Region:Asia

Author(s):Harsh Saxena

Product Code:KR1553

Pages:119

Published On:October 2021

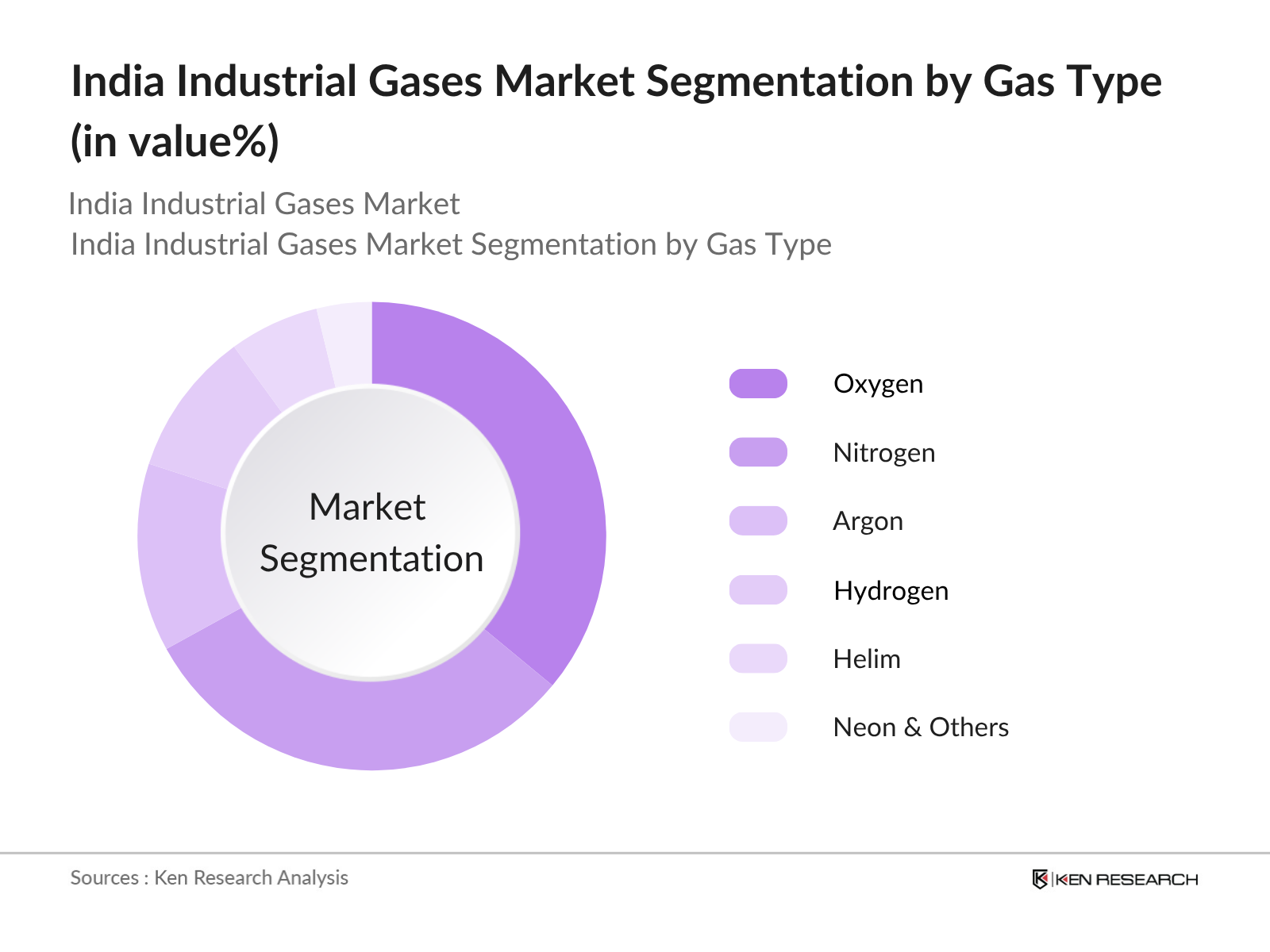

By Gas Type:The market is segmented into various types of industrial gases, including oxygen, nitrogen, argon, hydrogen, helium, and others. Among these, oxygen and nitrogen remain the most widely used gases across multiple industries, particularly in healthcare, steelmaking, and manufacturing. The demand for specialty gases is rising due to their specific applications in electronics, chemical processing, and research laboratories.

