Region:Asia

Author(s):Rebecca

Product Code:KRAC8495

Pages:83

Published On:November 2025

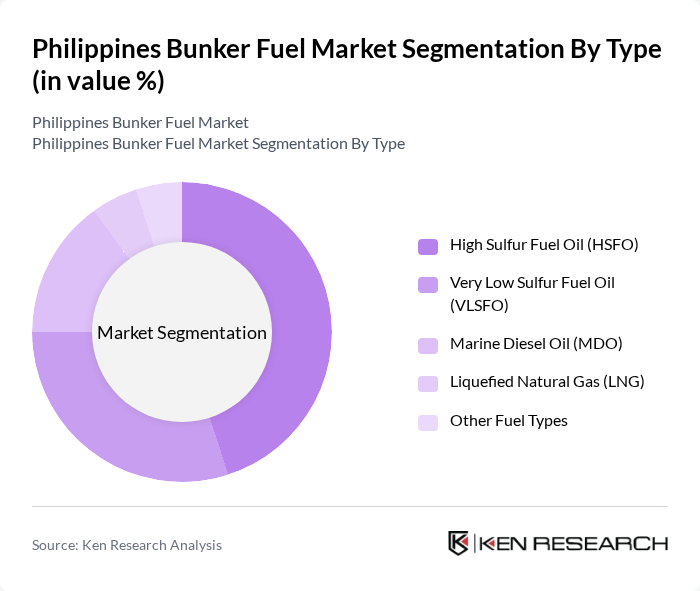

By Type:The bunker fuel market can be segmented into various types, including High Sulfur Fuel Oil (HSFO), Very Low Sulfur Fuel Oil (VLSFO), Marine Diesel Oil (MDO), Liquefied Natural Gas (LNG), and Other Fuel Types. Among these, HSFO has traditionally dominated due to its cost-effectiveness, although VLSFO is gaining traction due to stricter environmental regulations. The shift towards cleaner fuels is influencing consumer preferences, leading to a gradual increase in the adoption of VLSFO and LNG. Although LNG infrastructure is still limited, partnerships with regional energy companies and foreign investors are slowly addressing supply chain gaps.

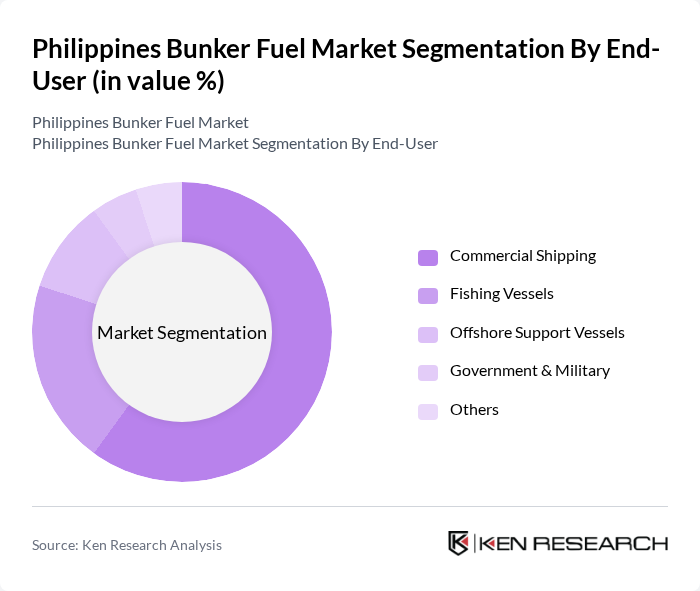

By End-User:The end-user segmentation includes Commercial Shipping, Fishing Vessels, Offshore Support Vessels, Government & Military, and Others. The commercial shipping sector is the largest consumer of bunker fuel, driven by the increasing volume of goods transported via sea routes. Fishing vessels also contribute significantly, particularly in regions with rich fishing grounds. The demand from offshore support vessels is growing due to the expansion of oil and gas exploration activities in the region.

The Philippines Bunker Fuel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pilipinas Shell Petroleum Corporation, Chevron Philippines, Inc., Petron Corporation, TotalEnergies Philippines Corporation, Seaoil Philippines, Inc., Aboitiz Power Corporation, Philippine National Oil Company (PNOC), Hanjin Shipping Philippines, Evergreen Marine Philippines, Mitsui O.S.K. Lines Philippines, COSCO Shipping Philippines, BW Group Philippines, K Line Philippines, Maersk Philippines, NYK Line Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines bunker fuel market is poised for growth as the country enhances its maritime infrastructure and aligns with global sustainability trends. The increasing adoption of low-sulfur fuels and the shift towards cleaner energy sources will drive demand. Additionally, the government's commitment to improving port facilities and regulatory frameworks will create a conducive environment for market expansion. As shipping companies adapt to these changes, the market is expected to evolve, presenting new opportunities for innovation and investment in eco-friendly fuel solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | High Sulfur Fuel Oil (HSFO) Very Low Sulfur Fuel Oil (VLSFO) Marine Gas Oil (MGO) Liquefied Natural Gas (LNG) Other Fuel Types |

| By End-User | Commercial Shipping Fishing Vessels Offshore Support Vessels Government & Military Others |

| By Region | Luzon Visayas Mindanao |

| By Application | Cargo Shipping Passenger Shipping Tanker Operations Others |

| By Supply Chain Model | Direct Supply Bunker Brokers Bunker Traders Others |

| By Pricing Model | Fixed Pricing Spot Pricing Contract Pricing Others |

| By Quality Standards | ISO 8217 Standards MARPOL Compliance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Shipping Company Operations | 45 | Fleet Managers, Operations Directors |

| Bunker Fuel Suppliers | 38 | Sales Managers, Supply Chain Coordinators |

| Port Authority Insights | 32 | Port Managers, Regulatory Affairs Officers |

| Environmental Compliance | 28 | Environmental Officers, Compliance Managers |

| Logistics and Distribution | 35 | Logistics Managers, Procurement Specialists |

The Philippines Bunker Fuel Market is valued at approximately USD 760 million, driven by increasing maritime transportation demand and the expansion of the shipping industry in the region.