Region:Europe

Author(s):Shubham

Product Code:KRAA0704

Pages:95

Published On:August 2025

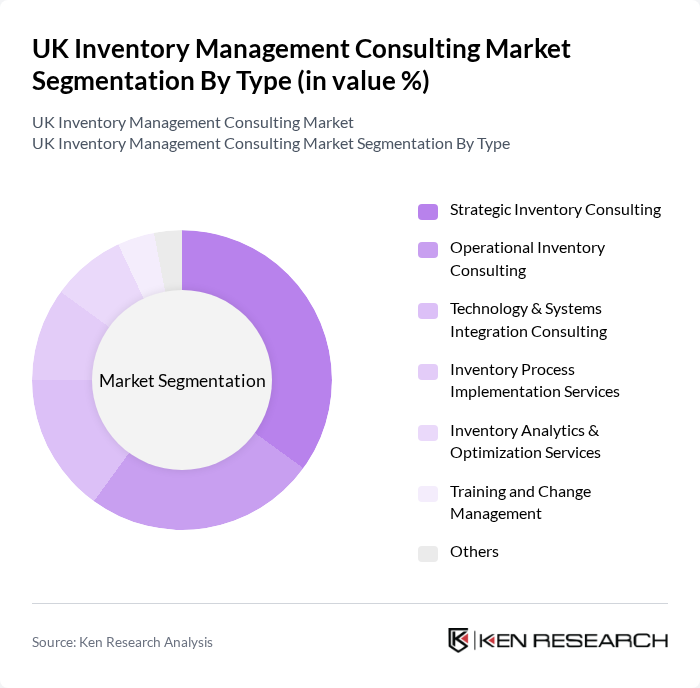

By Type:The market is segmented into various types of consulting services, including Strategic Inventory Consulting, Operational Inventory Consulting, Technology & Systems Integration Consulting, Inventory Process Implementation Services, Inventory Analytics & Optimization Services, Training and Change Management, and Others. Strategic Inventory Consulting leads the segment, driven by businesses' need for long-term planning, digital transformation, and alignment with overall corporate strategy. Operational Inventory Consulting follows closely, as companies focus on enhancing day-to-day operations, process automation, and efficiency through technology-enabled solutions .

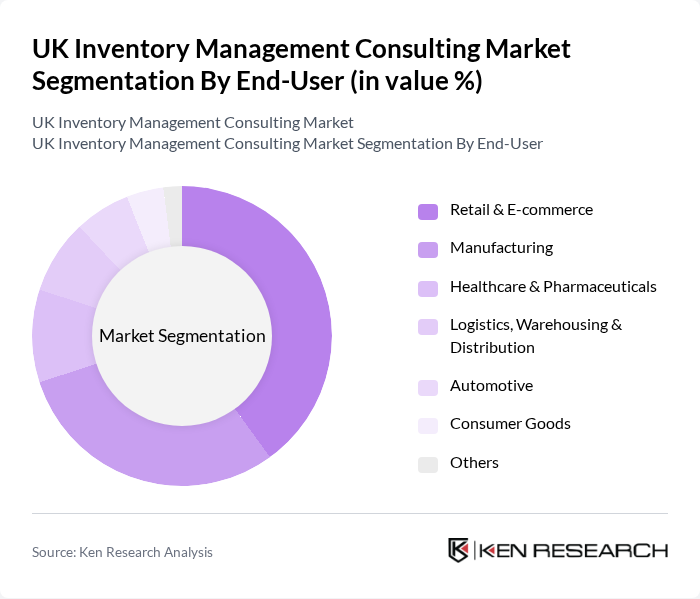

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Logistics, Warehousing & Distribution, Automotive, Consumer Goods, and Others. Retail & E-commerce is the dominant end-user, driven by the rapid growth of online shopping and the need for agile, data-driven inventory management to meet evolving consumer demand. Manufacturing remains a significant segment, as companies strive to optimize supply chains, minimize excess inventory, and implement just-in-time practices. Healthcare & Pharmaceuticals, Logistics, and Automotive sectors are also increasingly investing in inventory consulting to address regulatory compliance, supply chain disruptions, and digital transformation .

The UK Inventory Management Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture, Deloitte, PwC, KPMG, EY, Capgemini, Bain & Company, McKinsey & Company, Oliver Wyman, Roland Berger, Gartner, IBM Consulting, BearingPoint, Baringa Partners, and Crimson & Co (now part of Argon & Co) contribute to innovation, geographic expansion, and service delivery in this space .

The UK inventory management consulting market is poised for significant transformation as businesses increasingly recognize the importance of agile supply chains. The integration of advanced technologies, such as AI and IoT, will drive efficiency and responsiveness in inventory management. Additionally, the growing emphasis on sustainability will compel firms to adopt eco-friendly practices. As companies navigate these changes, consulting firms that offer tailored solutions will be well-positioned to capture emerging opportunities and support clients in achieving their strategic goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategic Inventory Consulting Operational Inventory Consulting Technology & Systems Integration Consulting Inventory Process Implementation Services Inventory Analytics & Optimization Services Training and Change Management Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Logistics, Warehousing & Distribution Automotive Consumer Goods Others |

| By Service Model | On-site Consulting Remote/Virtual Consulting Hybrid Consulting |

| By Industry Vertical | Retail Manufacturing Healthcare & Life Sciences Automotive Food & Beverage Electronics & Technology Others |

| By Project Duration | Short-term Projects (<6 months) Medium-term Projects (6-18 months) Long-term Projects (>18 months) |

| By Pricing Model | Fixed Fee Hourly/Time-Based Billing Retainer-Based Performance-Based |

| By Client Size | Small Enterprises (<50 employees) Medium Enterprises (50-250 employees) Large Enterprises (>250 employees) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Supply Chain Analysts |

| Manufacturing Supply Chain Optimization | 80 | Operations Managers, Production Planners |

| E-commerce Inventory Solutions | 90 | eCommerce Managers, Logistics Coordinators |

| Warehouse Management Systems | 60 | Warehouse Managers, IT Systems Analysts |

| Inventory Technology Adoption | 50 | Technology Managers, Innovation Managers |

The UK Inventory Management Consulting Market is valued at approximately USD 1.1 billion, reflecting its significance within the broader UK consulting industry, which ranges between GBP 14.9 billion and GBP 20.4 billion.