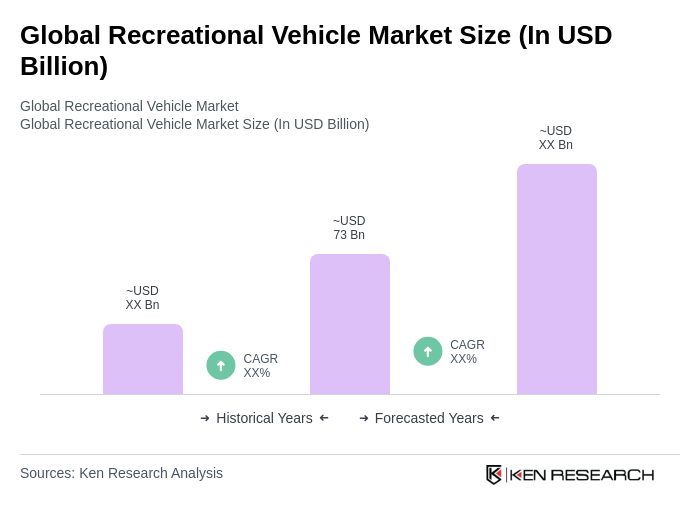

Global Recreational Vehicle Market Overview

- The Global Recreational Vehicle Market is valued at USD 73 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer interest in outdoor activities, a rise in disposable income, and the growing trend of road trips and camping. The market has seen a surge in demand for recreational vehicles as more individuals seek flexible travel options that allow for social distancing and a connection with nature. Additionally, the adoption of electric and hybrid RVs, integration of smart technologies, and a focus on sustainability are shaping current market trends .

- Key players in this market include the United States, Canada, and Australia, which dominate due to their vast landscapes, established camping culture, and supportive infrastructure for RV travel. The popularity of national parks and scenic routes in these regions further enhances the appeal of recreational vehicles, making them a preferred choice for both leisure and adventure seekers. North America holds the largest market share, supported by a robust consumer base and ingrained road trip culture, while Europe and Australia are experiencing notable growth due to increased interest in camping and outdoor tourism .

- In 2023, the U.S. government implemented new regulations aimed at enhancing safety standards for recreational vehicles. This includes mandatory compliance with updated emissions standards and safety features, which are designed to improve the overall safety and environmental impact of RVs. For example, the “Federal Motor Vehicle Safety Standards (FMVSS) and Emissions Compliance Rules, 2023” issued by the National Highway Traffic Safety Administration (NHTSA) require manufacturers to integrate advanced safety technologies and meet stricter emissions thresholds for all new RV models. These regulations are expected to influence manufacturing practices and consumer choices in the market .