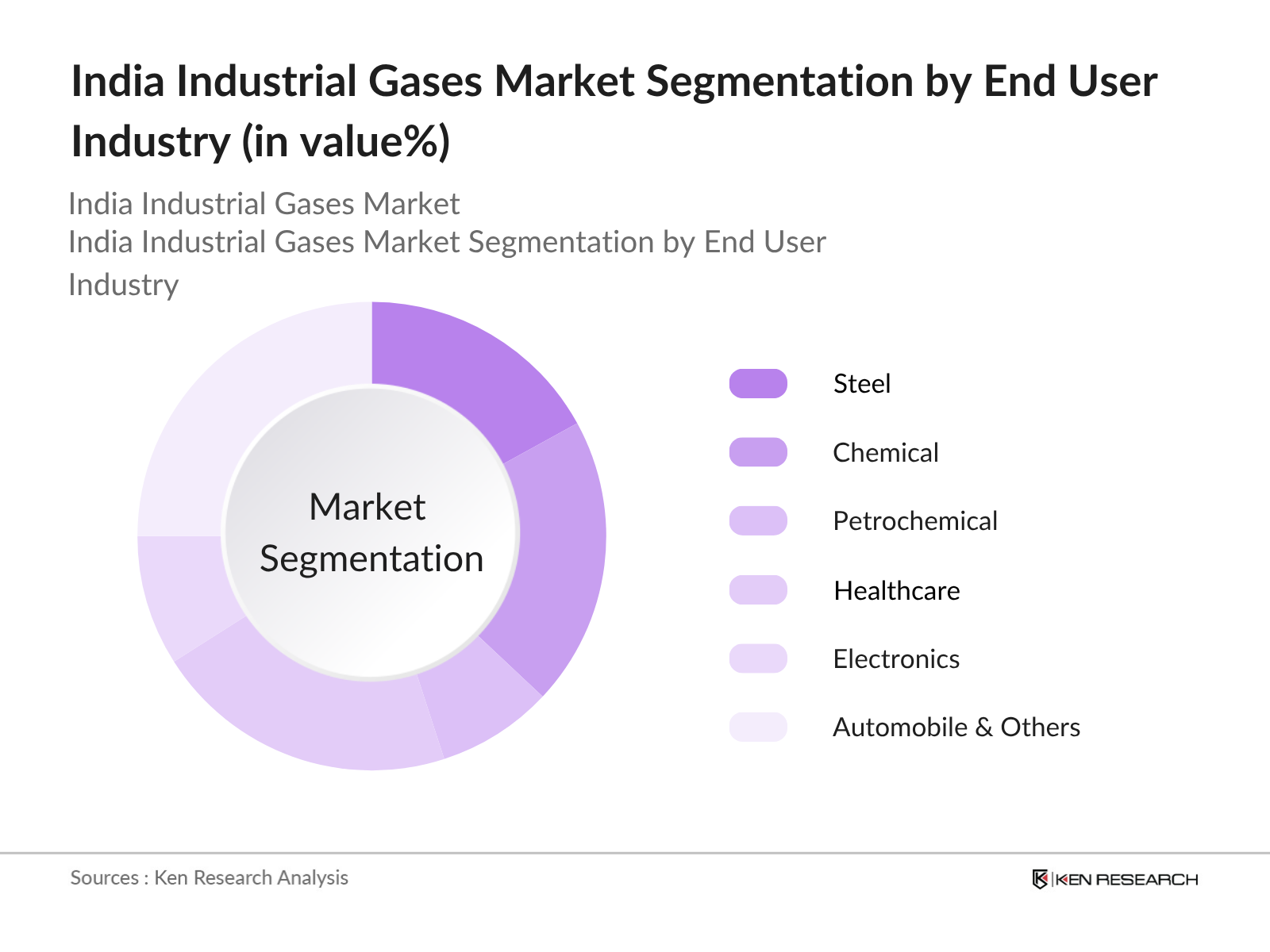

By End-User:The industrial gases market is further segmented by end-user industries, including healthcare, manufacturing, food and beverage, electronics, chemical processing, and others. The healthcare sector is a significant consumer of oxygen and nitrogen, driven by expanding hospital infrastructure and medical research. Manufacturing, especially steel and automotive, utilizes a variety of gases for welding, cutting, and heat treatment. Food and beverage, electronics, and chemical processing industries also contribute to rising demand, reflecting broader industrial expansion and modernization.

The India Industrial Gases Market is characterized by a dynamic mix of regional and international players. Leading participants such as Linde India Limited, Inox Air Products Limited, Air Water India Private Limited, Air Liquide and Ellenbarrie Industrial Gases Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The India industrial gases market is poised for significant transformation, driven by technological advancements and a shift towards sustainability. The integration of digital technologies, such as IoT and AI, is expected to enhance operational efficiency and safety standards. Furthermore, the increasing focus on renewable energy and clean technologies will likely create new avenues for growth. As industries adapt to these changes, the demand for customized gas solutions tailored to specific applications will also rise, shaping the future landscape of the market.

