Region:North America

Author(s):Shubham

Product Code:KRAA1832

Pages:93

Published On:August 2025

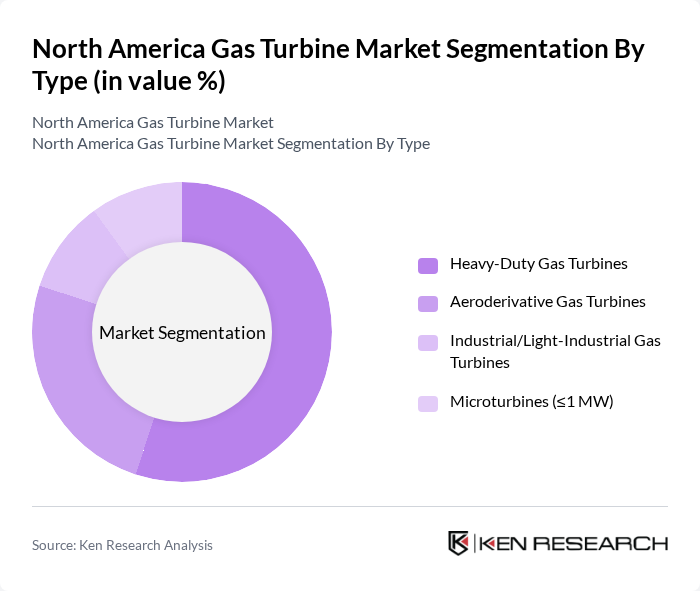

By Type:The market is segmented into Heavy-Duty Gas Turbines, Aeroderivative Gas Turbines, Industrial/Light-Industrial Gas Turbines, and Microturbines (?1 MW). Heavy-Duty Gas Turbines are leading the market due to their high efficiency and reliability in large-scale combined-cycle and baseload applications. Aeroderivative Gas Turbines are also gaining traction for their fast-start, cycling capability, and suitability for peaking and grid-balancing, including integration with renewables and emergency capacity needs .

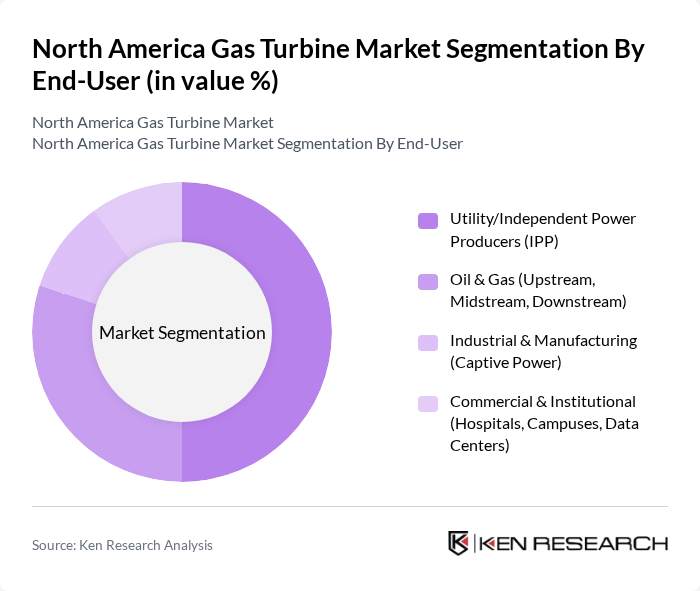

By End-User:The market is categorized into Utility/Independent Power Producers (IPP), Oil & Gas (Upstream, Midstream, Downstream), Industrial & Manufacturing (Captive Power), and Commercial & Institutional (Hospitals, Campuses, Data Centers). The Utility/IPP segment is the largest due to ongoing gas-fired fleet additions for reliability, flexible peaking, and combined-cycle efficiency. The Oil & Gas sector also significantly contributes to the market through turbines used in mechanical drive and onsite power for extraction, processing, and pipeline compression .

The North America Gas Turbine Market is characterized by a dynamic mix of regional and international players. Leading participants such as GE Vernova (Gas Power, including Aeroderivative), Siemens Energy, Mitsubishi Power Americas, Inc., Ansaldo Energia S.p.A., Solar Turbines Incorporated (Caterpillar Company), Rolls-Royce plc (MTU Aero Engines partnerships for industrial aero), Caterpillar Inc. (Turbomachinery through Solar Turbines), Baker Hughes Company (Nuovo Pignone Turbomachinery), MAN Energy Solutions SE, Woodward, Inc. (Controls and Fuel Systems), Doosan Enerbility Co., Ltd., Wärtsilä Corporation (Hybrid/CHP and services), Kawasaki Heavy Industries, Ltd., Capstone Green Energy Corporation, OPRA Turbines B.V. contribute to innovation, geographic expansion, and service delivery in this space .

The North American gas turbine market is poised for significant transformation driven by technological advancements and a shift towards sustainable energy solutions. As the demand for cleaner energy sources continues to rise, gas turbines will play a pivotal role in meeting energy needs while reducing emissions. The integration of digital technologies and hybrid energy systems will further enhance operational efficiency, positioning the market for robust growth. Additionally, the expansion of natural gas infrastructure will facilitate broader adoption across various sectors, ensuring a resilient energy future.

| Segment | Sub-Segments |

|---|---|

| By Type | Heavy-Duty Gas Turbines Aeroderivative Gas Turbines Industrial/Light-Industrial Gas Turbines Microturbines (?1 MW) |

| By End-User | Utility/Independent Power Producers (IPP) Oil & Gas (Upstream, Midstream, Downstream) Industrial & Manufacturing (Captive Power) Commercial & Institutional (Hospitals, Campuses, Data Centers) |

| By Application | Combined Cycle Power Generation Simple Cycle/Peaking Power Combined Heat and Power (CHP)/Cogeneration Mechanical Drive/Compression |

| By Fuel Type | Natural Gas Distillate/Other Liquid Fuels (Dual-Fuel) Hydrogen-Ready Blends Biogas/Syngas |

| By Sales Channel | Direct (OEM) EPC/Integrators Authorized Distributors Aftermarket/Service Agreements |

| By Installation Location | Onshore Offshore (Platforms, FPSOs) Remote/Distributed Sites (Microgrids) Brownfield Retrofits/Repowers |

| By Capacity | ?40 MW –120 MW –300 MW ?300 MW |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Power Generation Sector | 120 | Plant Managers, Energy Analysts |

| Aviation Gas Turbines | 90 | Aerospace Engineers, Procurement Managers |

| Industrial Applications | 80 | Operations Directors, Facility Managers |

| Gas Turbine Maintenance Services | 70 | Maintenance Supervisors, Technical Managers |

| Research & Development in Turbine Technology | 60 | R&D Engineers, Innovation Managers |

The North America Gas Turbine Market is valued at approximately USD 8.4 billion, reflecting stable demand driven by natural gas availability and fleet modernization across utility and industrial applications.