Region:Global

Author(s):Rebecca

Product Code:KRAC3278

Pages:95

Published On:October 2025

By Type:The bunker fuel market is segmented into various types, including High Sulfur Fuel Oil (HSFO), Very Low Sulfur Fuel Oil (VLSFO), Marine Gas Oil (MGO), Liquefied Natural Gas (LNG), Biofuels, and Others. Among these, Very Low Sulfur Fuel Oil (VLSFO) has gained significant traction due to stringent regulations on sulfur emissions. The shift towards cleaner fuels is driven by both regulatory compliance and the growing awareness of environmental sustainability among shipping companies.

By End-User:The end-user segmentation includes Commercial Shipping, Fishing Vessels, Offshore Support Vessels, Cruise Ships, Naval Vessels, and Others. The Commercial Shipping segment is the largest due to the high volume of goods transported globally. This segment's growth is fueled by the increasing demand for international trade and the expansion of global supply chains, which necessitate reliable and efficient bunkering services.

The Global Bunker Fuel Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil, BP Marine, Shell Marine, TotalEnergies, Chevron Marine, Bunker Holding, World Fuel Services, GAC Bunker Fuels, Aegean Marine Petroleum Network, Peninsula Petroleum, Unioil Petroleum, Hoyer Group, TFG Marine, Bunker One, TGS Bunker Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bunker fuel market in None is poised for transformation, driven by a shift towards sustainable practices and technological advancements. As shipping companies increasingly adopt low-sulfur fuels and invest in digital fuel management systems, operational efficiencies are expected to improve. Additionally, the growing emphasis on reducing carbon footprints will likely accelerate the transition to alternative energy sources, reshaping the competitive landscape and fostering innovation within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | High Sulfur Fuel Oil (HSFO) Very Low Sulfur Fuel Oil (VLSFO) Marine Gas Oil (MGO) Liquefied Natural Gas (LNG) Biofuels Others |

| By End-User | Commercial Shipping Fishing Vessels Offshore Support Vessels Cruise Ships Naval Vessels Others |

| By Region | Asia-Pacific Europe North America Middle East & Africa Latin America Others |

| By Application | Cargo Shipping Tanker Shipping Bulk Shipping Container Shipping Others |

| By Supply Chain Model | Direct Supply Bunker Brokers Bunker Traders Others |

| By Pricing Model | Fixed Pricing Spot Pricing Contract Pricing Others |

| By Quality Standards | ISO Standards MARPOL Compliance Regional Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Shipping Company Fuel Procurement | 120 | Procurement Managers, Fleet Operations Directors |

| Bunker Fuel Suppliers | 85 | Sales Managers, Business Development Executives |

| Port Authority Fuel Management | 80 | Port Operations Managers, Regulatory Compliance Officers |

| Environmental Impact Assessments | 70 | Environmental Consultants, Sustainability Managers |

| Alternative Fuel Initiatives | 60 | Research Analysts, Innovation Managers |

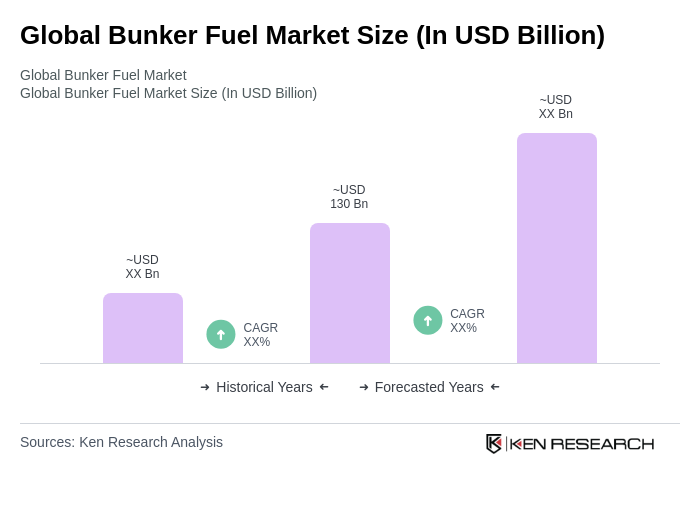

The Global Bunker Fuel Market is valued at approximately USD 130 billion, driven by increasing demand for marine transportation and regulatory changes aimed at reducing sulfur emissions, which have led to a shift towards cleaner fuel alternatives.