Region:Global

Author(s):Shubham

Product Code:KRAA3174

Pages:90

Published On:August 2025

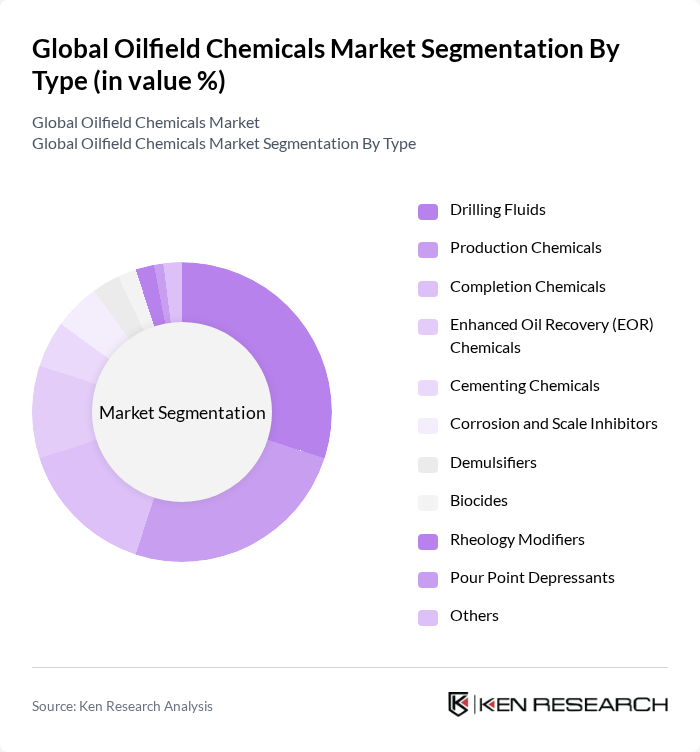

By Type:The market is segmented into various types of oilfield chemicals, including drilling fluids, production chemicals, completion chemicals, enhanced oil recovery (EOR) chemicals, cementing chemicals, corrosion and scale inhibitors, demulsifiers, biocides, rheology modifiers, pour point depressants, and others. Among these, drilling fluids and production chemicals are the most significant due to their essential roles in the drilling and extraction processes. The demand for these chemicals is driven by the need for efficient, safe, and environmentally sustainable operations in oil and gas extraction. The increasing complexity of drilling environments, such as ultra-deepwater and unconventional resources, further drives the need for specialized chemical formulations .

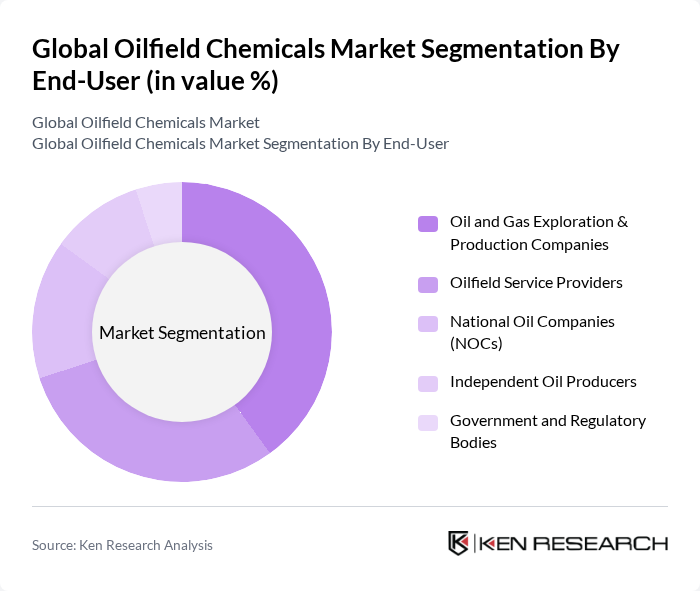

By End-User:The end-user segment includes oil and gas exploration and production companies, oilfield service providers, national oil companies (NOCs), independent oil producers, and government and regulatory bodies. Oil and gas exploration and production companies are the leading end-users, as they require a wide range of chemicals for various stages of oil extraction and production processes. The increasing exploration activities in untapped and challenging regions, such as deepwater and shale formations, are further driving the demand for oilfield chemicals. Service providers are also expanding their portfolios to offer integrated chemical solutions tailored to specific reservoir conditions .

The Global Oilfield Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Halliburton Company, Schlumberger Limited, Baker Hughes Company, Ecolab Inc., Clariant AG, Newpark Resources, Inc., AkzoNobel N.V., Huntsman Corporation, Solvay S.A., Chevron Phillips Chemical Company, Croda International Plc, Innospec Inc., Afton Chemical Corporation, TETRA Technologies, Inc., Albemarle Corporation, Ashland Inc., CES Energy Solutions Corp., ChampionX Corporation, Kemira Oyj, Stepan Company, The Dow Chemical Company, and The Lubrizol Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the oilfield chemicals market appears promising, driven by ongoing technological advancements and a shift towards sustainable practices. As companies increasingly adopt digital solutions and automation, operational efficiencies are expected to improve significantly. Furthermore, the focus on enhanced oil recovery (EOR) methods will likely drive demand for specialized chemicals. The market is also anticipated to benefit from strategic partnerships aimed at developing innovative, eco-friendly solutions that align with global sustainability goals, ensuring long-term growth and resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Drilling Fluids Production Chemicals Completion Chemicals Enhanced Oil Recovery (EOR) Chemicals Cementing Chemicals Corrosion and Scale Inhibitors Demulsifiers Biocides Rheology Modifiers Pour Point Depressants Others |

| By End-User | Oil and Gas Exploration & Production Companies Oilfield Service Providers National Oil Companies (NOCs) Independent Oil Producers Government and Regulatory Bodies |

| By Application | Onshore Operations Offshore Operations Well Stimulation Well Completion Production Enhancement |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Chemical Composition | Organic Chemicals Inorganic Chemicals Biodegradable Chemicals |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Drilling Fluids Market | 100 | Drilling Engineers, Procurement Managers |

| Production Chemicals Sector | 80 | Production Managers, Chemical Engineers |

| Enhanced Oil Recovery Chemicals | 60 | Reservoir Engineers, R&D Managers |

| Oilfield Services Providers | 90 | Operations Directors, Business Development Managers |

| Environmental Compliance in Oilfields | 50 | Environmental Managers, Compliance Officers |

The Global Oilfield Chemicals Market is valued at approximately USD 28 billion, reflecting a five-year historical analysis. This valuation is driven by the increasing demand for oil and gas, enhanced oil recovery techniques, and advancements in drilling operations.