Region:Asia

Author(s):Rebecca

Product Code:KRAA1375

Pages:92

Published On:August 2025

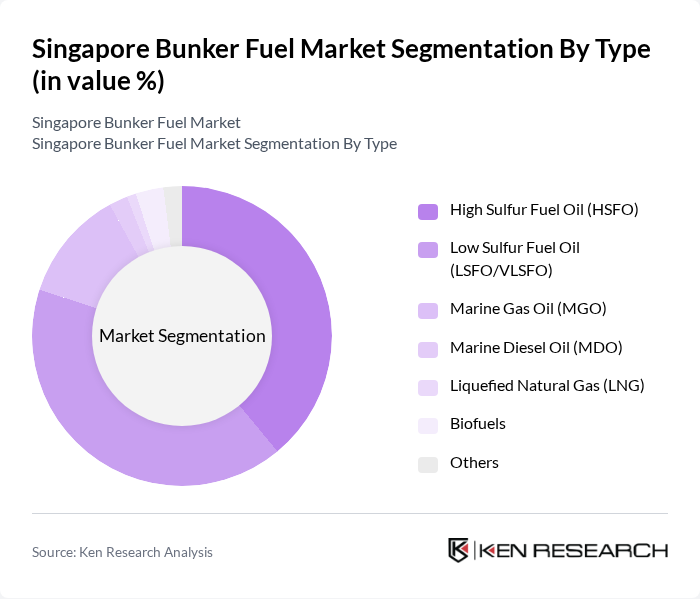

By Type:The market is segmented into various types of bunker fuels, including High Sulfur Fuel Oil (HSFO), Low Sulfur Fuel Oil (LSFO/VLSFO), Marine Gas Oil (MGO), Marine Diesel Oil (MDO), Liquefied Natural Gas (LNG), Biofuels, and Others. Among these, Low Sulfur Fuel Oil (LSFO/VLSFO) is currently dominating the market due to the stringent regulations on sulfur emissions and the increasing adoption of cleaner fuels by shipping companies. The shift towards LSFO is driven by both regulatory compliance and the growing awareness of environmental sustainability among stakeholders in the maritime industry .

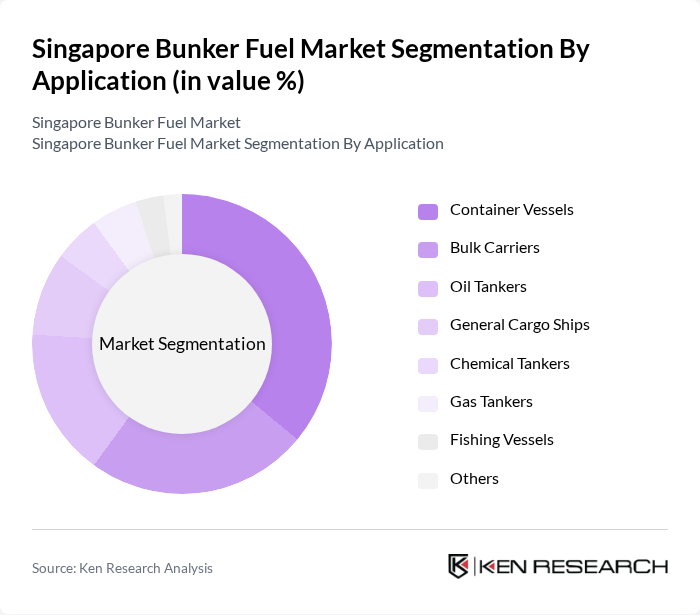

By Application:The bunker fuel market is further segmented by application into Container Vessels, Bulk Carriers, Oil Tankers, General Cargo Ships, Chemical Tankers, Gas Tankers, Fishing Vessels, and Others. Container vessels are the leading application segment, driven by the increasing global trade and the rise in containerized shipping. The demand for efficient and reliable fuel sources for these vessels is critical, as they account for a significant portion of maritime traffic and require consistent fuel supply to maintain operational efficiency .

The Singapore Bunker Fuel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Singapore Petroleum Company Limited, ExxonMobil Asia Pacific Pte Ltd, Shell Eastern Trading (Pte) Ltd, Chevron Singapore Pte Ltd, TotalEnergies Marine Fuels, Bunker One (Singapore) Pte Ltd, KPI OceanConnect, Hartree Partners (Singapore) Pte Ltd, Minerva Bunkering (Singapore) Pte Ltd, Intercontinental Bunkering (Asia) Pte Ltd, World Fuel Services (Singapore) Pte Ltd, Chemoil Energy Limited, Bunker Holding A/S, Panoil Petroleum Pte Ltd, Sinopec Fuel Oil (Singapore) Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Singapore Bunker Fuel Market appears promising, driven by ongoing investments in sustainable practices and technological advancements. As the industry adapts to stricter environmental regulations, the demand for low sulfur and alternative fuels is expected to rise. Additionally, the integration of digital technologies in operations will enhance efficiency and transparency. The market is likely to witness increased collaboration between fuel suppliers and shipping companies, fostering innovation and ensuring compliance with evolving regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | High Sulfur Fuel Oil (HSFO) Low Sulfur Fuel Oil (LSFO/VLSFO) Marine Gas Oil (MGO) Marine Diesel Oil (MDO) Liquefied Natural Gas (LNG) Biofuels Others |

| By Application | Container Vessels Bulk Carriers Oil Tankers General Cargo Ships Chemical Tankers Gas Tankers Fishing Vessels Others |

| By Supplier Type | Oil Majors Large Independents Small Independents Traders/Brokers Others |

| By Delivery Method | Ship-to-Ship (STS) Truck-to-Ship (TTS) Terminal-to-Ship Pipeline-to-Ship Others |

| By Pricing Model | Fixed Pricing Spot Pricing Contract Pricing Others |

| By Geographic Coverage | Port of Singapore Jurong Port Other Regional Ports Others |

| By Customer Type | Large Shipping Companies Small and Medium Enterprises Government and Military Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bunker Fuel Suppliers | 60 | Sales Managers, Operations Directors |

| Shipping Companies | 50 | Fleet Managers, Procurement Officers |

| Port Authorities | 40 | Regulatory Affairs Managers, Operations Supervisors |

| Environmental Agencies | 40 | Policy Analysts, Environmental Compliance Officers |

| Fuel Quality Testing Labs | 25 | Laboratory Managers, Quality Assurance Specialists |

The Singapore Bunker Fuel Market is valued at approximately USD 22 billion, driven by increasing demand for marine transportation, international trade expansion, and stringent sulfur emission regulations promoting low sulfur fuel options.