Systems | 50 | Supply Chain Managers, Compliance Officers |

| Food and Beverage Inventory Practices | 40 | Warehouse Managers, Quality Control Specialists |

The South Africa Inventory Management Consulting Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the increasing complexity of supply chains and the demand for operational efficiency and technology integration in inventory management practices.