Region:Europe

Author(s):Shubham

Product Code:KRAB0707

Pages:95

Published On:August 2025

By Type:The market is segmented into High Sulfur Fuel Oil (HSFO), Very Low Sulfur Fuel Oil (VLSFO), Marine Gas Oil (MGO), Liquefied Natural Gas (LNG), Biofuels, and Other Fuel Types. Among these, Very Low Sulfur Fuel Oil (VLSFO) has gained significant traction due to regulatory changes mandating lower sulfur content in marine fuels. The shift towards VLSFO is driven by shipping companies' need to comply with the International Maritime Organization's (IMO) 2020 sulfur cap, leading to increased adoption of this cleaner fuel type. LNG and biofuels are also witnessing rising adoption, supported by EU and IMO decarbonization initiatives.

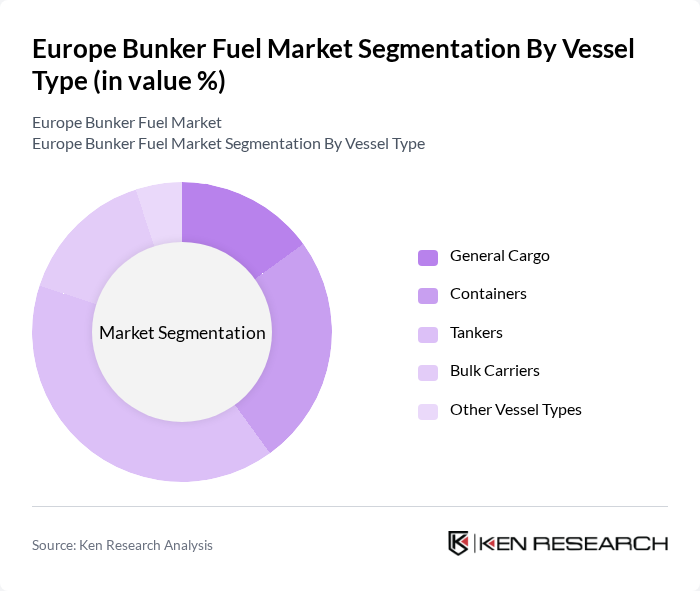

By Vessel Type:The market is also segmented by vessel type, including General Cargo, Containers, Tankers, Bulk Carriers, and Other Vessel Types. Tankers dominate this segment due to their critical role in transporting crude oil and refined products. The increasing global oil demand, fleet modernization, and the need for efficient transportation solutions have led to a higher reliance on tankers, thereby driving bunker fuel consumption for this vessel type. Container ships and bulk carriers also contribute significantly, reflecting the diversity of Europe’s maritime trade.

The Europe Bunker Fuel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aegean Marine Petroleum Network Inc., Bunker Holding A/S, World Fuel Services Corporation, Chemoil Energy Limited, Peninsula Petroleum Limited, TotalEnergies SE, ExxonMobil Corporation, Shell PLC, Gazprom Neft PJSC, KPI OceanConnect, BP PLC, Bunker One A/S, VITOL Group, Trafigura Group Pte Ltd, AP Moller-Maersk A/S contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe bunker fuel market is poised for transformation, driven by a strong emphasis on sustainability and technological innovation. As the shipping industry increasingly adopts low-carbon solutions, the demand for alternative fuels, such as LNG and biofuels, is expected to rise. Additionally, advancements in digital technologies will enhance supply chain efficiencies, enabling better fuel management and compliance tracking. These trends will shape a more resilient and environmentally friendly bunker fuel landscape in Europe.

| Segment | Sub-Segments |

|---|---|

| By Type | High Sulfur Fuel Oil (HSFO) Very Low Sulfur Fuel Oil (VLSFO) Marine Gas Oil (MGO) Liquefied Natural Gas (LNG) Biofuels Other Fuel Types |

| By Vessel Type | General Cargo Containers Tankers Bulk Carriers Other Vessel Types |

| By Geography | The United Kingdom Germany Norway Spain Rest of Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Shipping Company Fuel Procurement | 120 | Procurement Managers, Fleet Operations Directors |

| Bunker Fuel Suppliers | 90 | Sales Managers, Business Development Executives |

| Port Authority Fuel Management | 60 | Port Managers, Regulatory Compliance Officers |

| Environmental Compliance in Shipping | 50 | Sustainability Officers, Environmental Managers |

| Shipping Industry Analysts | 40 | Market Analysts, Research Directors |

The Europe Bunker Fuel Market is valued at approximately USD 39 billion, driven by increasing maritime transportation demand, expanding trade volumes, and the shift towards cleaner fuels in response to environmental regulations.