Region:Europe

Author(s):Dev

Product Code:KRAA1564

Pages:80

Published On:August 2025

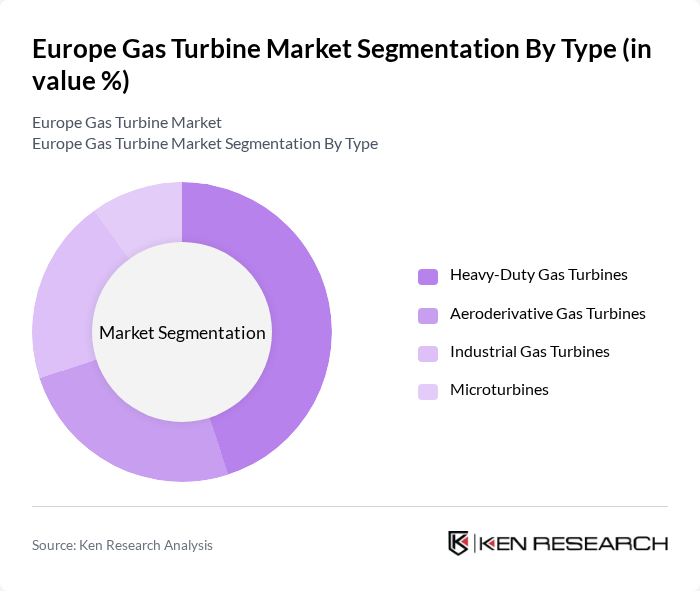

By Type:The market is segmented into Heavy-Duty Gas Turbines, Aeroderivative Gas Turbines, Industrial Gas Turbines, and Microturbines. Heavy-Duty Gas Turbines are leading the market due to their high efficiency and reliability in large-scale power generation applications. Aeroderivative Gas Turbines are gaining traction for their flexibility and quick start-up capabilities, making them suitable for peaking power plants. Industrial Gas Turbines are widely used in various industrial applications, while Microturbines are emerging as a solution for distributed generation and combined heat and power systems .

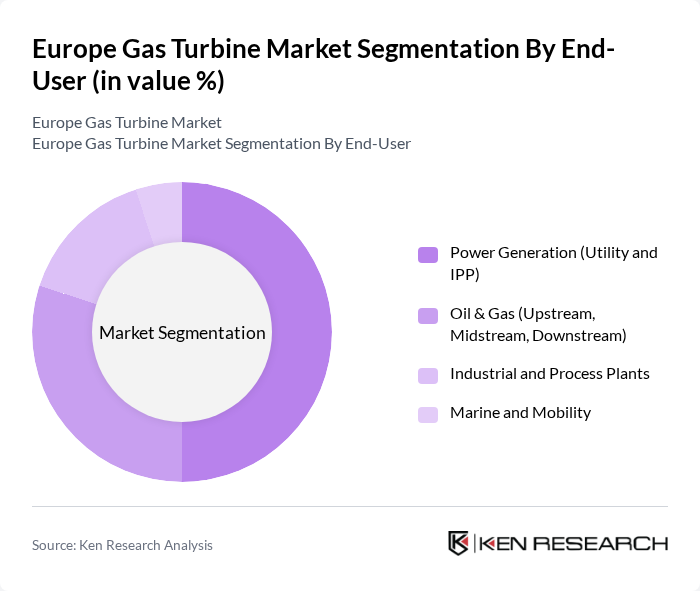

By End-User:The market is segmented into Power Generation (Utility and IPP), Oil & Gas (Upstream, Midstream, Downstream), Industrial and Process Plants, and Marine and Mobility. The Power Generation sector is the largest end-user, driven by the need for reliable and efficient electricity generation. The Oil & Gas sector also plays a significant role, utilizing gas turbines for various applications, including compression and power generation. Industrial and Process Plants are increasingly adopting gas turbines for their energy needs, while the Marine and Mobility sector is exploring gas turbines for propulsion and auxiliary power .

The Europe Gas Turbine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Energy AG, GE Vernova Inc. (Gas Power), Mitsubishi Power, Ltd., Ansaldo Energia S.p.A., Rolls-Royce Holdings plc (Rolls-Royce plc), Kawasaki Heavy Industries, Ltd., Solar Turbines Incorporated (a Caterpillar company), MAN Energy Solutions SE, Baker Hughes Company (Baker Hughes Gas Technology), Wärtsilä Corporation, Capstone Green Energy Corporation, Doosan Enerbility Co., Ltd., OPRA Turbines B.V., Zorya-Mashproekt (State Enterprise, Ukraine), Alstom S.A. (heritage fleet; legacy support) contribute to innovation, geographic expansion, and service delivery in this space.

The Europe gas turbine market is poised for significant transformation driven by technological advancements and regulatory frameworks. As the region pushes towards carbon neutrality by 2050, the integration of gas turbines with renewable energy sources will become increasingly vital. The focus on digitalization and smart technologies will enhance operational efficiency, while investments in hybrid systems will create new avenues for growth. The market is expected to adapt rapidly to evolving energy demands and environmental standards, ensuring a sustainable energy future.

| Segment | Sub-Segments |

|---|---|

| By Type | Heavy-Duty Gas Turbines Aeroderivative Gas Turbines Industrial Gas Turbines Microturbines |

| By End-User | Power Generation (Utility and IPP) Oil & Gas (Upstream, Midstream, Downstream) Industrial and Process Plants Marine and Mobility |

| By Application | Combined Cycle Power Plants Open Cycle/Peaker Plants Cogeneration/CHP Systems Mechanical Drive and Compression |

| By Fuel Type | Natural Gas Hydrogen Blends Biogas/Syngas Liquid Fuels (Diesel, Kerosene) |

| By Distribution Channel | Direct OEM Sales EPC/Project Developers Aftermarket and Service Providers Distributors/Channel Partners |

| By Region | Western Europe Eastern Europe Northern Europe Southern Europe |

| By Policy Support | Capacity Mechanisms and Ancillary Services Emissions Trading System (EU ETS) and Carbon Pricing Renewable/Low-Carbon Gas Incentives (e.g., Hydrogen) Grid Flexibility and Reserve Market Rules |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Power Generation Sector | 120 | Plant Managers, Energy Analysts |

| Oil & Gas Industry | 100 | Operations Directors, Technical Engineers |

| Industrial Applications | 80 | Facility Managers, Procurement Specialists |

| Research & Development | 60 | R&D Managers, Innovation Leads |

| Regulatory Bodies | 40 | Policy Makers, Regulatory Analysts |

The Europe Gas Turbine Market is valued at approximately USD 2.7 billion, reflecting a combination of installed base services and new equipment demand driven by the need for flexible power generation and renewable energy integration.