GCC Luxury Furniture Market Overview

- The GCC Luxury Furniture Market is valued at USD 4.8 billion, based on a five-year historical analysis. This growth is primarily driven by rising disposable incomes, rapid urbanization, and a growing preference for high-quality, aesthetically pleasing furniture among consumers. The increasing number of luxury residential, commercial, and hospitality projects in the region has further fueled demand for luxury furniture, making it a significant segment in the overall furniture market. The market is also benefiting from the expansion of e-commerce platforms, which are making luxury furniture more accessible to a broader consumer base.

- Key players in this market include the UAE and Saudi Arabia, which dominate due to their affluent populations and a strong culture of luxury consumption. The UAE, particularly Dubai, is recognized for its high-end retail environment and a wide array of luxury furniture showrooms, while Saudi Arabia's expanding urban centers and substantial investments in real estate and hospitality projects contribute to its market strength. The region’s luxury furniture sector is further supported by the influx of international brands and a growing trend toward customized and bespoke furniture solutions.

- In 2023, the UAE government implemented regulations to promote sustainable practices in the furniture industry. TheUAE Cabinet Decision No. 10 of 2023 on the Regulation of Products Related to Sustainability and Environmental Protection, issued by the UAE Cabinet, established binding guidelines for sourcing materials responsibly, reducing waste in production processes, and encouraging the use of eco-friendly materials. This regulation requires manufacturers to comply with minimum sustainability standards and submit regular compliance reports, aligning with the broader national vision of sustainability and environmental conservation.

GCC Luxury Furniture Market Segmentation

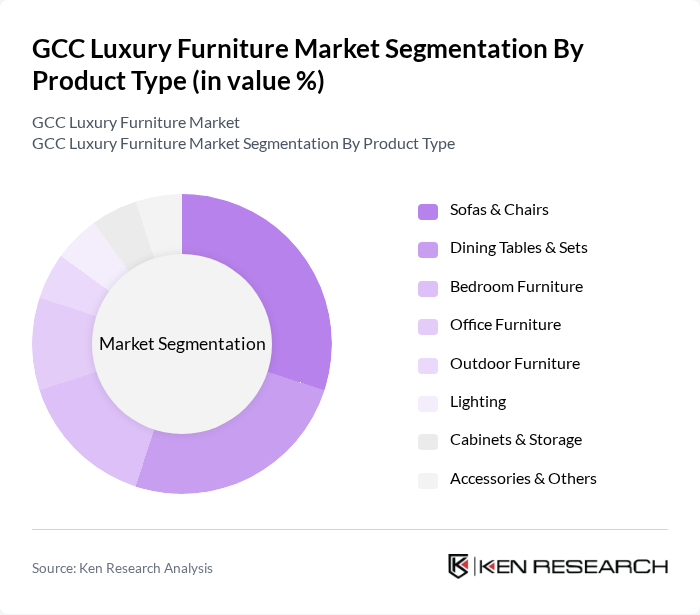

By Product Type:The product type segmentation includes categories such as Sofas & Chairs, Dining Tables & Sets, Bedroom Furniture, Office Furniture, Outdoor Furniture, Lighting, Cabinets & Storage, and Accessories & Others. Among these,Sofas & Chairsare the most popular, reflecting their essential role in both home and office decor, as well as their ability to express personal style and comfort. Demand forDining Tables & Setsremains significant, driven by the growing trend of hosting gatherings and family meals at home. The market is also witnessing increased interest in multifunctional and wellness-oriented furniture, as well as a blend of contemporary and traditional design influences.