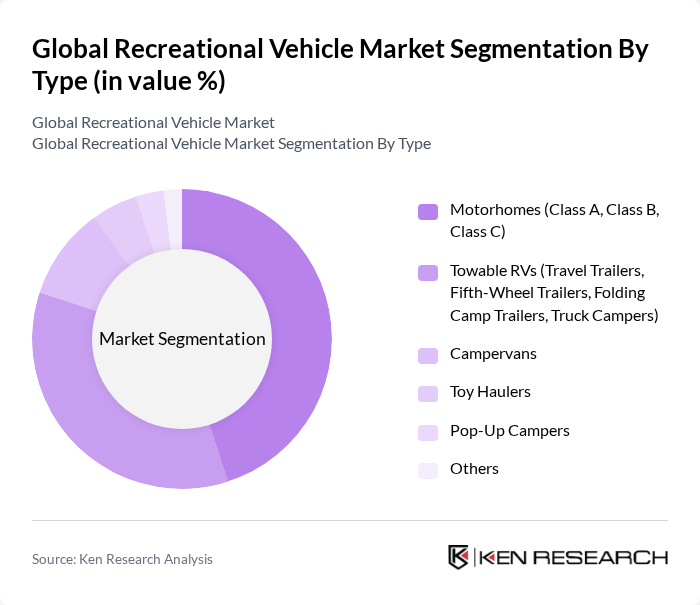

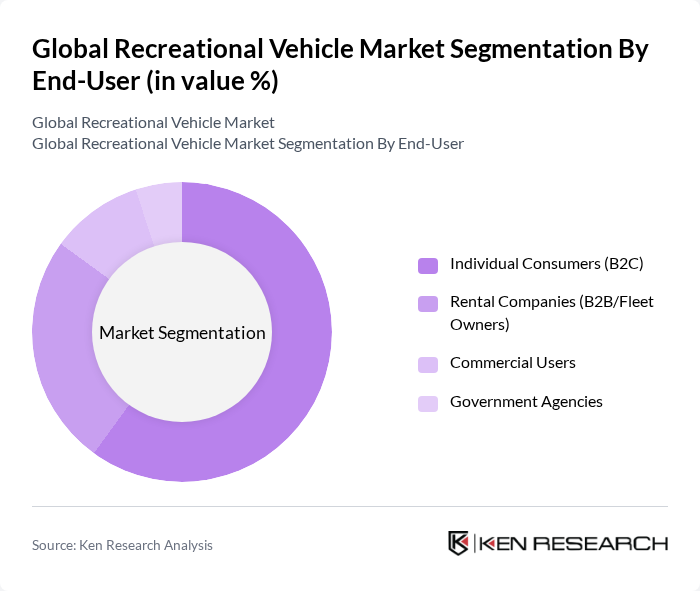

Global Recreational Vehicle Market Segmentation

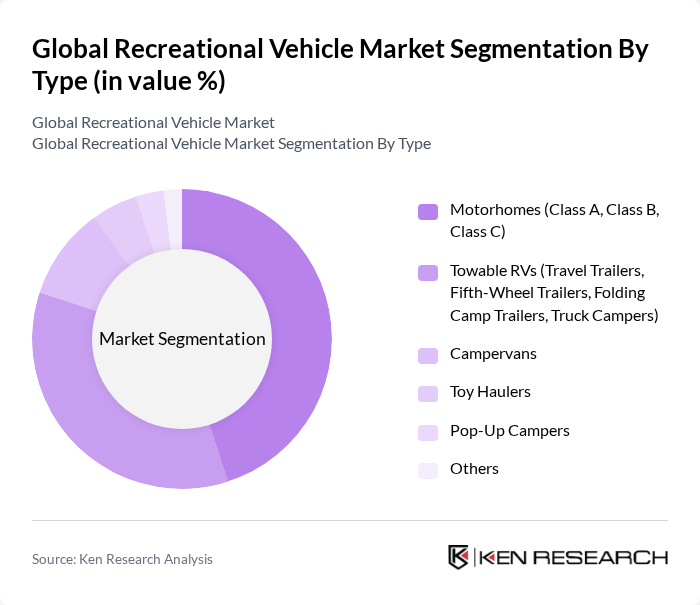

By Type:The recreational vehicle market is segmented into various types, including Motorhomes, Towable RVs, Campervans, Toy Haulers, Pop-Up Campers, and Others. Among these, Motorhomes—particularly Class A, Class B, and Class C—are leading the market due to their all-in-one convenience and comfort, appealing to families and long-distance travelers. Towable RVs also hold a significant share, favored for their versatility and affordability. The growing adoption of electric and hybrid models, as well as lightweight and energy-efficient designs, is further influencing segment growth .

By End-User:The market is segmented by end-users into Individual Consumers, Rental Companies, Commercial Users, and Government Agencies. Individual consumers dominate the market, driven by the growing trend of family vacations and outdoor adventures. Rental companies also play a significant role, catering to those who prefer short-term use without the commitment of ownership. Commercial users and government agencies contribute to demand through fleet purchases for tourism, emergency response, and mobile service delivery .

Global Recreational Vehicle Market Competitive Landscape

The Global Recreational Vehicle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thor Industries, Inc., Winnebago Industries, Inc., Forest River, Inc., REV Group, Inc., Airstream, Inc., Jayco, Inc., Keystone RV Company, Coachmen RV, Newmar Corporation, Tiffin Motorhomes, Inc., Dutchmen Manufacturing, Inc., Heartland Recreational Vehicles, LLC, Palomino RV, Northwood Manufacturing, Inc., Gulf Stream Coach, Inc., Hymer GmbH & Co. KG, Dethleffs GmbH & Co. KG, Swift Group Limited, ALINER (Columbia Northwest, Inc.), Trigano SA, Lightship contribute to innovation, geographic expansion, and service delivery in this space.

Global Recreational Vehicle Market Industry Analysis

Growth Drivers

- Increasing Outdoor Recreational Activities:The global outdoor recreation market is projected to reach $800 billion by future, driven by a surge in activities such as camping, hiking, and road trips. This trend is supported by the National Park Service reporting over 325 million visitors in recent years, a 10% increase from the previous year. As more individuals seek outdoor experiences, the demand for recreational vehicles (RVs) rises, positioning the RV market for significant growth in the None region.

- Rising Disposable Income:According to the World Bank, global GDP per capita is expected to increase to $12,000 in future, enhancing consumer purchasing power. In the None region, this rise in disposable income is leading to increased spending on leisure activities, including RV purchases. The RV Industry Association reported that a majority of RV owners have an annual household income exceeding $100,000, indicating a strong correlation between income levels and RV ownership, further driving market growth.

- Growing Demand for Eco-Friendly Travel Options:With climate change concerns rising, the demand for eco-friendly travel solutions is increasing. The global market for electric vehicles is projected to reach $1.5 trillion by future, influencing RV manufacturers to innovate sustainable models. In future, 25% of new RVs sold in the None region are expected to be electric or hybrid, reflecting a significant shift towards environmentally conscious travel options that cater to eco-aware consumers.

Market Challenges

- High Initial Purchase Costs:The average cost of a new RV in the None region is approximately $50,000, which can be a significant barrier for potential buyers. This high initial investment limits access to the market, particularly for younger consumers and families. Additionally, financing options may not be favorable, with interest rates projected to rise to 6% in future, further complicating affordability and limiting market expansion.

- Maintenance and Storage Issues:Owning an RV entails ongoing maintenance costs, averaging $1,200 annually, which can deter potential buyers. Furthermore, the lack of adequate storage facilities in urban areas poses a challenge, as many RV owners require dedicated space for their vehicles. In future, it is estimated that 30% of RV owners face difficulties in finding suitable storage, impacting overall market growth and ownership rates in the None region.

Global Recreational Vehicle Market Future Outlook

The future of the recreational vehicle market in the None region appears promising, driven by evolving consumer preferences and technological advancements. As outdoor activities gain popularity, RV manufacturers are expected to innovate, focusing on electric and hybrid models. Additionally, the integration of smart technology will enhance user experience, making RVs more appealing. The market is likely to see increased competition, leading to better products and services, ultimately benefiting consumers and expanding the market landscape.

Market Opportunities

- Technological Advancements in RV Design:Innovations in RV design, such as lightweight materials and energy-efficient systems, present significant opportunities. By future, the adoption of smart technology in RVs is expected to increase by 40%, enhancing user experience and operational efficiency, thus attracting tech-savvy consumers and boosting sales.

- Expansion into Emerging Markets:Emerging markets, particularly in Asia and South America, are witnessing a growing middle class with increased disposable income. By future, these regions are projected to contribute 20% of global RV sales, offering manufacturers a lucrative opportunity to expand their market presence and cater to new consumer segments seeking recreational vehicles.