Region:Global

Author(s):Geetanshi

Product Code:KRAA0123

Pages:91

Published On:August 2025

By Type:The gas turbine market is segmented into four main types: Heavy-Duty Gas Turbines, Aeroderivative Gas Turbines, Industrial Gas Turbines, and Micro Gas Turbines. Heavy-duty gas turbines are primarily used in large-scale power generation, valued for their high efficiency, reliability, and suitability for combined cycle applications. Aeroderivative gas turbines are favored for their operational flexibility, rapid start-up, and suitability for peaking and backup power. Industrial gas turbines serve a variety of industrial processes, including mechanical drive and cogeneration. Micro gas turbines are increasingly adopted in distributed generation and small-scale combined heat and power (CHP) applications due to their compact size, lower emissions, and fuel flexibility .

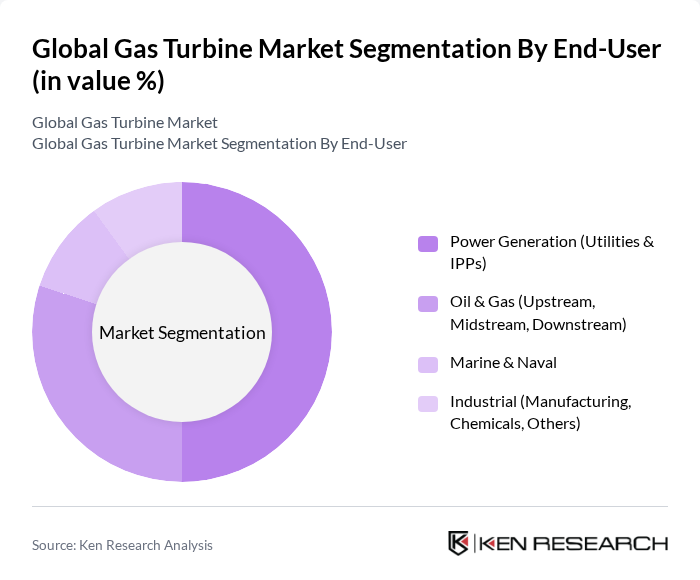

By End-User:The end-user segmentation of the gas turbine market includes Power Generation (Utilities & IPPs), Oil & Gas (Upstream, Midstream, Downstream), Marine & Naval, and Industrial (Manufacturing, Chemicals, Others). The Power Generation sector remains the largest consumer, driven by the need for reliable, flexible, and efficient electricity generation, especially in regions transitioning from coal to gas. The Oil & Gas sector utilizes gas turbines for compression, mechanical drive, and onsite power generation. The Marine & Naval segment is expanding due to the demand for efficient propulsion and onboard power systems, while the Industrial sector is increasingly adopting gas turbines for process heat, cogeneration, and decentralized energy solutions .

The Global Gas Turbine Market is characterized by a dynamic mix of regional and international players. Leading participants such as General Electric (GE Power), Siemens Energy, Mitsubishi Power (Mitsubishi Heavy Industries Group), Rolls-Royce Holdings plc, Ansaldo Energia, Solar Turbines (Caterpillar Inc.), Kawasaki Heavy Industries, MAN Energy Solutions, Baker Hughes, Doosan Enerbility (formerly Doosan Heavy Industries), Wartsila Oyj Abp, Bharat Heavy Electricals Limited (BHEL), OPRA Turbines, Vericor Power Systems, Zorya-Mashproekt contribute to innovation, geographic expansion, and service delivery in this space.

The future of the gas turbine market appears promising, driven by the increasing integration of renewable energy sources and advancements in turbine technology. As countries strive to meet their carbon neutrality goals, gas turbines will play a pivotal role in providing reliable backup power. Additionally, the trend towards decentralized energy generation is expected to create new opportunities for gas turbine applications, particularly in remote and off-grid areas, enhancing energy security and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Heavy-Duty Gas Turbines Aeroderivative Gas Turbines Industrial Gas Turbines Micro Gas Turbines |

| By End-User | Power Generation (Utilities & IPPs) Oil & Gas (Upstream, Midstream, Downstream) Marine & Naval Industrial (Manufacturing, Chemicals, Others) |

| By Application | Combined Cycle Power Plants Simple Cycle Power Plants Cogeneration/CHP (Combined Heat & Power) Mechanical Drive |

| By Fuel Type | Natural Gas Liquid Fuels (Diesel, Kerosene, etc.) Hydrogen & Hydrogen Blends Biogas & Synthetic Fuels |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Open Cycle Gas Turbines (OCGT) Combined Cycle Gas Turbines (CCGT) Hybrid Systems (Gas + Renewable Integration) |

| By Maintenance Type | Scheduled Maintenance Unscheduled Maintenance Maintenance, Repair & Overhaul (MRO) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Power Generation Sector | 120 | Plant Managers, Energy Analysts |

| Oil & Gas Applications | 90 | Operations Managers, Project Engineers |

| Aerospace Industry | 60 | Aerospace Engineers, Procurement Specialists |

| Industrial Applications | 50 | Facility Managers, Technical Directors |

| Research & Development | 40 | R&D Managers, Innovation Leads |

The Global Gas Turbine Market is valued at approximately USD 24 billion, driven by increasing demand for cleaner energy sources, modernization of power infrastructure, and advancements in turbine efficiency, including hydrogen-ready and low-emission technologies.