Region:Europe

Author(s):Dev

Product Code:KRAA1601

Pages:94

Published On:August 2025

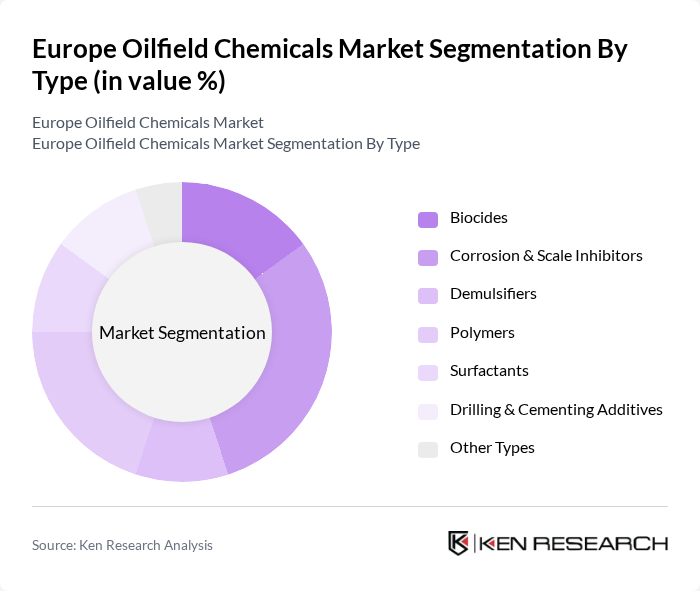

By Type:The market is segmented into various types of oilfield chemicals, including biocides, corrosion & scale inhibitors, demulsifiers, polymers, surfactants, drilling & cementing additives, and other types. Each of these subsegments plays a crucial role in enhancing the efficiency and safety of oilfield operations. Among these, corrosion & scale inhibitors are particularly dominant due to their essential function in preventing equipment degradation and ensuring operational longevity.

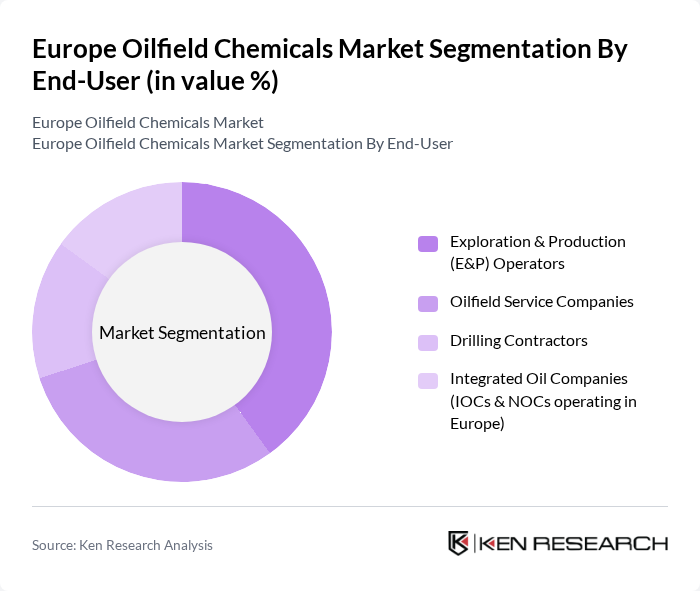

By End-User:The end-user segment includes exploration & production (E&P) operators, oilfield service companies, drilling contractors, and integrated oil companies (IOCs & NOCs operating in Europe). The exploration & production operators are the leading end-users, driven by the increasing need for efficient and effective chemical solutions to optimize production processes and enhance recovery rates.

The Europe Oilfield Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Halliburton Company, SLB (Schlumberger Limited), Baker Hughes Company, Clariant AG, Ecolab Inc. (Nalco Champion), Nouryon (formerly AkzoNobel Specialty Chemicals), Solvay S.A., Huntsman Corporation, Croda International Plc, Newpark Resources, Inc., The Chemours Company, Afton Chemical Corporation, Innospec Inc., TETRA Technologies, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe oilfield chemicals market appears promising, driven by a combination of technological advancements and a growing emphasis on sustainability. As companies increasingly adopt digital solutions and IoT technologies, operational efficiencies are expected to improve significantly. Furthermore, the shift towards greener practices will likely lead to the development of innovative, eco-friendly chemical solutions, positioning the market for robust growth in the future while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Biocides Corrosion & Scale Inhibitors Demulsifiers Polymers Surfactants Drilling & Cementing Additives Other Types |

| By End-User | Exploration & Production (E&P) Operators Oilfield Service Companies Drilling Contractors Integrated Oil Companies (IOCs & NOCs operating in Europe) |

| By Application | Drilling & Cementing Production Chemicals Workover & Completion Well Stimulation Enhanced Oil Recovery (EOR) |

| By Distribution Channel | Direct Sales to Operators/Service Firms Authorized Distributors Framework Agreements & Tenders |

| By Region | United Kingdom Norway Russia Rest of Europe |

| By Pricing Strategy | Contract-Based Pricing Spot/Project-Based Pricing Value-Based Pricing (Performance-Linked) |

| By Regulatory Compliance | REACH and CLP Compliance OSPAR/HOCNF Certification for Offshore Chemicals ISO 9001/14001/45001 Certifications |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Drilling Fluids Market | 120 | Drilling Engineers, Product Managers |

| Production Chemicals Sector | 90 | Procurement Managers, Operations Supervisors |

| Enhanced Oil Recovery Agents | 70 | Research Scientists, Technical Directors |

| Environmental Compliance in Oilfields | 60 | Environmental Managers, Compliance Officers |

| Market Trends in Oilfield Chemicals | 100 | Market Analysts, Business Development Managers |

The Europe Oilfield Chemicals Market is valued at approximately USD 6.9 billion, reflecting a significant share of the global market, which is estimated to be around USD 1920 billion. This valuation is based on comprehensive analyses from reputable market trackers.