Region:Europe

Author(s):Dev

Product Code:KRAC0386

Pages:98

Published On:August 2025

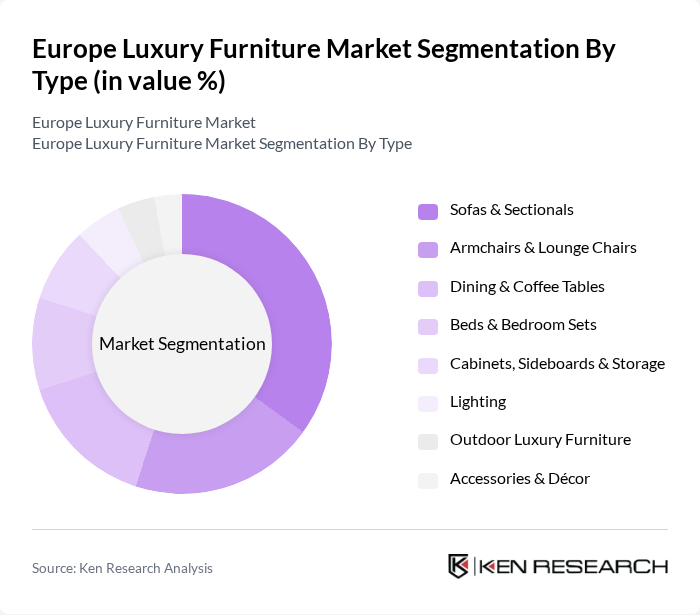

By Type:The luxury furniture market is segmented into various types, including sofas & sectionals, armchairs & lounge chairs, dining & coffee tables, beds & bedroom sets, cabinets, sideboards & storage, lighting, outdoor luxury furniture, and accessories & décor. Among these, sofas & sectionals are the most dominant sub-segment, driven by consumer preferences for comfort and style in living spaces. The trend towards open-plan living has further increased the demand for versatile and stylish seating options.

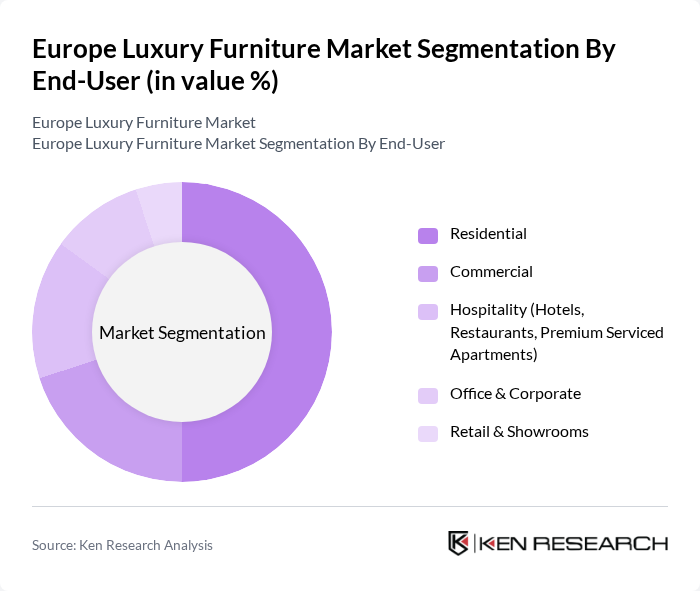

By End-User:The market is segmented by end-user into residential, commercial, hospitality (hotels, restaurants, premium serviced apartments), office & corporate, and retail & showrooms. The residential segment leads the market, driven by increasing consumer spending on home furnishings and a growing trend towards personalized interior design. Consumers are increasingly investing in luxury furniture to enhance their living spaces, reflecting their lifestyle and status.

The Europe Luxury Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roche Bobois, B&B Italia, Poltrona Frau, Cassina, Minotti, Fendi Casa, Armani/Casa, Knoll (MillerKnoll), Ligne Roset, Vitra, Flexform, Molteni&C, Natuzzi Italia, GUBI, Carl Hansen & Søn contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe luxury furniture market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value for consumers, brands that prioritize eco-friendly practices are likely to gain a competitive edge. Additionally, the integration of smart technology into furniture design is expected to attract tech-savvy consumers, further expanding market opportunities. The continued growth of e-commerce will also facilitate access to luxury furniture, enhancing consumer engagement and driving sales in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Sofas & Sectionals Armchairs & Lounge Chairs Dining & Coffee Tables Beds & Bedroom Sets Cabinets, Sideboards & Storage Lighting Outdoor Luxury Furniture Accessories & Décor |

| By End-User | Residential Commercial Hospitality (Hotels, Restaurants, Premium Serviced Apartments) Office & Corporate Retail & Showrooms |

| By Distribution Channel | Flagship Stores & Mono-brand Boutiques Specialty & Design Stores Home Centers & Department Stores Online (Brand E-commerce & Premium Marketplaces) Interior Designers/Contract Channels |

| By Price Range | Premium (Entry Luxury) High-End Ultra-Luxury/Bespoke |

| By Material | Solid Wood & Veneers Metals (Steel, Brass, Aluminum) Glass & Stone (Marble, Granite) Fabrics & Textiles Leather Sustainable/Engineered Materials |

| By Style | Modern/Contemporary Traditional/Classical Mid-Century & Scandinavian Artisanal/Bespoke |

| By Functionality | Bespoke/Custom-made Space-saving & Modular Smart & Connected Multi-functional |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Furniture Retailers | 150 | Store Managers, Sales Directors |

| High-End Furniture Manufacturers | 100 | Production Managers, Design Heads |

| Interior Designers Specializing in Luxury | 80 | Lead Designers, Project Managers |

| Affluent Consumers | 120 | Homeowners, Luxury Buyers |

| Luxury Furniture Distributors | 90 | Distribution Managers, Supply Chain Analysts |

The Europe Luxury Furniture Market is valued at approximately USD 12.5 billion, reflecting a significant growth trend driven by increasing disposable incomes and a rising preference for high-quality, aesthetically pleasing furniture among consumers.