| Segment | Sub-Segments |

|---|---|

| By Gas Type | Oxygen Nitrogen Argon Hydrogen Helium Neon Xenon Krypton Blended |

| By End-User Industry | Steel Chemical Petrochemical Healthcare Electronics Automobile Others |

| By Supply Mode | Packaged Gases Bulk Gases |

| By Region | North South East West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Sector Gas Usage | 60 | Hospital Administrators, Medical Equipment Managers |

| Manufacturing Industry Applications | 100 | Production Managers, Quality Control Supervisors |

| Food Processing Gas Applications | 50 | Food Safety Officers, Operations Managers |

| Metal Fabrication Sector Insights | 40 | Welding Engineers, Procurement Managers |

| Research and Development in Industrial Gases | 40 | R&D Managers, Chemical Engineers |

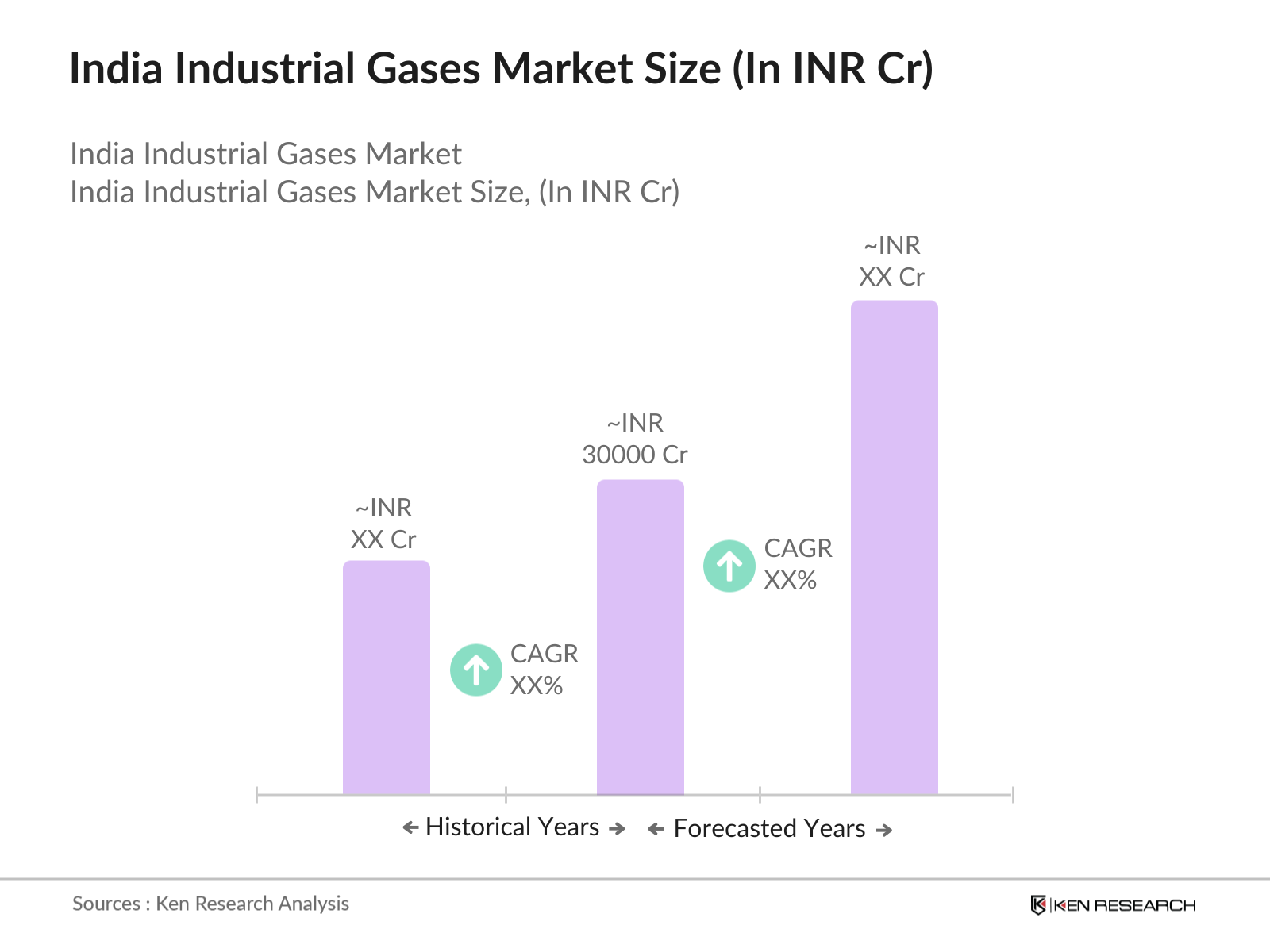

The India Industrial Gases Market is valued at approximately INR 30000 Cr, driven by increasing demand from sectors such as healthcare, manufacturing, and food processing, along with rapid industrialization and urbanization in the country.