Europe Recreational Vehicle Market Overview

- The Europe Recreational Vehicle market is valued at USD 30 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer interest in outdoor activities, a rise in disposable income, and a growing trend towards road trips and camping vacations. The market has seen a significant uptick in demand for both motorized and towable recreational vehicles, reflecting a shift in consumer preferences towards mobile living and travel experiences. Technological advancements, such as improved fuel efficiency, smart connectivity features, and enhanced comfort, are further accelerating adoption, while the popularity of sustainable and eco-friendly travel options is shaping new product development .

- Countries such as Germany, the United Kingdom, and France dominate the Europe Recreational Vehicle market due to their strong tourism infrastructure, extensive road networks, and a culture that embraces outdoor leisure activities. Germany, in particular, holds the largest market share, supported by robust manufacturing capabilities and a high number of registered RVs. The UK and France benefit from a large number of campsites and scenic routes that attract RV enthusiasts, with France also experiencing a surge in millennial tourists and increased use of rental RVs .

- In recent years, the European Union has implemented regulations aimed at reducing emissions from recreational vehicles, mandating that all new RVs meet stringent environmental standards. These measures are part of a broader initiative to promote sustainable tourism and reduce the carbon footprint of travel, encouraging manufacturers to innovate and produce more eco-friendly models. The regulatory environment continues to evolve, with increasing emphasis on electrification, alternative fuels, and advanced emission control technologies .

Europe Recreational Vehicle Market Segmentation

By Type:The market is segmented into various types of recreational vehicles, including motorhomes, campervans, caravans (travel trailers), fifth-wheel trailers, pop-up campers, truck campers, toy haulers, and others. Among these, motorhomes and caravans are particularly popular due to their versatility, comfort, and suitability for both short and extended trips. The increasing trend of road trips, outdoor activities, and the appeal of flexible travel experiences has led to a surge in demand for these vehicles, making them the leading subsegments in the market. Advancements such as modular interiors, smart controls, and enhanced safety features are further driving consumer preference for these categories .

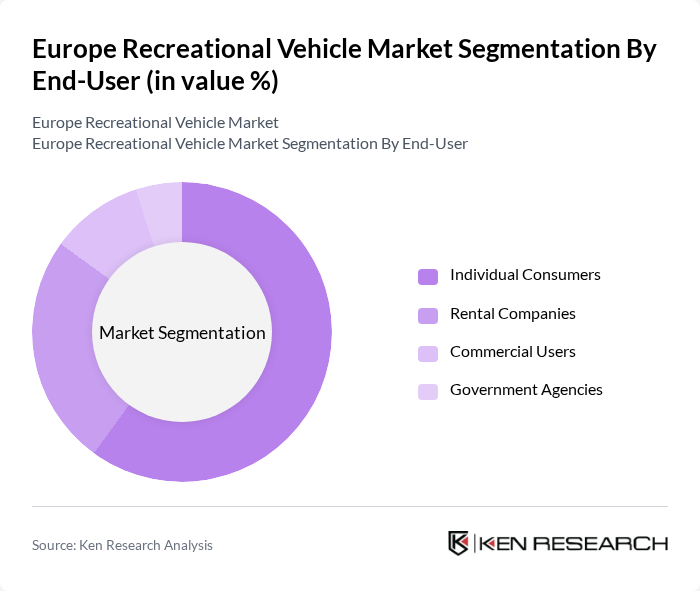

By End-User:The end-user segmentation includes individual consumers, rental companies, commercial users, and government agencies. Individual consumers represent the largest segment, driven by the growing popularity of RV travel for leisure, family vacations, and long-term touring. Rental companies are also seeing increased demand as more people opt for renting RVs for short trips and experiential travel, while commercial users and government agencies utilize RVs for a variety of operational and service-related needs. The trend towards flexible, experience-driven travel continues to significantly boost the individual consumer segment, making it the market leader .

Europe Recreational Vehicle Market Competitive Landscape

The Europe Recreational Vehicle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dethleffs GmbH & Co. KG, Hymer GmbH & Co. KG, Knaus Tabbert AG, Adria Mobil d.o.o., Trigano S.A., Thor Industries, Inc., Winnebago Industries, Inc., Forest River, Inc., Rapido Group, Laika Caravans S.p.A., Bürstner GmbH & Co. KG, Carthago Reisemobilbau GmbH, Challenger (Groupe Trigano), Eura Mobil GmbH, Pilote Group contribute to innovation, geographic expansion, and service delivery in this space.

Europe Recreational Vehicle Market Industry Analysis

Growth Drivers

- Increasing Demand for Outdoor Recreational Activities:The European outdoor recreation market is projected to reach €200 billion in future, driven by a growing interest in activities such as camping, hiking, and road trips. This trend is supported by a 15% increase in outdoor participation rates since 2020, as reported by the European Outdoor Group. The rise in health consciousness and the desire for nature-based experiences are key factors fueling this demand, leading to a surge in recreational vehicle (RV) usage.

- Rise in Disposable Income Among Consumers:In future, the average disposable income in Europe is expected to rise to €30,000 per capita, reflecting a 3% increase from the previous year. This increase allows consumers to allocate more funds towards leisure activities, including RV purchases and rentals. The European Commission reports that 60% of households plan to spend more on travel and outdoor experiences, further driving the demand for recreational vehicles as a preferred mode of travel.

- Growth in Tourism and Travel Trends:The European tourism sector is anticipated to generate €1 trillion in revenue in future, with a significant portion attributed to domestic travel. The European Travel Commission indicates that 70% of travelers prefer road trips, which boosts the RV market. Additionally, the rise of "staycations" and local tourism has led to increased interest in RVs, as they offer flexibility and comfort for exploring local attractions and natural landscapes.

Market Challenges

- High Initial Investment Costs:The average cost of a new recreational vehicle in Europe is approximately €60,000, which poses a significant barrier for many potential buyers. This high initial investment can deter consumers, especially in a post-pandemic economy where financial caution prevails. According to the European Automobile Manufacturers Association, financing options are limited, making it challenging for first-time buyers to enter the market, thus impacting overall sales.

- Regulatory Compliance and Safety Standards:The RV industry in Europe faces stringent regulatory requirements, including compliance with the EU's General Safety Regulation. Manufacturers must adhere to complex safety standards, which can increase production costs by up to 15%. Additionally, the need for continuous updates to meet evolving regulations can strain resources for smaller manufacturers, limiting their ability to compete effectively in the market.

Europe Recreational Vehicle Market Future Outlook

The future of the European recreational vehicle market appears promising, driven by evolving consumer preferences and technological advancements. The shift towards electric and hybrid RVs is expected to gain momentum, aligning with sustainability goals. Furthermore, the integration of smart technologies will enhance user experience, making RVs more appealing. As the RV lifestyle continues to gain traction, manufacturers will likely focus on customization options to cater to diverse consumer needs, fostering a vibrant market landscape.

Market Opportunities

- Expansion of Rental Services for Recreational Vehicles:The RV rental market in Europe is projected to grow significantly, with revenues expected to reach €1 billion in future. This growth is driven by the increasing popularity of short-term rentals, particularly among younger consumers seeking flexible travel options. The rise of digital platforms facilitates easy access to rental services, making RV travel more accessible and appealing to a broader audience.

- Development of Eco-Friendly Vehicle Options:With environmental concerns on the rise, the demand for eco-friendly RVs is expected to increase. The European market is projected to see a 25% growth in electric RV models in future, driven by consumer preferences for sustainable travel options. Manufacturers are investing in research and development to create innovative, low-emission vehicles, aligning with the EU's Green Deal objectives and attracting environmentally conscious consumers.