Region:Middle East

Author(s):Rebecca

Product Code:KRAC2566

Pages:98

Published On:October 2025

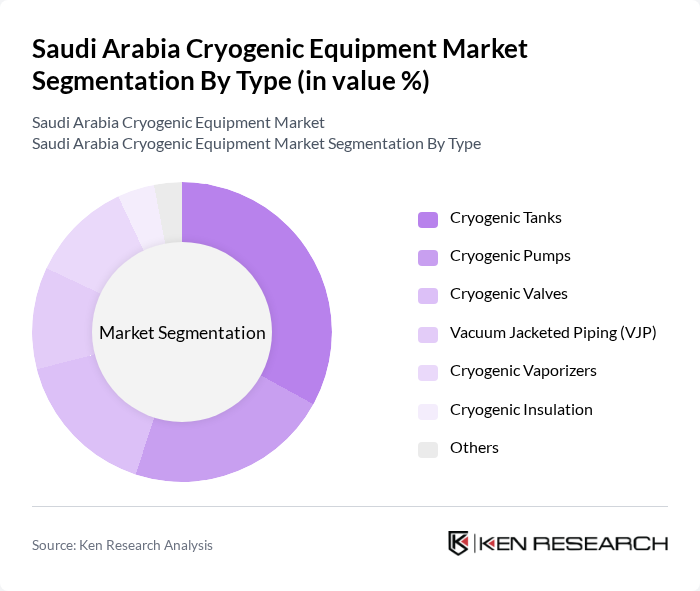

By Type:The cryogenic equipment market can be segmented into various types, including Cryogenic Tanks, Cryogenic Pumps, Cryogenic Valves, Vacuum Jacketed Piping (VJP), Cryogenic Vaporizers, Cryogenic Insulation, and Others. Among these, Cryogenic Tanks are leading the market due to their essential role in safely storing and transporting liquefied gases such as LNG, nitrogen, and oxygen. The rising demand for LNG and industrial gases, coupled with the expansion of gas processing and storage infrastructure, has significantly increased the need for high-quality cryogenic tanks, making them a critical component in the supply chain .

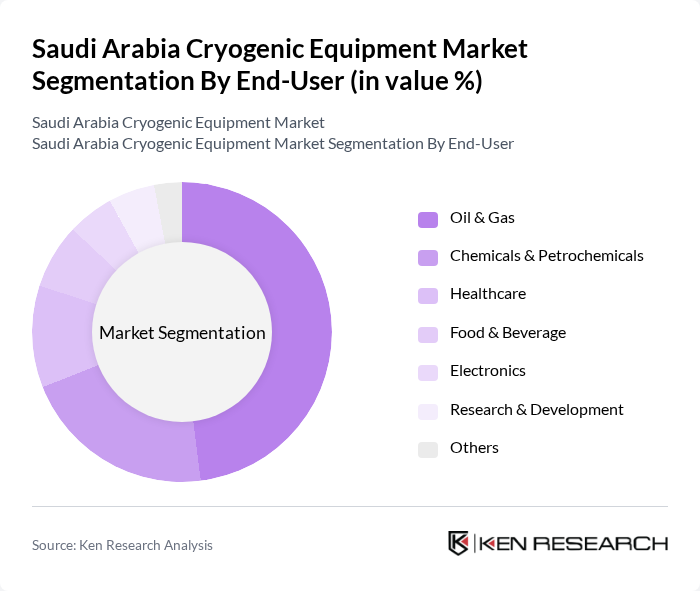

By End-User:The end-user segmentation includes Oil & Gas, Chemicals & Petrochemicals, Healthcare, Food & Beverage, Electronics, Research & Development, and Others. The Oil & Gas sector is the dominant end-user, driven by the extensive use of cryogenic equipment in LNG production, transportation, and storage. The sector’s growth is supported by ongoing investments in gas processing, energy diversification, and the expansion of LNG infrastructure, making it a key driver of cryogenic equipment demand in Saudi Arabia .

The Saudi Arabia Cryogenic Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Products and Chemicals, Inc., Linde plc, Chart Industries, Inc., Air Liquide S.A., INOX India Pvt Ltd, Cryolor, Herose GmbH, Wessington Cryogenics Ltd., Nikkiso Cryogenic Industries, Fives Group, Premier Cryogenics Ltd., Cryoquip, Inc., ACD Cryo, Inc., Sulzer Ltd., and Saudi Aramco (for in-house cryogenic operations) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia cryogenic equipment market appears promising, driven by technological advancements and increasing applications across various sectors. The integration of IoT in cryogenic systems is expected to enhance operational efficiency and safety, while the focus on sustainability will push for greener technologies. As the government continues to invest in energy infrastructure, the market is likely to see a surge in demand for innovative cryogenic solutions, positioning Saudi Arabia as a key player in the global market.

| Segment | Sub-Segments |

|---|---|

| By Type | Cryogenic Tanks Cryogenic Pumps Cryogenic Valves Vacuum Jacketed Piping (VJP) Cryogenic Vaporizers Cryogenic Insulation Others |

| By End-User | Oil & Gas Chemicals & Petrochemicals Healthcare Food & Beverage Electronics Research & Development Others |

| By Application | Liquefied Natural Gas (LNG) Production Industrial Gas Processing Cryogenic Energy Storage Medical Applications Food Preservation Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| By Price Range | Low Price Mid Price High Price Premium Price |

| By Technology | Cryogenic Distillation Cryogenic Freezing Cryogenic Grinding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Cryogenic Applications | 100 | Medical Equipment Managers, Hospital Procurement Officers |

| Industrial Gas Production | 80 | Operations Managers, Plant Engineers |

| Food Processing and Preservation | 60 | Quality Control Managers, Production Supervisors |

| Research and Development Facilities | 50 | Lab Managers, Research Scientists |

| Energy Sector Cryogenic Solutions | 70 | Project Managers, Technical Directors |

The Saudi Arabia Cryogenic Equipment Market is valued at approximately USD 330 million, driven by the increasing demand for liquefied natural gas (LNG) and advancements in cryogenic technology across various sectors, including energy and healthcare.