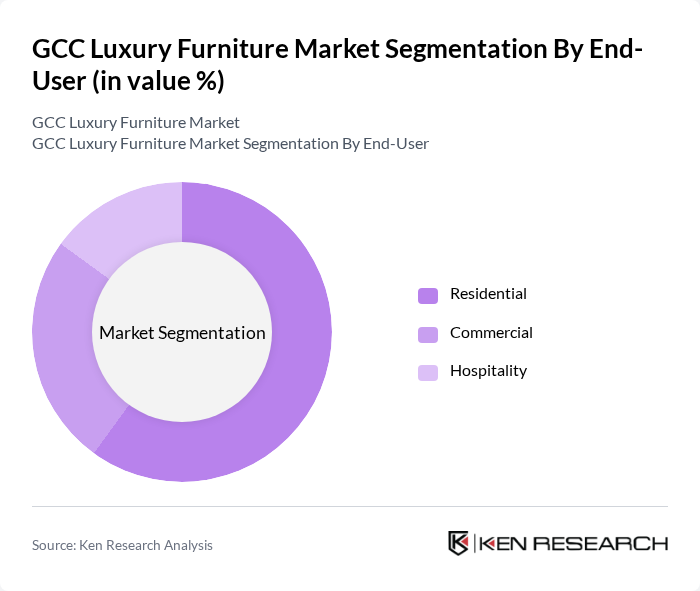

By End-User:The end-user segmentation includesResidential,Commercial, andHospitalitysectors. The Residential segment dominates the market, driven by increasing home ownership, a growing trend of interior design among homeowners, and the desire for personalized luxury living spaces. The Commercial segment is also significant, as businesses invest in high-quality furniture to enhance their work environments and brand image. The Hospitality sector is expanding due to the ongoing development of luxury hotels and resorts, particularly in the UAE and Saudi Arabia, which are major tourism and business destinations.

GCC Luxury Furniture Market Competitive Landscape

The GCC Luxury Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Huzaifa, PAN Emirates Home Furnishings, IDdesign, Danube Home, Home Centre, IKEA, Roche Bobois, Poltrona Frau, B&B Italia, Fendi Casa, Minotti, Cassina, Ligne Roset, Knoll, Flexform, Baker Furniture, Christopher Guy, HAY, Vitra, and Tom Dixon contribute to innovation, geographic expansion, and service delivery in this space.

GCC Luxury Furniture Market Industry Analysis

Growth Drivers

- Rising Disposable Income:The GCC region has witnessed a significant increase in disposable income, with average household income rising to approximately $66,000 in future. This increase is driven by economic diversification efforts and a growing expatriate population. As consumers have more financial resources, they are increasingly willing to invest in luxury furniture, which is perceived as a status symbol. This trend is particularly evident in urban areas, where luxury furniture sales have surged by 15% year-on-year.

- Increasing Urbanization:Urbanization in the GCC is accelerating, with over 88% of the population now residing in urban areas in future. This shift is leading to a higher demand for luxury furniture, as urban dwellers seek to enhance their living spaces. The construction of high-end residential projects, which increased by 22% in future, further fuels this demand. Urban consumers are increasingly focused on aesthetics and quality, driving the luxury furniture market's growth.

- Growth in Hospitality Sector:The hospitality sector in the GCC is expanding rapidly, with over 1,200 new hotels projected to open in future. This growth is driven by increased tourism, which is expected to reach 55 million visitors annually in future. Luxury hotels and resorts are investing heavily in high-quality furniture to enhance guest experiences. Consequently, the demand for luxury furniture from the hospitality sector is projected to grow by 30% in the coming years, significantly impacting the overall market.

Market Challenges

- High Import Tariffs:The GCC luxury furniture market faces challenges due to high import tariffs, which can reach up to 20% on certain products. These tariffs increase the cost of imported luxury furniture, making it less competitive against locally produced alternatives. As a result, many consumers may opt for cheaper, locally manufactured options, which can hinder the growth of international luxury brands in the region. This challenge is particularly pronounced in markets like Saudi Arabia and the UAE.

- Intense Competition:The GCC luxury furniture market is characterized by intense competition, with over 220 brands vying for market share. This saturation leads to price wars and aggressive marketing strategies, which can erode profit margins. Established brands face pressure from emerging local designers and international players entering the market. In future, the competition is expected to intensify further, making it crucial for brands to differentiate themselves through unique offerings and superior customer service.

GCC Luxury Furniture Market Future Outlook

The GCC luxury furniture market is poised for continued growth, driven by rising disposable incomes and urbanization trends. As consumers increasingly prioritize quality and aesthetics, the demand for luxury furniture is expected to remain robust. Additionally, the integration of smart technology into furniture design will likely attract tech-savvy consumers. However, brands must navigate challenges such as high import tariffs and intense competition to capitalize on these opportunities effectively. The focus on sustainability will also shape future product offerings, aligning with consumer preferences.

Market Opportunities

- Expansion of E-commerce:The rise of e-commerce presents a significant opportunity for luxury furniture brands in the GCC. Online sales in the furniture sector are projected to grow by 35% in future, driven by increased internet penetration and consumer preference for online shopping. Brands can leverage this trend by enhancing their online presence and offering virtual showrooms to attract tech-savvy consumers.

- Sustainable Furniture Trends:The growing consumer awareness of environmental issues is creating opportunities for sustainable furniture options. In future, the demand for eco-friendly materials is expected to increase by 45%, as consumers seek products that align with their values. Brands that prioritize sustainability in their offerings can capture this emerging market segment and differentiate themselves from competitors.